Fast casual dining has hit a rough patch in recent years, with the pandemic-era boom wearing out amid growing inflationary pressures that are taking a toll on consumer spending.

Despite the broad-based slowdown in the segment, key players such as Chipotle Mexican Grill Inc. (NYSE:CMG), Sweetgreen Inc. (NYSE:SG), and CAVA Group Inc. (NYSE:CAVA) have seen different trajectories this past year, hinting at something bigger at play.

1. Chipotle’s Traffic Decline

Leading fast-casual restaurant chain specializing in Mexican cuisine, Chipotle has had a rough year, with the stock dropping nearly 49% YTD, which includes a steep decline last week, following its third-quarter results, where it missed consensus estimates on the top and bottom lines.

The company also witnessed a decline in traffic, at 0.8%, which was significantly ahead of estimates. CEO Scott Bowright attributed this to young and lower-income consumers pulling back on their spending.

See Also: Cava Group Analysts Cut Their Forecasts After Weaker-Than-Expected Q3 Results

“We’re losing lower-income and younger consumers to grocery,” Bowright said, while adding that his company wasn’t going to pursue deals and discounts to “chase short-term traffic.”

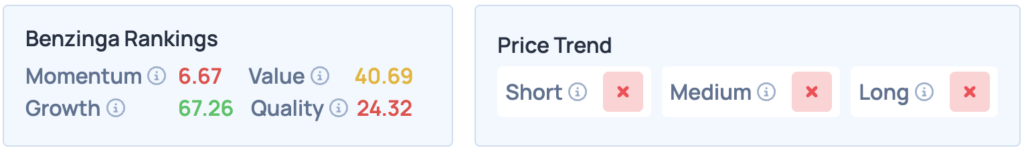

The stock continues to score high on Growth in Benzinga’s Edge Stock Rankings, but does poorly elsewhere, with an unfavorable price trend in the short, medium, and long terms. Click here for deeper insights into the stock, its peers, and competitors.

2. Sweetgreen’s Disappointing Q3

Salad chain Sweetgreen has fared much worse, with the stock down 80.52% year-to-date, and its disappointing third-quarter performance on Thursday adding to its woes.

The company reported $172.39 million in sales during its third quarter, down 0.60% year-to-date, compared to $173.2 million a year ago. It posted a loss of $36.14 million, or $0.31 per share, compared to a loss of $20.8 million, or $0.18 the prior year, missing estimates on the top and bottom lines.

Similar to Chipotle, Sweetgreen’s CFO, Jonathan Neman, blames the company’s lackluster performance on tightening discretionary spending budgets among consumers.

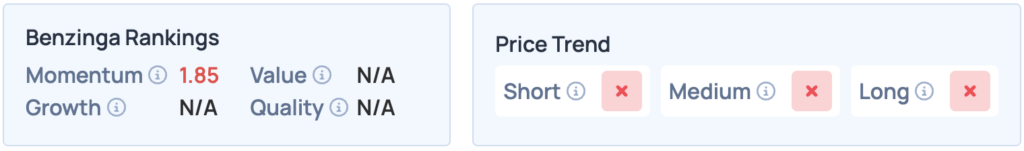

Sweetgreen does poorly in Benzinga’s Edge Stock Rankings, with a low Momentum score, alongside an unfavorable price trend in the short, medium, and long terms. Click here for more insights on the stock, the company, and the broader industry.

3. Gen Z Troubles For CAVA

Mediterranean restaurant chain, CAVA Group, has seen similar struggles with its Gen Z and lower-income patrons beginning to pullback as inflationary pressures mount.

The stock is down 59.55% year-to-date, and its third-quarter results this week further steepened the curve, with the company reporting $292.23 million in revenue, up 19.86% year-over-year, but falling short of consensus estimates at $292.8 million.

Earnings stood at $0.12 per share, which again fell short of analyst consensus estimates at $0.13 per share, amid significant macro headwinds during the quarter.

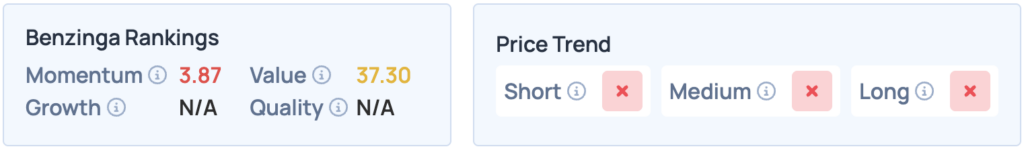

The company is ranked poorly in Benzinga’s Edge Stock Rankings, and has an unfavorable price trend in the short, medium, and long terms. Click here for deeper insights into the stock, its peers, and competitors.

Slop Bowls: How They Compare?

While all three stocks have witnessed significant declines over the past year, their operations and fundamentals do show certain variances.

| Stock | Year-To-Date Performance | Q3 Same-Store Sales | Full-Year Guidance |

| Chipotle Mexican Group | -48.97% | +0.30% | Low-single digit decline |

| Sweetgreen | -80.52% | -9.50% | -4.00% to -6.00% |

| CAVA Group | -59.55% | +1.90% | +4.00% |

Read More:

Image via Shutterstock