/Everest%20Group%20Ltd%20logo%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Everest Group, Ltd. (EG), headquartered in Hamilton, Bermuda, provides reinsurance and insurance products. Valued at $14.1 billion by market cap, the company offers property, casualty, and specialty reinsurance, as well as insurance solutions, along with claims management and support services.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and EG perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the insurance - reinsurance industry. EG's financial stability is driven by its substantial assets, diversified portfolio, and global network spanning over 100 countries. Strong financial strength ratings from top agencies further enhance its reliability and customer trust.

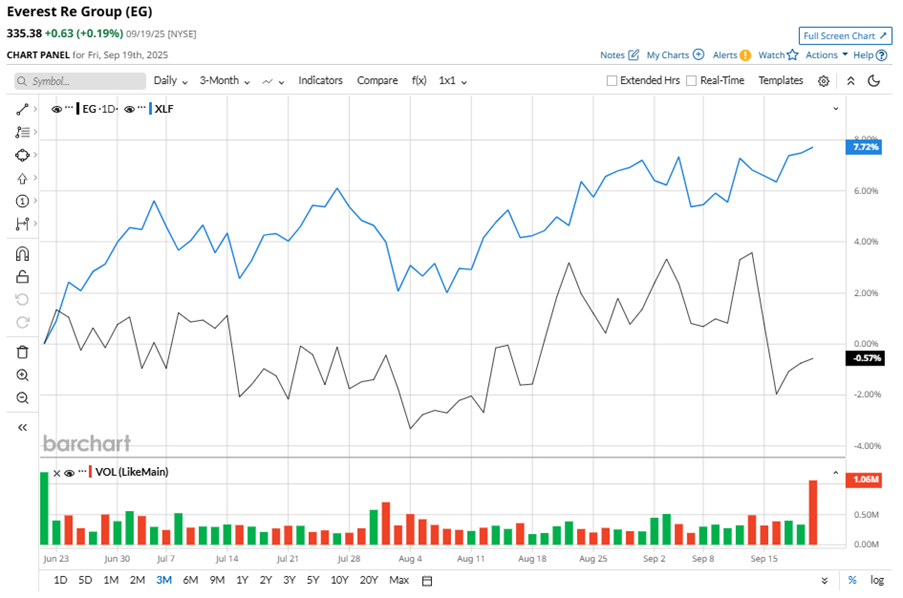

Despite its notable strength, EG shares slipped 17.7% from their 52-week high of $407.30, achieved on Oct. 4, 2024. Over the past three months, EG stock has gained marginally, underperforming the Financial Select Sector SPDR Fund’s (XLF) 8% gains during the same time frame.

In the longer term, shares of EG dipped 7.5% on a YTD basis and plunged 13.6% over the past 52 weeks, considerably underperforming XLF’s YTD gains of 12.3% and 18.7% returns over the last year.

To confirm the bearish trend, EG has been trading below its 50-day and 200-day moving averages since late October, with some fluctuations.

On Jul. 30, EG shares closed up marginally after reporting its Q2 results. Its EPS of $17.36 topped Wall Street expectations of $15.14. The company’s revenue was $4.5 billion, topping Wall Street forecasts of $4.4 billion.

EG’s rival, RenaissanceRe Holdings Ltd. (RNR), has outpaced the stock with 2.3% losses on a YTD basis and a 6.9% downtick over the past 52 weeks.

Wall Street analysts are reasonably bullish on EG’s prospects. The stock has a consensus “Moderate Buy” rating from the 18 analysts covering it, and the mean price target of $382.62 suggests a potential upside of 14.1% from current price levels.