The government shutdown didn't slow the markets down on Wednesday, with both the S&P 500 and Dow Jones Industrial Average delivering record closes on the day; the former closing above 6,700 for the first time.

As for the unusual options activity yesterday, it was a relatively busy day with 1,328 calls or puts generating Vol/OI (volume-to-open interest) ratios of 1.24 or higher and expiring in seven days or more.

Of the 1,328, there were 858 (65%) calls and 470 (35%) puts. That’s very bullish. As a result, for today’s commentary, I’ll be focusing on the calls rather than the puts.

Of the top 10 Vol/OI ratios for calls yesterday, they ranged from 258.77 for Ke Holdings (BEKE), in first place, to 45.08 for Microsoft (MSFT), in 10th position.

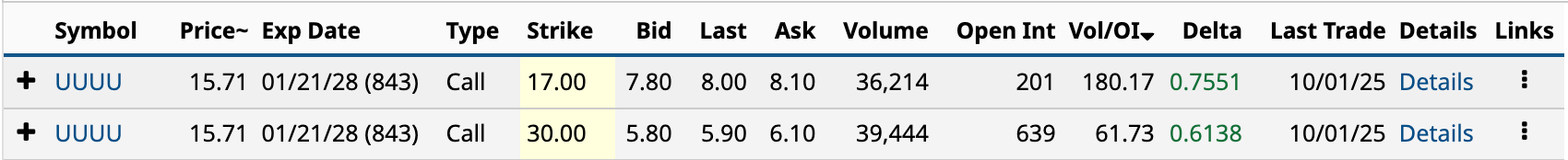

In between were two calls for Energy Fuels (UUUU), the hotter-than-a-pistol stock benefiting from investor enthusiasm about uranium miners.

The company had the second and ninth-highest Vol/OI ratios for call options yesterday at 180.17 and 61.73, respectively.

I won’t pretend I’m an expert on Energy Fuels. However, the stock symbol (UUUU) has piqued my interest-- I have a thing for single-letter stock symbols.

There’s no question that rare earth and critical minerals are “it” stocks at the moment. I probably wouldn’t invest in UUUU for the long haul, but that doesn’t mean you shouldn’t.

Energy Fuels’ two unusually active call LEAPS (Long-term Equity Anticipation Securities) from yesterday could be the play.

Here are my pros and cons for both.

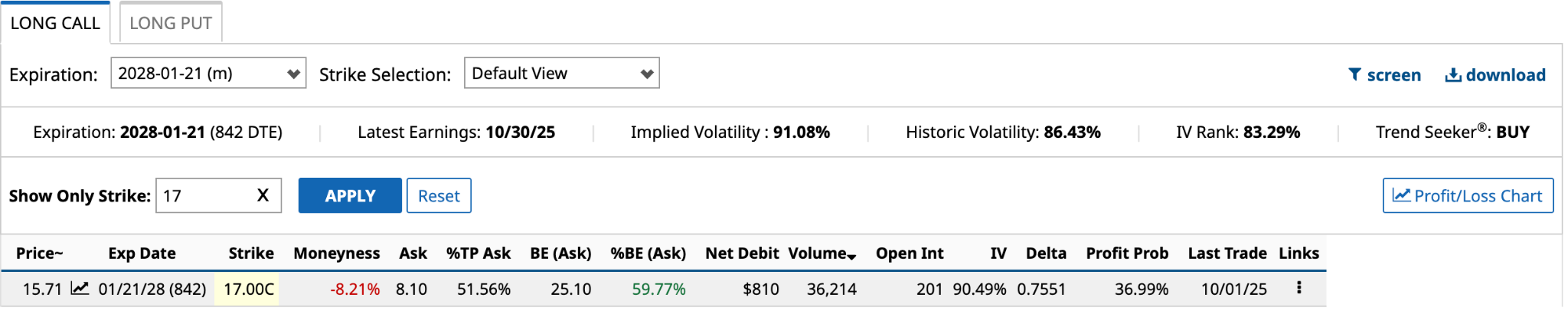

The $17 Strike

As you can see from the introduction, the Jan. 21/2028, $17 call had a DTE (days to expiration) of 843, approximately 28 months from the current date. That’s a long runway. Almost anything could happen between now and then.

Pictured below is the Barchart data for the $17 call in the pre-market on Thursday. The DTE has lost a day to 842. But I digress.

The net debit (ask price) of $8.10 is 52% of yesterday’s $15.71 closing price. OTM (out-of-the-money) by 8.21%, its shares must appreciate by nearly 60% to break even on the trade.

Based on an expected move of 78.24% over the next 842 days, up or down, it’s got a shot at blowing past its $25.10 breakeven price. As a result, its profit probability is decent at 36.99%.

