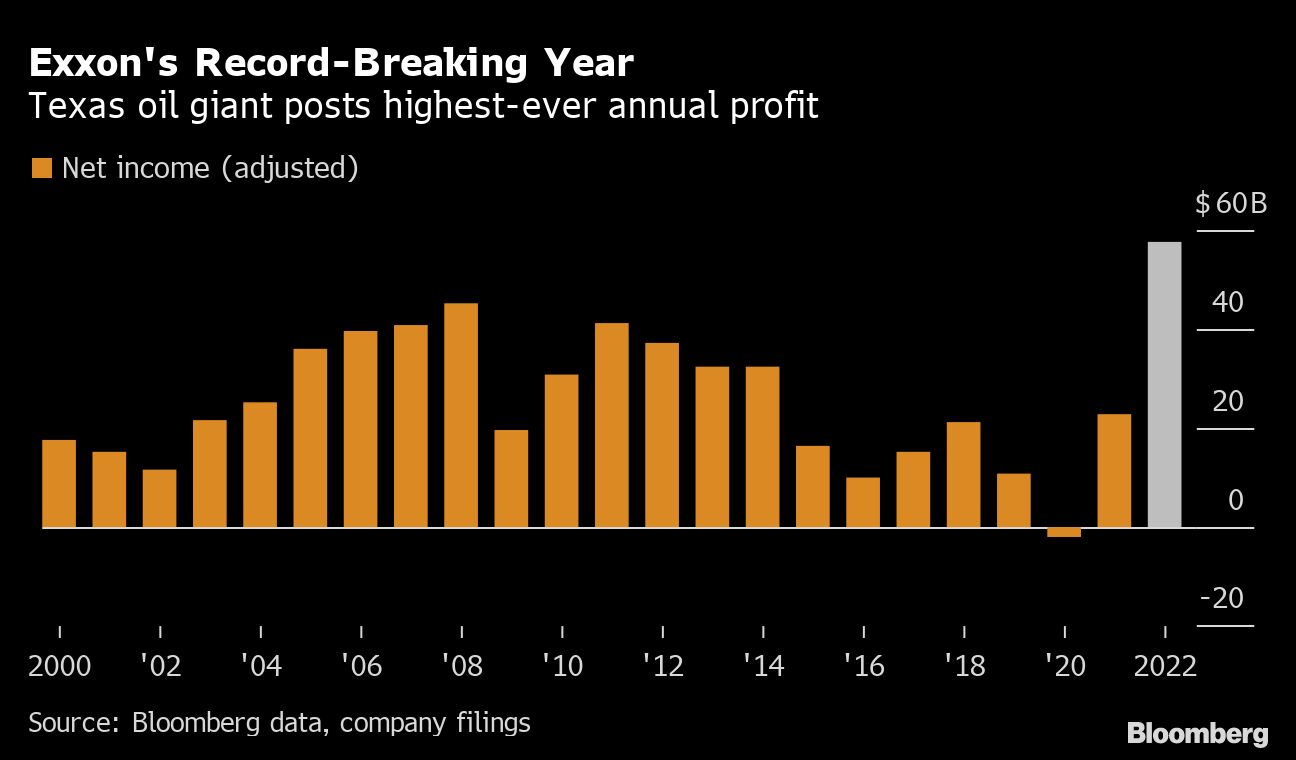

Exxon Mobil Corp. reaped a record $59 billion profit but disappointed some investors by holding the line on share buybacks.

Full-year profit, excluding one-time items, jumped 157% from 2021, far exceeding the driller’s prior record of $45.2 billion in 2008, which at the time marked the biggest in US corporate history. Chief Executive Officer Darren Woods said Exxon is harvesting the rewards from fossil-fuel investments in recent years that were panned as ill-timed.

“Our work began years ago, well before the pandemic, when we chose to invest counter-cyclically,” he said during a conference call with analysts on Tuesday. “We leaned in when others leaned out, bucking conventional wisdom.”

The stock was up more than 1.8% at 3:14 p.m. New York time after dropping earlier in the session. Exxon’s results followed those of US rival Chevron Corp., which posted a surprise earnings miss last week just days after announcing a mammoth $75 billion share-buyback program.

The five so-called supermajors are swimming in cash after a record 2022 but pressure is mounting on executive teams to satisfy competing demands: investor appetite for bigger payouts and buybacks versus political outrage over windfall profits during a time of war and economic dislocation.

Chevron was excoriated by the White House and Democratic members of Congress when it disclosed plans last week to funnel $75 billion to investors in the form of stock repurchases.

Exxon expanded buybacks multiple times last year and pledged to repurchase $35 billion of stock through 2024, unchanged from previous guidance The company is pursuing a “balanced” approach to buybacks and dividends while reducing debt and investing in new projects, Chief Financial Officer Kathy Mikells told analysts during the call.

