Ford Motor Co. (NYSE:F) shared its second-quarter 2025 financial results, posting a record $50.2 billion in revenue, as well as the impacts of President Donald Trump's tariffs during the company's earnings call with investors.

Check out the latest price of F stock here.

What Happened: "We expect tariffs to be a net headwind of about $2 billion this year," Ford CEO Jim Farley said during the earnings call with investors on Wednesday, adding that the company was closely working with policymakers and monitoring developments.

"We want to simplify the tariffs so that we can make up for that gap between the bilateral import tariff rates and what we’re paying in our tariff bill," Farley said in a Q&A session with investors during the earnings call.

He also added that Ford is "in daily contact" with the lawmakers over tariffs and has the opportunity to reduce tariff liability given its strong domestic manufacturing capabilities.

Farley also shared that the new emission norms have reduced the pressure on the company to buy ZEV credits and saved over $1.5 billion in costs. The relaxed norms also help Ford Blue, the company's ICE-powered vehicle line, explore "multi-billion dollar" opportunities over the next two years.

"We support a single durable national emission standard to ensure sound industry planning," Farley said, adding that the EPA's announcement helps Ford with "greater powertrain optionality."

Ford Model E, the company's electric vehicle lineup, also experienced growth, with revenues reaching $2.4 billion, but it also reported an EBIT loss of $1.3 billion, $179 million higher than the previous year.

"We have scheduled an event on Aug. 11 in Kentucky where we will share more about our plans to design and build breakthrough electric vehicles in America," the company said.

Why It Matters: The news comes as Ford shared its Q2 earnings recently, posting a strong performance for the company in the U.S. despite uncertainty in the auto industry.

The company has also pushed for more affordable EVs in the U.S. despite Trump's anti-EV stance, with the company planning to introduce more EVs and electrified vehicles in its lineup.

Elsewhere, the EPA, or Environmental Protection Agency, announced a proposal to rescind the crucial 2009 Endangerment Finding, which forms the basis for much of the U.S.'s climate action. Rolling it back would free automakers from any legal pressure to reduce carbon emissions.

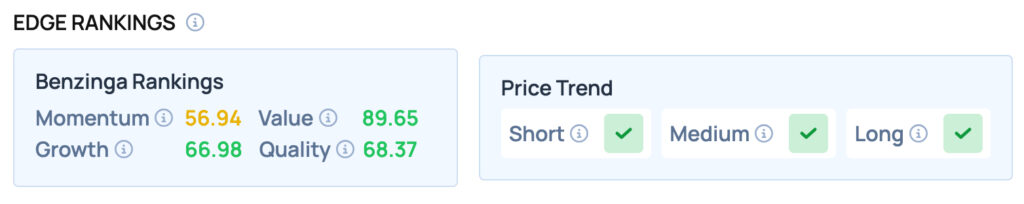

Ford scores well on the Growth, Quality and Value metrics and offers satisfactory Momentum. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Tada Images / Shutterstock.com