Eric Jackson, founder of EMJ Capital, has pushed back on comparisons to legendary GameStop Corp. (NYSE:GME) retail investor “Roaring Kitty,” asserting that his conviction in Opendoor Technologies Inc. (NASDAQ:OPEN) stems from fundamental value rather than internet virality.

Jackson Rejects The New Roaring Kitty Label

In a recent X post, Jackson declared, “People keep calling me the new Roaring Kitty. Respect to him—he proved retail can move markets. But here's the difference: $GME was a dying mall retailer. $OPEN is a Carvana-like platform in housing with real growth, real margins, and a clear path to $82 -> $500.”

He emphatically concluded, “This isn't a meme stock. It's a cult stock with generational re-pricing. #OPENArmy.”

Who Is ‘Roaring Kitty’?

“Roaring Kitty” is the online alias of Keith Gill, a former financial analyst who became a central figure in the 2021 GME short squeeze. Under the Reddit username DeepF***ingValue, Gill began posting on the WallStreetBets forum in 2019, sharing his detailed research and a bullish thesis on GameStop.

His consistent, data-driven posts and educational YouTube videos attracted a massive following of retail investors who, inspired by his conviction, piled into the stock.

This collective buying pressure triggered a historic short squeeze, sending GME’s stock price soaring at its peak, inflicting billions in losses on hedge funds and cementing Gill as a folk hero in the “meme stock” phenomenon.

What Is Jackson’s View On OPEN?

Jackson’s staunch defense comes as OPEN has experienced a staggering rally, surging 466.88% year-to-date and 662.18% over the last six months, fueled in part by his vocal advocacy.

He likens OPEN to the “Amazon of housing,” aiming to revolutionize the buying and selling process. This surge coincides with a pivotal management overhaul at Opendoor, including the return of co-founders Keith Rabois and Eric Wu to the board, and the appointment of Shopify’s former COO, Kaz Nejatian, as CEO.

Rabois, now chairman, has outlined a drastic plan to reduce the workforce from 1,400 to fewer than 200, criticizing remote work and DEI initiatives to refocus on “merit and excellence.”

Jackson Seeks Rapper Drake’s Support

Jackson’s strategy for mobilizing the “OPEN Army” has notably included targeting Canadian rapper Drake as a potential catalyst, even filming promotional videos outside Drake’s Toronto home.

At the Independent Investor Summit, Jackson confirmed Drake’s representatives expressed the rapper “likes the company,” indicating a unique, hands-on grassroots marketing approach to attract unconventional audiences.

Price Action

The stock fell 13.78% on Friday to $9.07 per share. The stock has advanced 281.09% over the year.

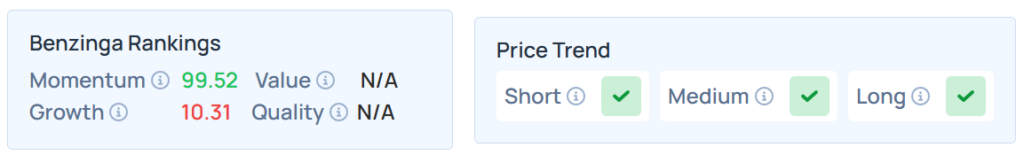

Benzinga’s Edge Stock Rankings indicate that OPEN maintains a stronger price trend in the short, medium, and long terms. However, the stock’s growth ranking is relatively weak. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended in a mixed manner on Friday. The SPY was down 0.033% at $657.41, while the QQQ advanced 0.44% to $586.66, according to Benzinga Pro data.

On Monday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were mixed.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Tada Images / Shutterstock.com