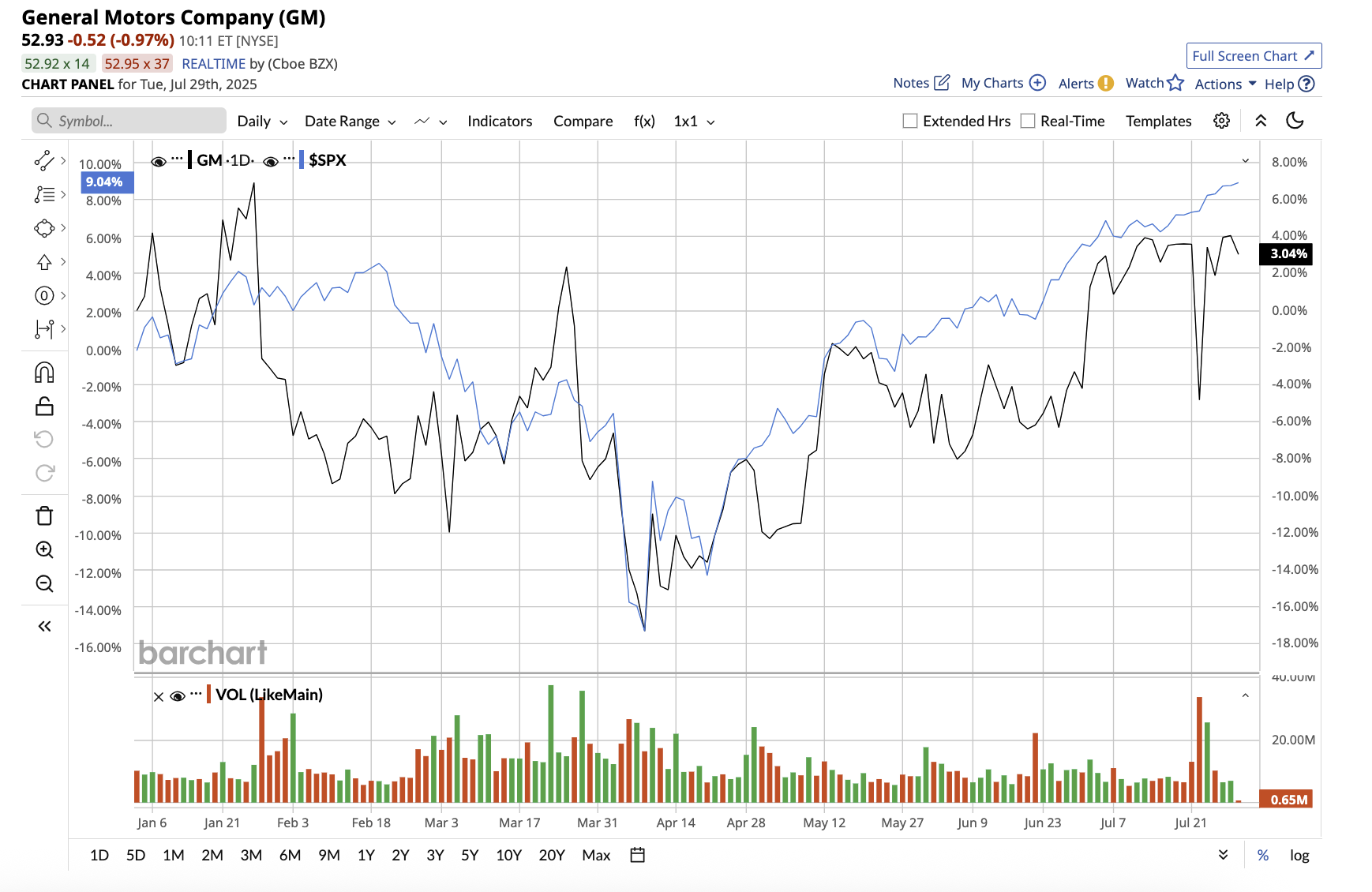

While Tesla (TSLA) has been grabbing headlines, legacy automaker General Motors (GM) is undergoing a quiet but significant transformation. GM is aggressively working to move beyond its “legacy” image. Valued at $50.9 billion, GM stock has lost nearly 2% year-to-date, trailing its peer Ford (F) (up 12.4%) and the overall market. The company reported its second-quarter earnings last week.

