Ford (NYSE:F) CEO Jim Farley isn't worried about Tesla. He's worried about China. In his words, Chinese automakers are the "700-pound gorilla" of the electric vehicles (EVs) industry because they offer “great innovation at a low cost.”

In the five years since taking the helm, Farley has taken big swings to transform the century-old automaker into a leaner and higher-margin business. Now, that transformation is entering a pivotal phase. With slowing EV demand in the U.S., the loss of key federal tax incentives, and intensifying competition from Chinese automakers like BYD (OTC:BYDDF) and Xiaomi, Ford is under pressure to reinvent how it builds electric vehicles.

“There's no real competition from Tesla (NASDAQ:TSLA), GM (NYSE:GM), or Ford with what we've seen from China. It is completely dominating the EV landscape globally and more and more outside of China,” Farley said on an episode of The Verge’s podcast ‘Decoder,’ which aired on Monday night.

Global Competition With China

This is not the first time Farley has talked about China’s lead in the EV race. “We are in a global competition with China, and it’s not just EVs. And if we lose this, we do not have a future Ford,” he had said in June.

For now, the company’s answer is the new Ford Universal EV Platform — a manufacturing overhaul the company is calling its "Model T moment”. The platform hinges on building EVs in just three pieces using large-scale castings and a fresh electric architecture. If it works, it could allow Ford to produce more affordable EVs at scale. But the first car on the new platform won't arrive until 2027, Farley said. That’s arguably a long wait for investors in a hyper-competitive market.

It’s something no one, not even Tesla, has pulled off yet. "There are no guarantees we can do this," he admitted.

Price Action

Shares of F rose 0.67% to end at $12.09 per share on Monday, and it dropped by 0.41% in pre-market. It has risen 25.28% year-to-date and 14.49% over the past year.

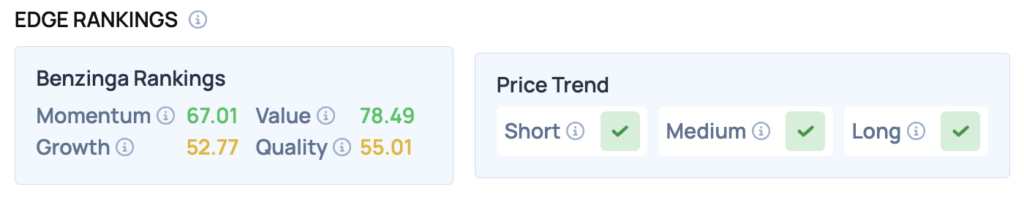

Benzinga's Edge Stock Rankings indicate that F maintains a stronger price trend in the short, medium, and long terms. However, the stock's Quality and Growth ranking is relatively poor. Additional performance details are available here.