Recently released minutes from the Federal Reserve's July meeting confirm that officials favoring a tough stance on inflation remain in control, opting to hold interest rates steady as they monitor the economic impact of tariffs.

Hawkish Stance Fueled By Greater Inflation Risks?

A majority of the committee's participants judged that the upside risk to inflation was the greater of its two primary risks.

This hawkish position comes as external pressures from trade policy continue to complicate the economic outlook. According to one analyst, tariffs are a primary factor keeping inflation a top-tier concern for the central bank.

"Inflation remains on the front burner for Fed officials as tariffs still pose a risk to the economy and a pickup in inflation," said Eric Teal, Chief Investment Officer for Comerica Wealth Management.

Teal noted that the effective tariff rate on imports rose to about 16% in August. This sentiment is mirrored in the Fed's internal discussion, where participants observed that “disinflation appeared to have stalled, with tariffs putting upward pressure on goods price inflation.”

Inflation Risk Outweighs Unemployment Risk

The decision to keep the federal funds rate in a target range of 4.25% to 4.5% was not unanimous, revealing a growing split within the committee. Governors Michelle W. Bowman and Christopher J. Waller both voted against the decision, preferring to lower the target range by 25 basis points.

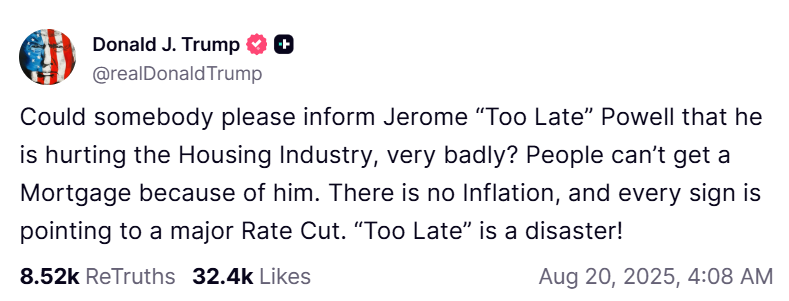

Their position aligns with recent demands from President Donald Trump, who has criticized the central bank on social media for hurting the housing industry, insisting that “There is no Inflation” and calling for a “major Rate Cut”.

However, the majority view prevailed. Chris Zaccarelli, Chief Investment Officer for Northlight Asset Management, said the minutes clearly show why the Fed didn’t cut rates. The decision was made "because the majority of officials thought the risk of higher inflation outweighed the risk of higher unemployment," he said.

All Eyes On Jackson Hole, August CPI, And September Fed Decision

With the July decision explained, all eyes now turn to the Fed's next meeting in September.

Zaccarelli suggested that Chair Jerome Powell is likely to “keep his cards close to his vest” at the upcoming Jackson Hole symposium, emphasizing that the Fed remains data dependent and will need to see key jobs and inflation reports before making its next move.

The three-day Economic Policy Symposium begins on Thursday, Aug. 21, and will go on till Aug. 23. The theme for the 2025 symposium is “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.”

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Thursday. The SPY was down 0.17% at $637.03, while the QQQ declined 0.088% to $565.40, according to Benzinga Pro data.

Read Next

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Credit: Jack Gruber-USA TODAY/ Imagn