Eric Trump, the executive vice president of The Trump Organization, expressed his “love” for cryptocurrency on Wednesday, citing his personal experiences with debanking as a major factor.

Financial Necessity Led The Trumps To Crypto

During an interview with Fox News, Trump said his businesses were abruptly excluded from the financial system as part of a broader campaign against the Trump family and conservatives.

“Capital One stripped 300 bank accounts from me in the middle of the night,” he mentioned. “This wasn’t just happening to the Trumps. This was happening to conservatives all over the country.”

Trump said he didn’t have a “damn choice” but to pivot toward cryptocurrency.

“It has become the fastest-growing industry anywhere in the world. It has removed a lot of the power from the big banks, who have weaponized their platforms against the American people, and I could not be more proud to be here,” he said.

See Also: ETH To $7,500 In 2025, Says Standard Chartered, As Ethereum ETFs Buy Over $500M Again

Debanking Allegations

The Trump Organization sued Capital One Financial Corp. (NYSE:COF) earlier this year, alleging that the bank closed hundreds of accounts linked to President Donald Trump for politically motivated reasons. Capital One has denied these allegations.

In a recent interview, Trump also accused JPMorgan Chase (NYSE:JPM) and Bank of America (NYSE:BAC) of discriminating against him by refusing to accept large deposits. JPMorgan denied any political motivation in its account closures.

Trump Family Bets Big On Crypto

The Trumps have been deepening their involvement in the cryptocurrency industry, investing in projects such as American Bitcoin, USD1 stablecoin and decentralized finance platform World Liberty Financial.

American Bitcoin, a Bitcoin (CRYPTO: BTC) mining firm, is set to make its debut on the Nasdaq stock exchange. Moreover, Trump Media and Technology Group (NASDAQ:DJT), a firm majority-owned by Trump, has announced plans to set up a Bitcoin treasury.

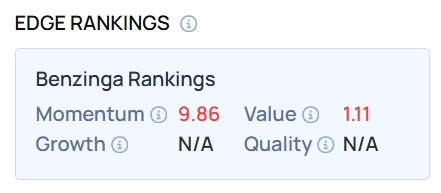

Price Action: Trump Media stock rose 0.17% in after-hours trading after closing 2.98% higher at $17.98 during Wednesday’s regular trading session, according to data from Benzinga Pro.

As of this writing, the DJT stock exhibited a low value score— a metric that evaluates an asset’s relative worth by comparing its market price to fundamental measures. In case you're looking to pack your portfolio with high-value equities, visit Benzinga's proprietary Edge Rankings score for assistance.

Read Next:

Photo courtesy: Maxim Elramsisy / Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.