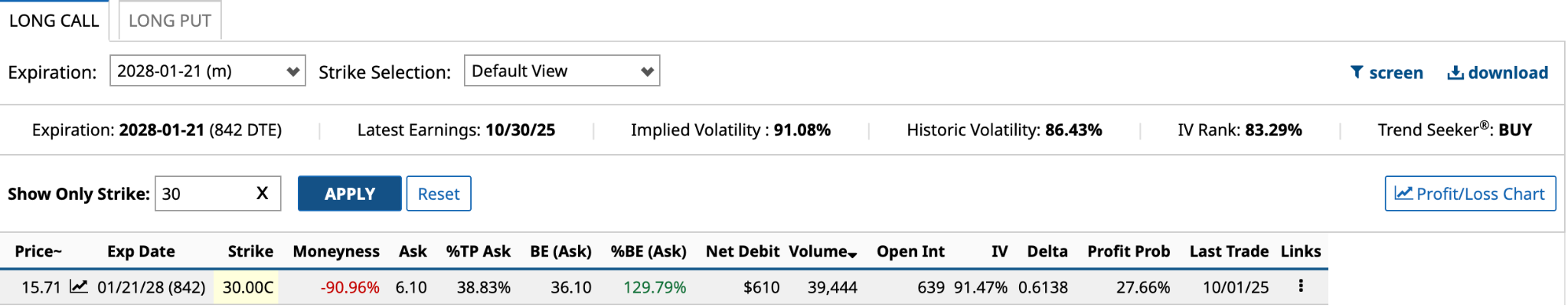

The $30 Strike

Now let’s consider the $30 call, whose data is shown below.

As you can see, the net debit is $2 lower at $6.10, or 39% of yesterday’s $15.71 closing price. Considerably OTM at 90.96%, its shares must appreciate by nearly 130% to break even on the trade. That’s a big ask, but if nuclear energy turns out to be the way America keeps up with the increased energy consumption from AI, it’s not impossible.

Based on an expected move of 78.24% over the next 842 days, up or down, Energy Fuels will have to keep delivering positive news about its business over the next two years for UUUU stock to double from where it currently trades. Its profit probability is lower at 27.66%.

In this next section, I will delve into the specifics of Energy Fuels and what makes it an excellent investment — or not. I’ll then finish with my thoughts on both LEAPS.

Energy Fuels’ Opportunity in a Nutshell

As the company’s investor relations website says, “Energy Fuels is a leading U.S.–based critical minerals company.”

As I said in the introduction, I am by no means an expert on Energy Fuels' business. However, it’s pretty clear that its future success depends on U.S. government officials continuing to promote U.S.-mined uranium.

You can't miss all of the online articles about President Trump and his desire to boost uranium production in the U.S. The administration’s ongoing support has been a significant accelerant for UUUU stock.

In May, the Globe & Mail, Canada’s leading business newspaper, published an article about Trump’s desire for the U.S. to dominate global uranium production.

There’s only one problem with this goal: achieving it is not something that the U.S. can do anytime soon. According to the Nuclear Energy Agency, the U.S. ranked 12th in uranium production in 2022, with 75 tonnes, compared to 7,380 tonnes for Canada, which is the second-largest producer globally, but trails Kazakhstan significantly, with nearly three times the production.

This presents both opportunities and challenges for U.S. producers, such as Energy Fuels.

The Pathway to Profitability

In Q2 2025, the company sold 50,000 pounds of uranium concentrate, generating $3.85 million in revenue. That was down from $8.59 million the previous year. Energy Fuels intentionally sold fewer pounds of uranium concentrate in this year’s second quarter due to weak prices. It expects them to improve by early 2026.

According to its press release, it could finish 2o25, with as much as 1.44 million pounds of uranium concentrate stockpiled from its Pinyon Plain (Arizona), La Sal (Utah) and Pandora mines (Utah).

Citibank estimates that the price of each pound of uranium concentrate will hit $100 by the end of this year. Let’s assume it does, and the company sells all of its stockpiled product.

The sale translates into $144 million in revenue [$100 price * 1.44 million pounds]. Of course, it won’t be able to sell all of that in one quarter, or even one year. In 2024, it sold 450,000 pounds at prices ranging from $75.13 to $91.51 per pound, resulting in nearly $38 million in revenue from uranium concentrates.

So, it’s possible it could sell 1.44 million pounds by the end of 2027. Prices could be even higher by then. According to S&P Global Market Intelligence, the analyst estimate for 2027 revenue is $355.9 million, with an EBIT (earnings before interest and taxes) of $85.5 million.

Considering its EBIT loss in 2024 was $68.2 million, an EBIT profit by 2027 would be a significant accomplishment.

The Bet’s Not Half-Baked

While a lot has to go right over the next two years for Energy Fuels to be profitable by Jan. 21, 2028, there is a pathway to achieve this.

From this perspective, the two options expiring in 841 days seem to be rational bets on Energy Fuels’ future prosperity.

If it were me, I’d go with the $17 call, because for an additional $200, you have a much better chance of breaking even or generating a healthy return on your investment.

Good luck.