/Expeditors%20International%20Of%20Washington%2C%20Inc_%20logo%20on%20screen-by%20madamF%20via%20Shutterstock.jpg)

Bellevue, Washington-based Expeditors International of Washington, Inc. (EXPD) is a premier global third-party logistics provider known for its expertise in air and ocean freight forwarding, customs brokerage, and end-to-end supply chain management. Operating across the Americas, Asia, Europe, and the Middle East, the company boasts a market cap of $16.1 billion.

Shares of the company have underperformed the broader market, falling 2.4% over the past year and rising 8.4% in 2025. In comparison, the S&P 500 Index ($SPX) has rallied 16.1% over the past year and 10% in 2025.

Focusing more closely, the logistics services provider has lagged behind the Industrial Select Sector SPDR Fund’s (XLI) 19.6% return over the past 52 weeks and has gained 16.2% on a YTD basis.

Expeditors delivered a strong Q2 2025 on Aug. 5, and its shares climbed 2.1% in the following trading session. Its revenue rose 9% year-over-year to $2.65 billion and EPS up 8% to $1.34, both beating expectations. Operating income grew 11% to $248 million, supported by 7% increases in both air and ocean freight volumes and a 10.5% jump in customs brokerage revenue, partly driven by tariff-related shipment pull-forward.

For the fiscal year ending in December 2025, analysts expect EXPD’s EPS to decline 4% year-over-year to $5.49. However, the company's earnings surprise history is promising. It topped or met the consensus estimates in the last four quarters.

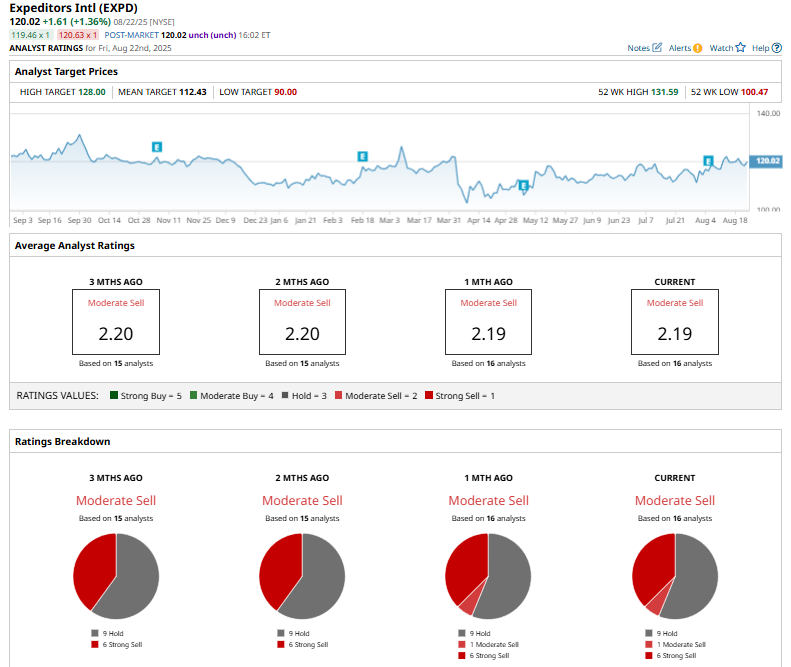

Among the 16 analysts covering the stock, the consensus rating is a “Moderate Sell.” That’s based on nine “Hold” ratings, one “Moderate Sell,” and six “Strong Sells.”

On Aug. 6, UBS Group raised its price target on Expeditors International of Washington from $117 to $120 while reiterating a “Neutral” rating, citing mixed analyst sentiment following the company’s strong Q2 earnings.

EXPD is trading above the mean price target of $112.43. The Street-high price target of $128 implies a potential upside of 6.6% from the current price levels.