Hedge fund manager Eric Jackson targets Canadian rapper Drake as a catalyst for Opendoor Technologies Inc. (NASDAQ:OPEN). Jackson filmed promotional videos outside Drake’s Toronto home, urging celebrity investment in the “OPEN Army.”

Check out how OPEN stock is trading here.

“He started from the bottom – well, so did we,” Jackson posted on August 1. At Friday’s Independent Investor Summit, Jackson confirmed Drake’s representatives indicated the rapper “likes the company.”

Management Transformation Drives Rally

According to a Business Insider report, the Californian digital real estate experienced a 1,500% summer rally following Jackson’s X thesis. Shares surged after announcing former Shopify Inc. (NYSE:SHOP) Chief Operating Officer Kaz Nejatian as CEO, with co-founders Keith Rabois and Eric Wu returning to board.

See Also: Goldman Sachs Warns An AI Slowdown Can Tank The Stock Market By 20%

“The management question has been resolved,” Jackson previously stated. Rabois assumes chairman role in “FounderMode” transition.

Retail Army Mobilizes

Jackson’s campaign gained strong support from retail investors. Scott Findlay, an investor, described Drake’s strategy as “hands-on, grassroots marketing” aimed at reaching unconventional audiences.

Bull Case Emerges

Jackson describes OPEN as the “Amazon (NASDAQ:AMZN) of housing,” aiming to streamline the buying and selling process. He also highlighted risks like prolonged high interest rates and worries about profitability, even after the company posted its first positive earnings before interest, taxes, depreciation, and amortization in three years.

The real estate innovator compares OPEN to Tesla Inc. (NASDAQ:TSLA) and Palantir Technologies Inc. (NYSE:PLTR), highlighting their dedicated customer bases and focus on addressing real market demands.

Stock Performance Soars

In 2025, OPEN gained 466.88%. On September 11, the stock reached a peak price of $10.52 with a trading volume of 1.1 billion shares, significantly higher than the average volume of 344.10 million.

The property innovator has an annual price range of $0.51 to $10.70, with a market capitalization of $6.68 billion.

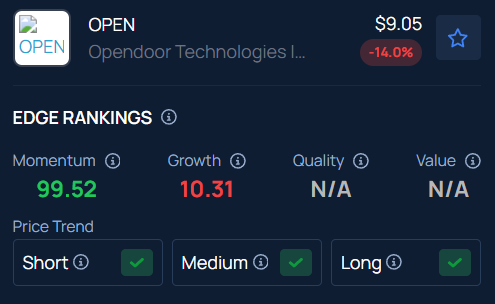

Price Action: Opendoor saw a dip of 13.78% and closed at $9.07 on Friday, according to Benzinga Pro data.

With a strong momentum in the 99th percentile, Benzinga’s Edge Stock Rankings show that OPEN is experiencing a positive price trend across all time frames. See how its momentum compares to other well-known stocks.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Tada Images / Shutterstock.com