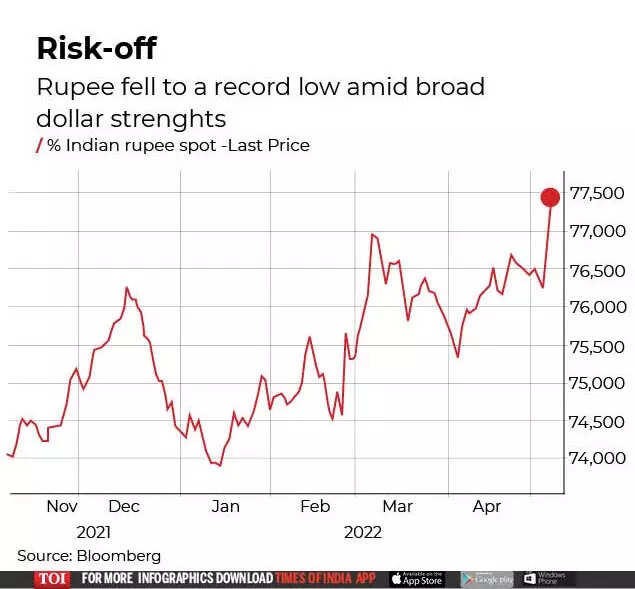

NEW DELHI: The see-sawing rupee has given Indian investors a tough time in the past few days. On Monday, the rupee slumped by 54 paise to close at a record low of 77.44 against the US dollar.

The currency fell to its all-time low in a matter of few days in wake of unabated outflow of foreign funds and a slew of other factors.

During the trading session yesterday, the rupee touched its lifetime low of 77.52.

However, rupee's loss meant gains for the US dollar. In fact, the US currency has had a wonderful stretch. Since the start of the year, it has gained almost 8 per cent.

But, a rising dollar is surely not a favourable scenario for Indian rupee. The rupee has been staggering since the beginning of the year and has fallen nearly 4 per cent so far.

The surprise rate hike by Reserve Bank of India's (RBI) monetary policy committee (MPC) last week could not stop rupee's decline as a widening current account deficit possess concerns. In fact, it seems to have heightened volatility.

RBI has been using forex reserves to in order to stem currency's loss. Data by RBI shows that even forex reserves have dropped to their lowest level in a year.

Even though rupee has hits record lows against the dollar, its fall is less than its peers. Japanese yen has fallen the most at 11.9 per cent, while pound has slumped 8.5 per cent.

Here are few reasons that led to slump in Indian rupee:

Geopolitical risks

Uncertain global conditions have triggered a risk appetite for the weakening of rupee. In fact, rupee has been under significant pressure ever since the disturbance of geopolitical situations owing to Russia's invasion of Ukraine.

Most of the major western economies have imposed sanctions on Russia, leading to volatility in global markets.

The crisis spiked fears of global inflation, thereby pushing up prices of essential commodities worldwide.

With crude oil prices soaring to record highs in wake of supply restrictions, India --which is the third largest importer of oil in world -- witnessed a significant rise in its import bill.

Rising bond yields

India's 10-year benchmark bond ended at a high of Rs 93.69 on Monday, yielding 7.46 per cent after reaching a high of 7.49 per cent earlier.

The government has now asked RBI to either buy back the bonds or conduct open market operations to cool yields that have hit their highest since 2019.

Besides, the US Federal Reserve's hawkish pivot on inflation in March drove a sell-off in their Treasuries.

The 10-year's yield on Monday touched 3.203 per cent, a few basis points from an almost decade-high peak in 2018.

Inflation concerns

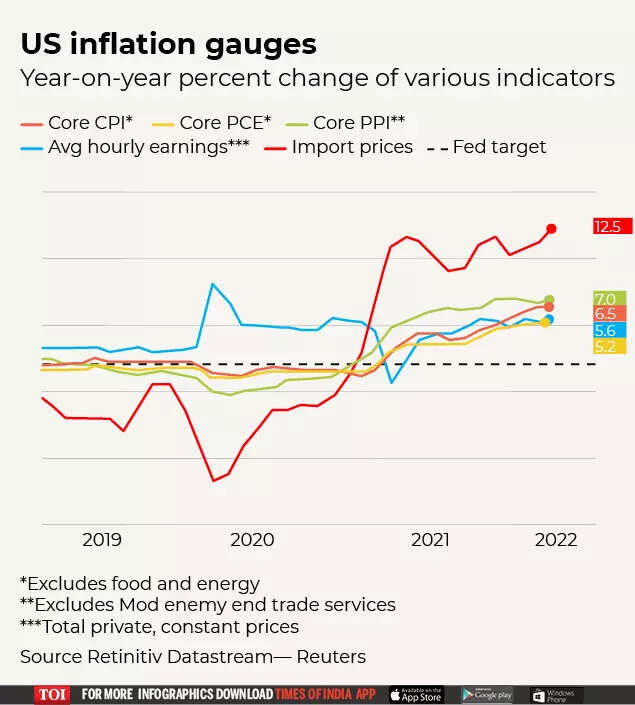

Russia's invasion of Ukraine, combined with renewed Covid-19 lockdowns in China, have exacerbated inflationary pressures.