With shifting electric vehicle (EV) demand, international tariff headwinds, and fierce competition, let’s find out if GM can keep up.

Tariff Headwinds Masked Core Strength

In the second quarter, total revenue fell 1.8% year-over-year to $47.1 billion. However, GM’s U.S. market share increased to 17.3%, thanks to strong product performance, particularly in SUVs. Much of GM’s momentum stems from its refreshed crossover portfolio. Management emphasized that 10 all-new or redesigned crossover models, including internal combustion engine (ICE) and EV variants, made significant gains in market share and profitability in the second quarter.

GM’s EV business is expanding well. According to the company, Chevrolet is now the second-best-selling EV brand in the U.S., thanks to the success of the Blazer and Equinox EVs. The Chevrolet Equinox, in particular, saw sales increase by more than 20% YoY. Cadillac has also risen to fifth place in the overall EV rankings, and it leads the luxury EV space with its Escalade IQ, Lyriq, and Optiq models. To increase EV adoption, General Motors now supports nearly 200 pilot travel centers along strategic highway routes and intends to expand access to over 100,000 public fast chargers in the U.S. by 2027.

China remains a key focus for GM’s international expansion strategy. GM is working with its joint venture partners to improve inventory management, cut costs, and increase profitability. Its new energy vehicles (NEVs) in China performed well, and GM was the only foreign automaker to gain market share in the second quarter. This is particularly impressive in a market where local EV giants such as BYD (BYDDY) and XPeng (XPEV) are increasingly dominant.

GM reported $3 billion in EBIT-adjusted earnings for the second quarter, a $1.4 billion decrease YoY, primarily due to tariffs totaling $1.1 billion. Adjusted automotive free cash flow stood at $2.8 billion, a decrease from the previous year, primarily due to tariff payments. Management emphasized that if tariffs were removed, GM’s fundamentals would be strong. GM is addressing the tariff issue through manufacturing adjustments to reduce exposure, targeted cost initiatives to offset impacts, and long-term pricing discipline to pass on some of the cost. Management expects to mitigate 30% of the total impact by 2025, with more to come as trade deals evolve.

GM Is Scaling Smartly and Strategically

While the global EV market has slowed, GM is working to address these changes without compromising its long-term goals. The automaker recently announced $4 billion in new investments in U.S. assembly plants. These upgrades will allow GM to produce 300,000 more high-margin light-duty pickups, full-size SUVs, and crossovers each year. The company believes these are the exact types of vehicles that will continue to drive its profits.

The company intends to diversify production across facilities in Michigan, Kansas, and Tennessee in order to reduce tariff exposure while increasing plant utilization. This adaptable footprint positions GM favorably in an ever-changing EV market. While the tariff situation is far from resolved, GM reiterated its full-year adjusted EPS guidance of $8.25 to $10 per share, which is in line with the consensus estimate. Free cash flow could range from $7.5 billion to $10 billion.

What Does Wall Street Say About GM Stock?

