Artificial intelligence is poised to transform labor-heavy industries such as consulting, accounting, and legal services—sectors worth an estimated $5 trillion globally—by enabling software-like margins and reducing dependence on human labor, Mayfield Managing Director Navin Chaddha told TechCrunch.

Chaddha said if 80% of the work is done by AI, companies can achieve gross margins of 80% to 90%. He added that Mayfield has earmarked $100 million from its latest fund specifically for companies building AI teammates.

Don't Miss:

- Warren Buffett once said, "If you don't find a way to make money while you sleep, you will work until you die." Here’s how you can earn passive income with just $10.

- Named a TIME Best Invention and Backed by 5,000+ Users, Kara's Air-to-Water Pod Cuts Plastic and Costs — And You Can Invest At Just $6.37/Share

Target Small Clients, Not Big Firms

Chaddha told TechCrunch that startups should target underserved small and midsize businesses rather than attempt to compete directly with consulting giants like Accenture (NYSE:ACN), McKinsey, or Tata Consultancy Services. He said 30 million small businesses in the U.S. and 100 million globally often lack access to traditional knowledge workers.

Instead of billing hourly or monthly, Chaddha said AI-first companies could use event-based pricing—charging per service delivered, such as a completed project or triggered event.

Gruve Scales With Pay-for-Performance Model

Chaddha said Mayfield led the $20 million Series A round for Gruve, a security-focused consulting startup. According to TechCrunch, Gruve acquired a $5 million managed services business and scaled it to $15 million in revenue within six months.

The company uses outcome-based pricing, charging only when a security event occurs, and has reportedly achieved gross margins of around 80%.

Chaddha highlighted that Gruve's approach resonated with clients like Cisco Systems (NASDAQ:CSCO), who prefer paying only when results are delivered. "They say, ‘Hey, I'm not getting hacked. Why am I paying for all these security people?"

Trending: Invest early in CancerVax's breakthrough tech aiming to disrupt a $231B market. Back a bold new approach to cancer treatment with high-growth potential.

Innovator's Dilemma in Big Firms

Chaddha told TechCrunch that legacy firms like McKinsey and Accenture face an innovator's dilemma: shifting from retainers and hourly billing to AI-driven, outcome-based pricing risks disrupting their predictable revenue streams.

He said this hesitation gives AI-first startups a critical window to scale before incumbents adapt.

The AI Teammate Distinction

Chaddha differentiated between AI tools and AI teammates. He defined AI teammates as systems that “collaborate with a human on shared goals and get to better outcomes," according to TechCrunch.

"The aim is not to replace," Chaddha said. "The aim is to team up and collaborate together."

These may be built using large language models or agentic frameworks and serve roles across HR, sales, and engineering.

See Also: $100k+ in investable assets? Match with a fiduciary advisor for free to learn how you can maximize your retirement and save on taxes – no cost, no obligation.

VC Strategy: Mental Discipline Counts

Chaddha told TechCrunch that Mayfield allocated $100 million last fall for AI teammate startups. He advised entrepreneurs to avoid fear of missing out, stay disciplined, and craft a clear long-term thesis.

"Have your own North Star. Have discipline and have no FOMO, because FOMO is for sheep," he said. Chaddha cautioned that while many will make money, about 80% of startups—and even VCs—may falter without a strong strategy.

Chaddha emphasized that investing in AI demands experience and restraint. "It's not a science; it's an art," he said. "The more you practice this, the better you get."

Read Next: BlackRock is calling 2025 the year of alternative assets. One firm from NYC has quietly built a group of 60,000+ investors who have all joined in on an alt asset class previously exclusive to billionaires like Bezos and Gates.

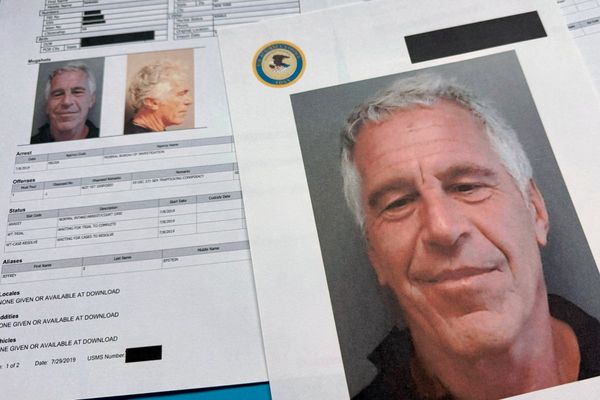

Image: Shutterstock