She gave no indication that Exxon will be increasing buybacks soon, even as the company’ posted the eighth-largest cash haul in the history of the S&P 500 Index.

“It’s outrageous that Exxon has posted a new record for Western oil company profits after the American people were forced to pay such high prices at the pump amidst Putin’s invasion,” White House spokesman Abdullah Hasan said in an email.

On a quarterly basis, Exxon surpassed expectations for the ninth time in 10 periods, posting adjusted fourth-quarter profit of $3.40 a share that was 10 cents higher than the median estimate by analysts in the Bloomberg Consensus.

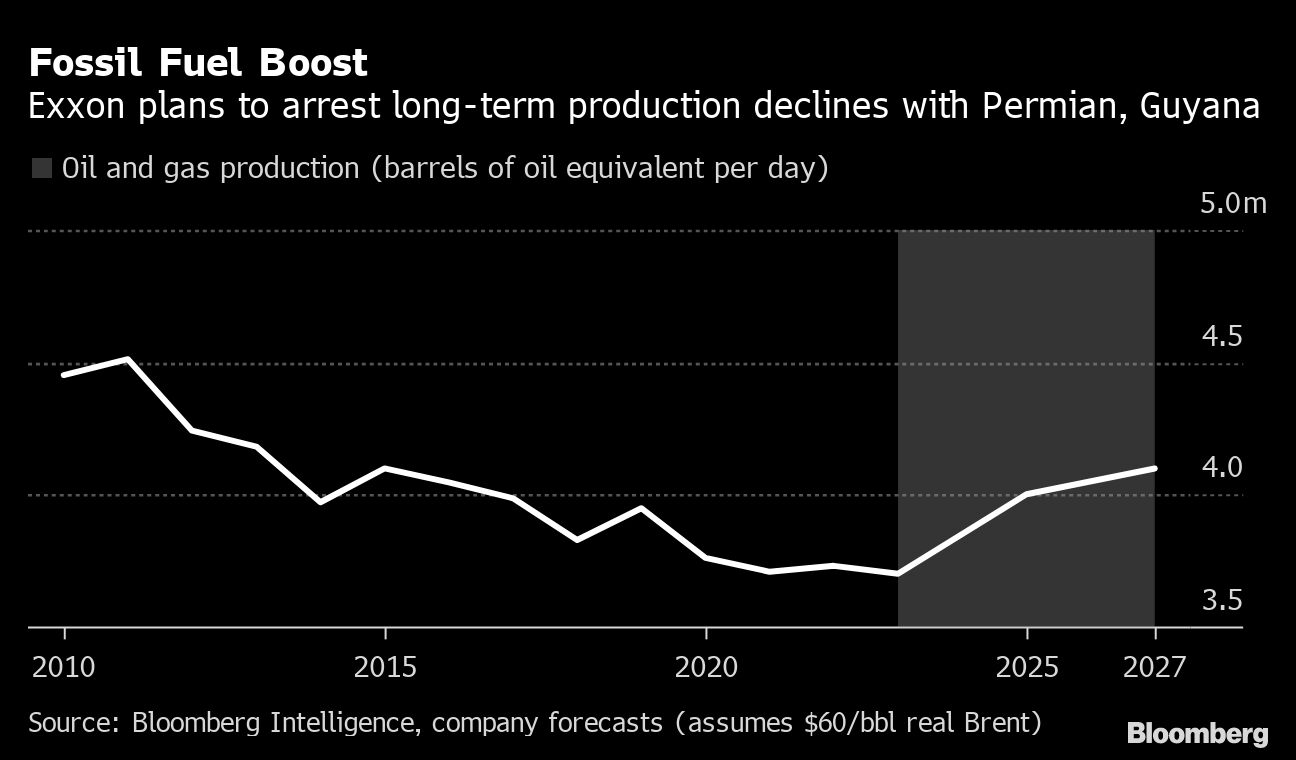

There are signs that Wall Street, after a long hiatus, is once again keen to see oil explorers increasing crude output. Chevron executives faced multiple questions about growth plans last week, and several analysts noted their disappointment at the California-based company’s outlook for a flat-to-3% increase this year.

Exxon has less reason to be concerned about when it comes to growth than some of its peers. Daily production surpassed forecasts at the equivalent of 3.82 million million barrels of oil and major projects in the US Permian Basin and Guyana are expected to drive growth over the next five years.

“We can’t call the cycles, we can’t predict where the markets will go and over what time frame, but we can control the cost of the barrels that we’re bringing on,” Woods said. Exxon’s new investments have helped expand its profit margin to 14% from 10% in 2012, he added.

©2023 Bloomberg L.P.