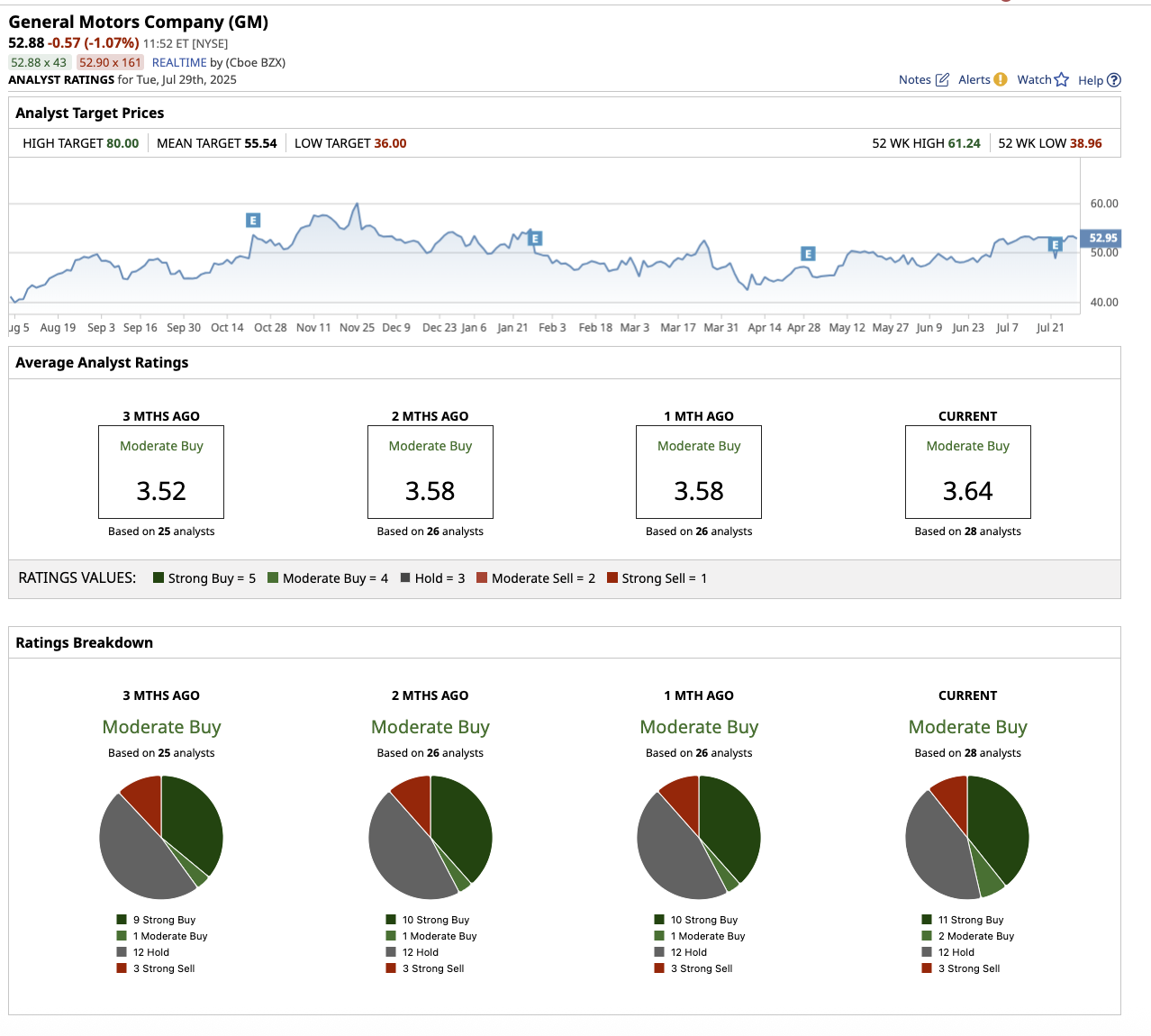

On Wall Street, GM stock is a “Moderate Buy.” Out of the 28 analysts that cover the stock, 11 rate it a “Strong Buy,” two suggest a “Moderate Buy,” 12 rate it a “Hold,” and three say it is a “Strong Sell.” The average target price of $55.54 is 5% above current levels. The high price estimate of $80 implies 51.3% upside over the next 12 months.

The Bottom Line: Is This Legacy Automaker Still a Buy?

No doubt, GM faces short-term risks with tariffs and a slower EV ramp. But its disciplined strategy, healthy balance sheet, and capital allocation position it well for long-term value creation. If you’re looking for a stable, cash-generating, well-managed auto stock with a clear path to the future, GM deserves a spot on your radar.