/Expedia%20Group%20Inc%20%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $27.2 billion, Expedia Group, Inc. (EXPE) is a global online travel company offering a wide range of services across business-to-consumer (B2C), business-to-business (B2B), and metasearch segments. With popular brands like Expedia.com, Hotels.com, Vrbo, and trivago, it provides tools for travelers to plan, book, and experience trips, while also supporting partners with travel technology and marketing solutions.

Shares of the Seattle, Washington-based company have outperformed the broader market over the past 52 weeks. EXPE stock has climbed 38.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 18.1%. Moreover, shares of Expedia are up 19.7% on a YTD basis, compared to SPX’s 16.8% return.

Focusing more closely, the online travel company has outpaced the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 18.2% increase over the past 52 weeks.

Shares of Expedia Group rose 4.1% on Aug. 7 after the company reported better-than-expected Q2 2025 results, with revenue up 6% to $3.79 billion and adjusted EPS up 21% to $4.24. The strong performance was driven by robust B2B and Advertising growth of 15% and 19%, respectively, and 16% growth in adjusted EBITDA with 190 basis points of margin expansion. Investor optimism was further boosted as Expedia raised its Q3 2025 guidance, now expecting gross bookings growth of 5% - 7% and revenue growth of 4% - 6%.

For the current fiscal year, ending in December 2025, analysts expect EXPE’s EPS to grow 22.3% year-over-year to $11.51. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

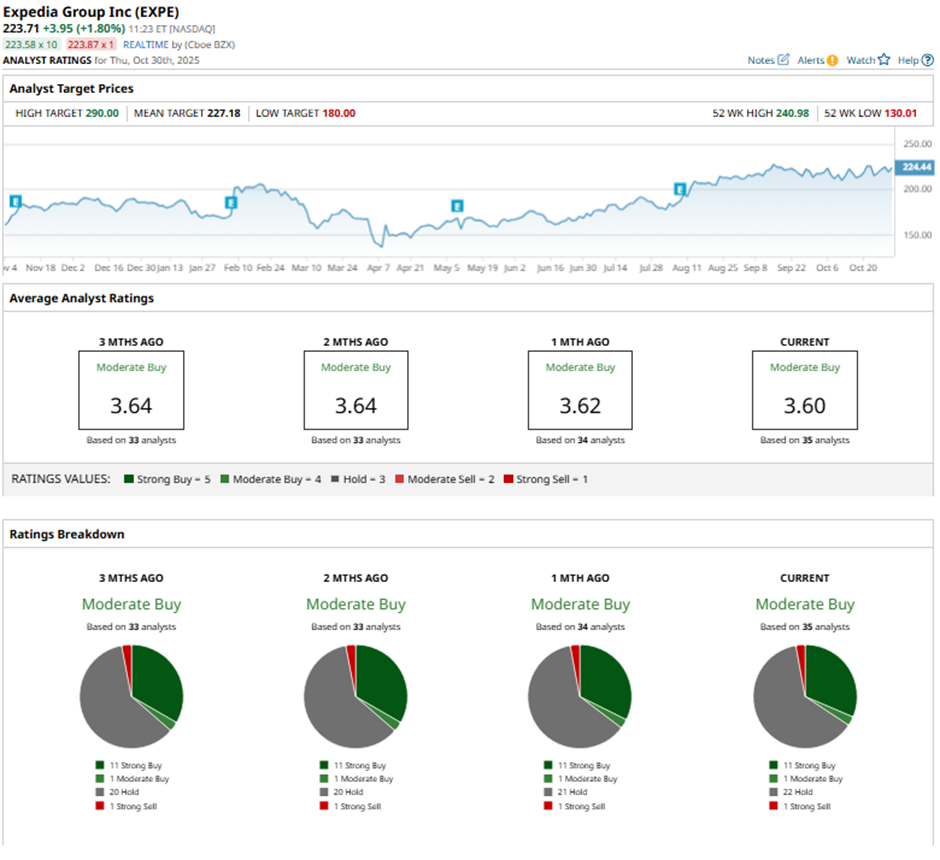

Among the 35 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” 22 “Holds,” and one “Strong Sell.”

On Oct. 27, Truist increased its price target on Expedia to $210 while maintaining a “Hold” rating.

The mean price target of $227.18 represents a 1.6% premium to EXPE’s current price levels. The Street-high price target of $290 suggests a 29.6% potential upside.