Utah-based Extra Space Storage Inc. (EXR), with a market cap of $31.7 billion, is a prominent REIT in the self-storage industry. It offers a wide range of well-located, secure storage units across the U.S., including boat, RV, and business storage.

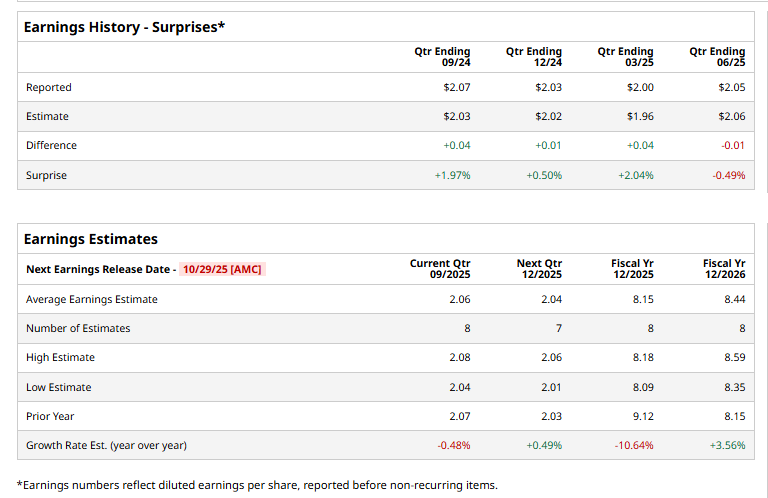

The leading REIT is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Wednesday, Oct. 29. Ahead of the event, analysts expect EXR to report an FFO of $2.06 per share on a diluted basis, down marginally from $2.07 per share in the same quarter last year. The company has surpassed Wall Street’s FFO estimates in three of the previous four quarterly reports, while missing in one quarter.

For the current year, analysts expect EXR to report FFO of $8.15 per share, down 10.6% from $9.12 in fiscal 2024. However, its FFO is expected to rise 3.6% year over year to $8.44 per share in fiscal 2026.

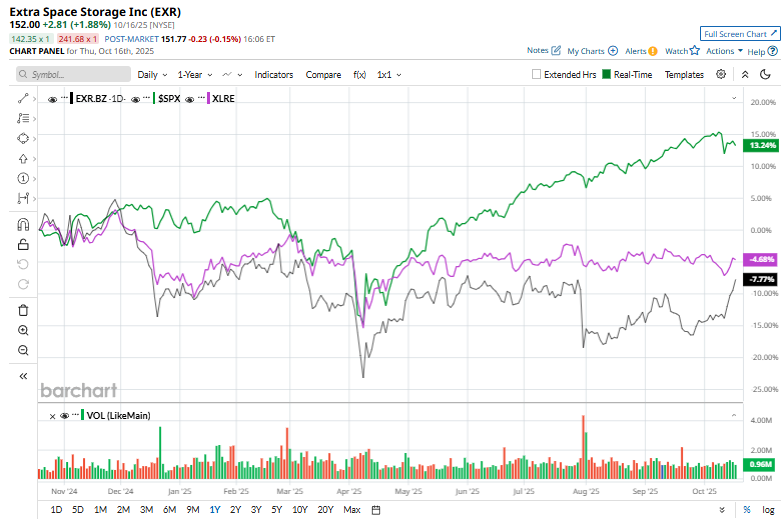

EXR stock has faced challenges over the past year, with shares down 3.1%, underperforming the S&P 500 Index’s ($SPX) 13.5% gains and the Real Estate Select Sector SPDR Fund’s (XLRE) 6.6% drop over the same time frame.

On July 30, shares of Extra Space Storage fell over 10% after the company released its Q2 2025 results. Its core FFO per share of $2.05 missed expectations, and same-store NOI declined 3.1% to $474.2 million amid rising expenses and higher interest costs. Investor concerns were heightened as the management revised 2025 guidance to a narrower FFO range of $8.05–$8.25 per share, projecting flat-to-negative same-store revenue growth and NOI declines.

Analysts’ consensus opinion on EXR stock is fairly upbeat, with a “Moderate Buy” rating overall. Out of 22 analysts covering the stock, eight advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and 13 give a “Hold.” EXR’s average analyst price target is $156.84, indicating a potential upside of 3.2% from the current levels.