Ford Motor Co. (NYSE:F) has paused production of the F-150 Lightning EV pickup truck amid aluminium shortages and a pivot towards Gasoline and hybrid-powered vehicles.

Check out the current price of F here.

F-150 Lightning Production Will Remain Paused, Says Ford

In a statement released by the company on Thursday, Ford announced that it was halting production of the pickup truck at the company's Rouge facility in Michigan.

"F-150 Lightning assembly at the Rouge Electric Vehicle Center will remain paused as Ford prioritizes gas and hybrid F-Series trucks, which are more profitable for Ford and use less aluminum," the company said in the statement.

Ford also announced it will transfer all electric vehicle assembly workers to the Dearborn Truck Plant, where they will join the new third crew of 1,200 employees. Ford's "Dearborn Truck Plant will target assembling more than 45,000 additional F-150 gas and hybrid trucks in 2026."

It's worth noting that Ford sold over 23,034 Lightning Pickup trucks in the U.S. this year, which made it the best-selling electric pickup truck in the country, outpacing rivals like Tesla Inc.‘s (NASDAQ:TSLA) Cybertruck.

Ford's Aluminium Woes

The news comes as Novelis, a key aluminium supplier to Ford, reported a major fire incident at its production facility in Oswego, New York, which rendered 40% of the plant unable to carry out production.

The incident has left major U.S. automakers scrambling for aluminium, with Ford's crosstown rival Stellantis NV (NYSE:STLA) reportedly halting production of the Jeep Wagoneer due to aluminium hood and door shortages.

Ford's Q3 Earnings Call Beats Estimates

Meanwhile, Ford reported better-than-expected earnings data during the company's Q3 earnings call with investors and analysts. The automaker reported earnings of 45 cents per share, beating analyst estimates of 36 cents per share. Quarterly revenue stood at $47.18 billion, also beating market expectations of $43.07 billion by a significant margin.

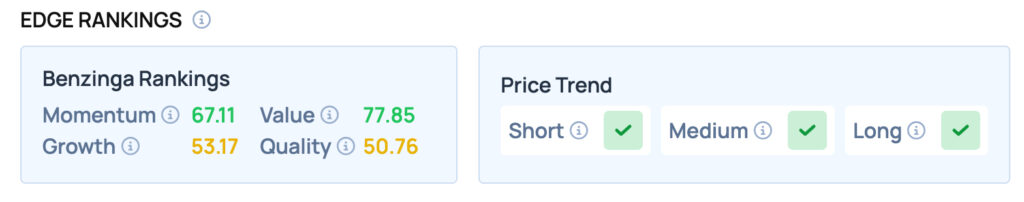

Ford scores well on the Momentum and Value metrics and offers satisfactory Growth and Quality. Ford also boasts a favorable price trend in the Short, Medium and Long terms. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo Courtesy: Mike Mareen On Shutterstock.com