The Fed's policy committee last week raised the key rate by a half point, the biggest hike since 2000, and said more big increases were likely.

Global supply shortages meant demand outstripped supplies. This sent prices soaring in world's largest economy, especially for housing and autos, with inflation rates not seen since the 1980s.

On the same day when the US Fed raised interest rates, the Reserve Bank of India too raised policy rates by 40 bps to 4.40 per cent to tame inflation.

Food inflation, which accounts for nearly half the consumer price index (CPI) basket, reached a multi-month high in March and is expected to remain elevated due to higher vegetable and cooking oil prices globally.

The anticipation of more rate hikes in the future by the US Federal Reserve pushed up the dollar to its highest levels in 2 decades, driven by higher treasury yields.

Low forex reserves

India's foreign exchange reserves have slumped below $600 billion mark for the first time in almost a year.

For the week ended April 29, the country's forex reserves dipped by $2.695 billion to $597.728 billion, according to the Reserve Bank of India's weekly statistical supplement.

This is the eighth consecutive weekly fall in India's forex reserves.

The country's forex reserves have fallen below the $600-billion-mark for the first time in almost a year. The last time India's forex reserves were below the $600-billion-mark was during the week ended May 28, 2021.

India's foreign currency assets, which is the biggest component of the forex reserves, dropped by $1.11 billion to $532.823 billion during the week under review, the RBI data showed.

FIIs continue to withdraw funds

Foreign investors have been net sellers in the domestic equity markers since the past 7 months now. Heavy bouts of selling by the foreign investors are usually a sign of weakening of the rupee against the dollar.

In 6 trading sessions so far this month, FIIs have withdrawn over Rs 20,000 crore from Indian stock markets.

Since October last year, FIIs have withdrawn over Rs 2.92 lakh crore from the markets. This is the 8th straight month when foreign investors are selling Indian shares.

Rupee against other currencies

In the last 20 trading sessions, the rupee has witnessed maximum pressure from rising US dollars.

While, in terms of UK, Euro and Japan's Yen, the domestic currency improved somewhat.

The pound sterling has eased from near Rs 100 level to Rs 95.5 at present in the past few sessions, while Euro and Yen too eased marginally to Rs 81.7 and Rs 59.32 respectively.

On Monday, the US dollar index, which measures the currency against six major currencies, broke past the 104 level and was near 20-year highs at 104.07. The index, which has skyrocketed 8 per cent, so far in 2022, had closed at 103.79 in the previous session.

The dollar index rose 0.203 per cent at 103.900, with the euro down 0.24 per cent to $1.053.

RBI intervenes

The RBI is intervening in all foreign exchange markets and will continue to do so to protect the rupee, Bloomberg said in a report.

It intervened in the spot, forwards and non-deliverable forwards market on Monday, the report said.

The RBI sees pressure on the rupee from a weaker yuan and stronger dollar, rather than domestic reasons.

As a result of RBI's intervention, the rupee rose for a 2nd day on Wednesday to settle at 77.25 against the US dollar.

Dollar retreated from its 20-year high levels and bond yields eased to below 3 per cent mark.

How it may impact

The falling rupee is most likely to impact spending decisions of households as certain things may become expensive.

For imports, payments are made in terms of dollars. A depreciating rupee would push up the price of importing goods.

Oil prices may rise further since India imports a major chunk of its oil needs. Other imported items like luxury cars, car components or even products that require parts to be imported from abroad like mobile phones and appliances may also become expensive. Thus, it might add to the overall inflation in short-term.

The Reserve Bank has already started undertaking measures to tame inflation. Further hikes in policy repo rates would push up interest costs further. The banks will start raising their lending rates, thereby requiring people to pay higher EMIs on their loans.

For people looking to study abroad during this time, the fees amount will rise as a dollar would now cost more in terms of rupee than earlier. Prospective students or even existing ones may face a hike in their spending.

In terms of remittances, or the money that people residing abroad send to their families back home in India, it would cost more as they will end up sending more in terms of rupee.

Another major impact of falling rupee might be felt on the tourism sector. With summer holidays round the corner and Covid-19 cases remaining in control, many people would want to resume their abroad travel plans. Such people might end up spending much higher than they would have a few days back.

On the flip side, exports from India will become cheaper. But, last month, commerce and industry minister Piyush Goyal said that even though exports will become cheaper it would not be in the nation's long-term interest.

He pointed out that currency devaluation is actually detrimental to a nation's interest, growth story and impacts its competitiveness in long run.

(With inputs from agencies)