As Bitcoin (CRYPTO: BTC) is facing renewed pressure below the $90,000-mark, attention is turning to several Bitcoin-linked stocks showing a significant weakening in momentum amid the cryptocurrency’s correction.

Apart from Michael Saylor‘s Strategy Inc. (NASDAQ:MSTR), whose momentum score has declined to the 5.11th percentile, investors are closely watching three companies—Bitcoin Depot Inc. (NASDAQ:BTM), Bakkt Holdings Inc. (NYSE:BKKT), and Bitdeer Technologies Group (NASDAQ:BTDR)—as their Benzinga Edge’s Stock Rankings‘ momentum metrics have declined sharply week-on-week.

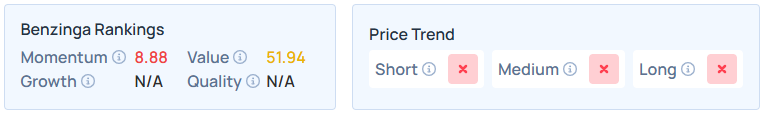

Bitcoin Depot

- BTM, a key player in Bitcoin ATM operations, experienced a steep drop in its momentum percentile. The stock’s momentum has plunged from a strong 75.33 percentile to a current rank of just 8.88, marking a dramatic week-on-week decline of 66.45 percentile points.

- This substantial erosion in relative momentum highlights investor concerns as Bitcoin’s recent price contraction weighs heavily on Bitcoin Depot’s trading profile.

- The stock was down 47.90% over the last month and 6.88% year-to-date, also logging an annual decline of 24.75%.

- It maintains a weaker price trend over the short, medium, and long terms, with a moderate value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

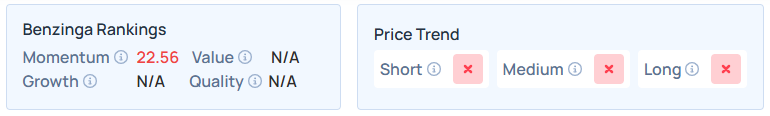

Bakkt Holdings

- Similarly, Bakkt Holdings, a platform facilitating cryptocurrency trading and asset custody, has seen its momentum weaken significantly. Bakkt’s momentum score fell from an already elevated level of 91.42 to 22.56, reflecting a 68.86-point decline.

- This downturn indicates a pullback in investor enthusiasm after the previous rally, as external headwinds from Bitcoin's price volatility cast a shadow on Bakkt's near-term outlook.

- BKKT tumbled 51.56% over the month, 45.09% YTD, and 50.12% over the year.

- Benzinga’s Edge Stock Rankings shows that it maintains a weaker price trend over the short, medium, and long terms. Additional information is available here.

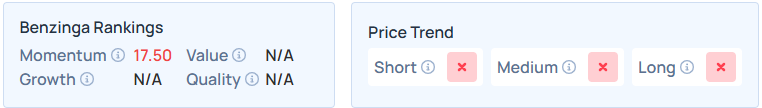

Bitdeer Technologies Group

- Bitdeer Technologies Group, a blockchain technology firm, also features among the stocks with deteriorating momentum. The company’s momentum ranking slid from 64.77 to 17.50, a week-on-week decline of 47.27 points.

- This decline signals that Bitdeer is not immune to the broader crypto market’s challenges, which have prompted a reassessment of risk among momentum-focused traders.

- Lower by 55.72% over the month, it dropped by 55.01% YTD and 16.55% over the year.

- It maintains a weaker price trend over the short term but a strong trend in the medium and long terms. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

BTC Down Over 30% From October’s All-Time High

BTC was trading 31..95% lower from its all-time high on Oct. 7. During the publication of this article, the prices were 0.43% lower at $85,891.30 per coin.

The futures of the S&P 500, Nasdaq 100, and Dow Jones indices were trading higher on Monday, after a positive close on Friday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock