I concluded my Q2 Barchart report on the energy sector with the following:

While the situation in the Middle East has calmed since the ceasefire between Israel/the U.S. and Iran, the region remains a tinderbox. Any hostilities over the coming weeks and months could cause sudden rallies in the crude oil, oil product, and natural gas futures markets due to supply concerns. As China is a leading consumer of crude oil, improvements in China’s economy could boost demand, supporting prices.

Meanwhile, OPEC+ has increased petroleum output, and the U.S. energy policy now favors a “drill-baby-drill” and “frack-baby-frack” approach to oil and gas. Increasing U.S. and OPEC+ output could put downward pressure on prices. The bottom line is that petroleum and product prices could be highly volatile over the second half of 2025. Coal and ethanol prices will likely follow oil and oil product price trends.

Natural gas is a seasonal energy commodity that tends to peak as winter approaches. Seasonality could support higher natural gas prices in late third quarter and fourth quarter of 2025.

Expect continued volatility in the energy sector, and you will not be disappointed.

While heating oil futures and distillate crack spreads, and ethanol swaps posted gains in Q3, the other energy commodities declined in Q3, and the bearish price action continues in late October 2025.

Crude oil continues to decline

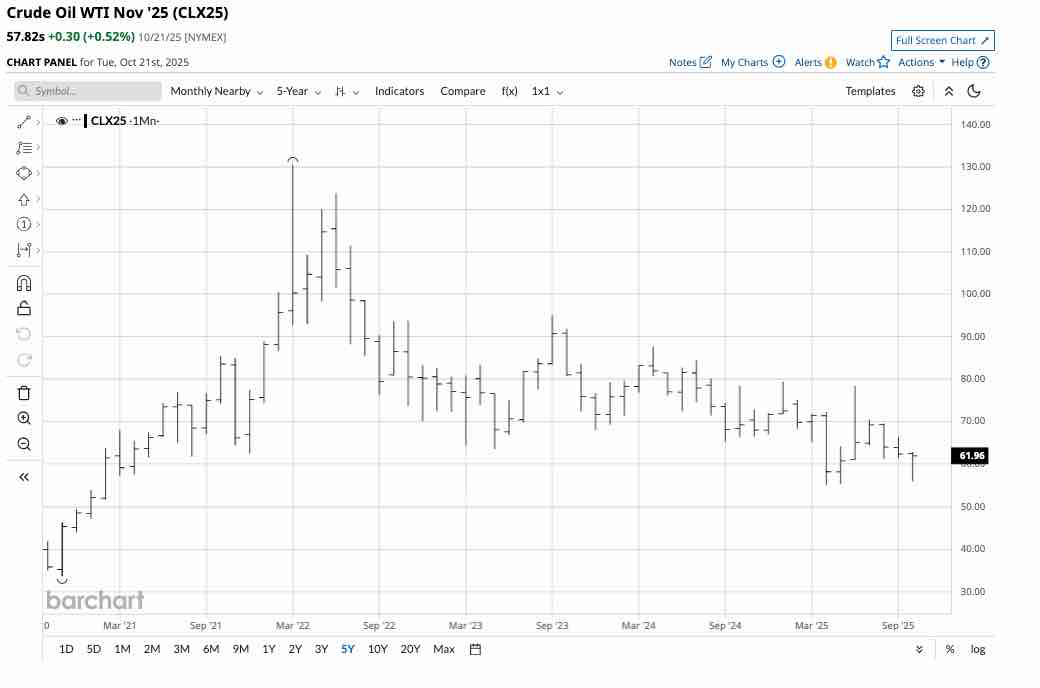

Nearby NYMEX WTI crude oil futures fell 4.21% in Q3 and were 13.04% lower over the first nine months of 2025.

The monthly chart highlights the bearish trend that sent the WTI futures to settle at $62.37 per barrel on September 30, 2025. The NYMEX futures have continued to reach lower lows in Q4, falling to $55.96 per barrel on October 20, just above the April 2025 low of $55.12, the critical technical support level. After recovering, crude oil futures were just below the $62 per barrel level on October 27.

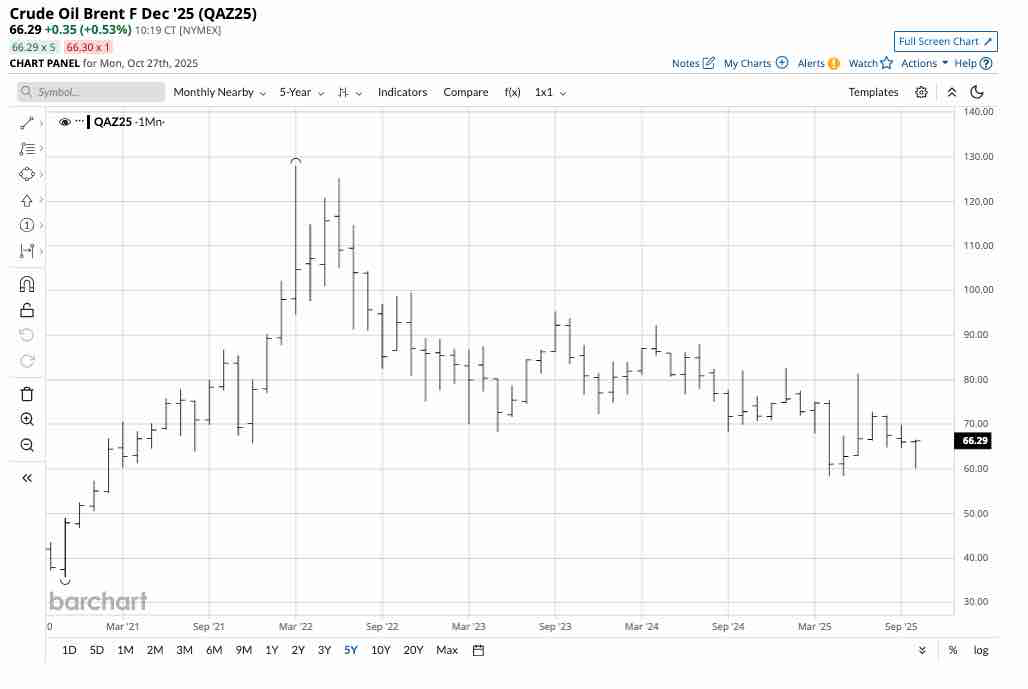

Nearby ICE Brent crude oil futures fell 0.90% in Q3 and were 10.02% lower over the first nine months of 2025.

The monthly chart highlights the bearish trend that sent the Brent futures to settle at $67.16 per barrel on September 30, 2025. The Brent futures have continued to reach lower lows in Q4, falling to $60.07 per barrel on October 20, just above the April 2025 low of $58.39, the critical technical support level. The Brent futures recovered and were above $66 per barrel on October 2. 7

WTI and Brent crude oil futures have been trending lower since the highs from 2022, and the bearish path of least resistance continues in Q4 2025.

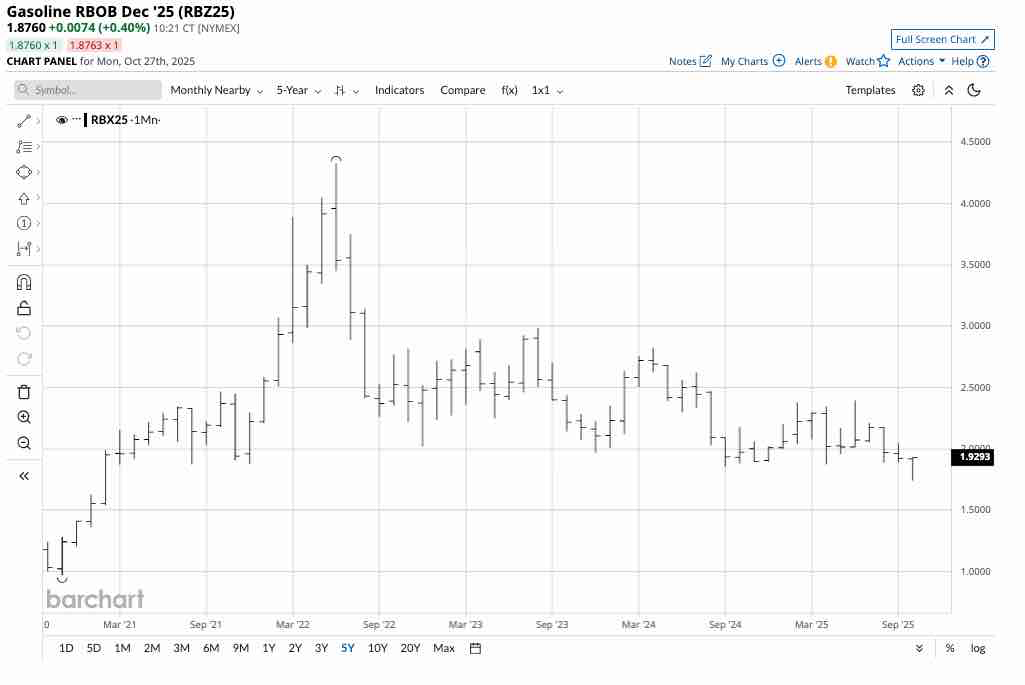

Oil products reflect seasonality

Gasoline is a seasonal oil product that tends to rally during the driving season in spring and summer when demand increases, and trends lower during fall and winter when divers put fewer miles on their odometers. Nearby NYMEX gasoline futures fell 4.79% in Q3 and were 1.81% lower over the first nine months of 2025.

The monthly chart highlights the bearish trend that sent the gasoline futures to settle at $1.9729 per gallon wholesale on September 30, 2025. The gasoline futures have continued to reach lower lows in Q4, falling to $1.7407 per barrel on October 17, the lowest price since February 2021, before recovering.

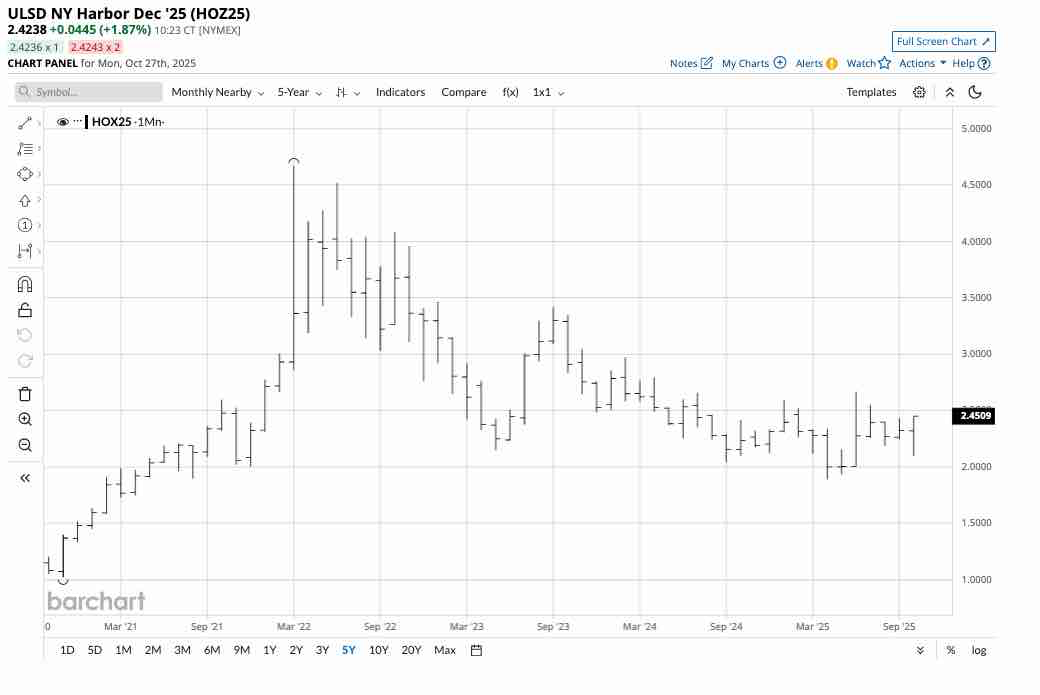

Despite its use for heating during winter, heating oil is less of a seasonal oil product as it is a proxy for other distillates, including diesel and jet fuels. Nearby NYMEX heating oil futures rose 2.47% in Q3 and were 0.70% higher over the first nine months of 2025.

The monthly chart highlights the bearish trend that sent the heating oil futures to settle at $2.3325 per gallon wholesale on September 30, 2025. The heating oil futures have continued to reach lower lows in Q4, falling to $2.1011 per gallon on October 17, above the April 2025 low of $1.8925 per gallon, the critical technical support level. Heating oil futures recovered by the end of October.

Crack spreads reflect the refining margin for processing crude oil into gasoline and distillate products. The gasoline crack spread declined in Q3, while the distillate crack spread rose during the three-month period. However, both gasoline and distillate refining margins were considerably higher over the first nine months of 2025. The gasoline refining margin was slightly lower than the Q3 closing level as of October 27, while the distillate crack spread was higher than the September 30, 2025, closing level.

Natural gas declines, despite seasonality

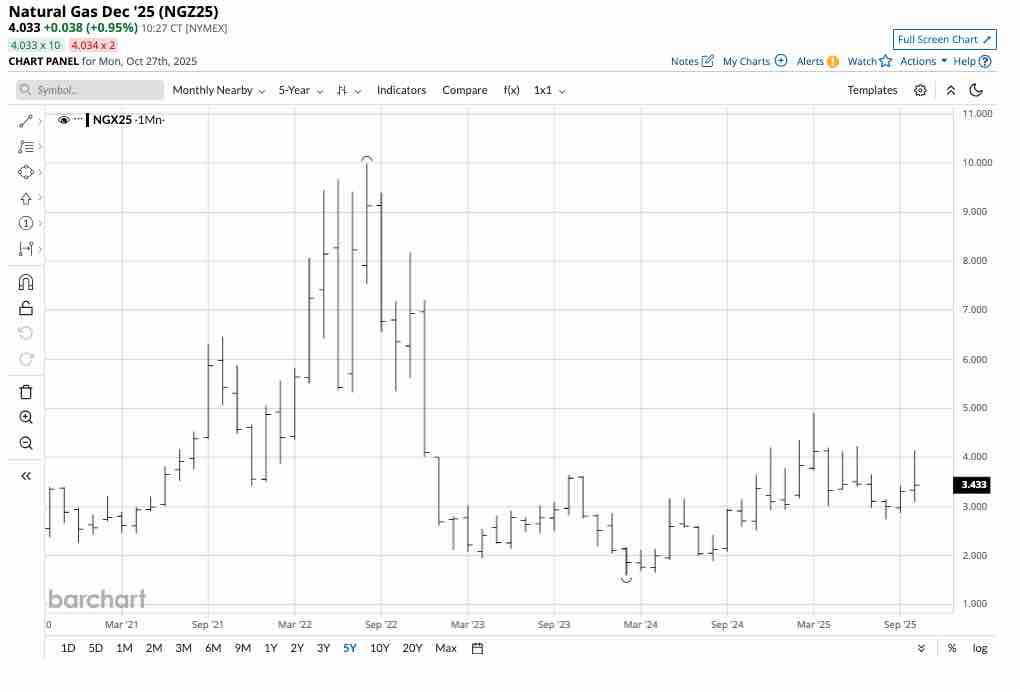

U.S. natural gas futures for delivery at the Henry Hub in Erath, Louisiana, tend to reach annual highs as the winter approaches. However, as of the end of Q3 2025, seasonality had not yet impacted prices. Nearby NYMEX natural gas futures fell 4.43% in Q3 and were 9.08% lower over the first nine months of 2025.

The monthly chart highlights the mostly sideways trend that caused the NYMEX natural gas futures to settle at $3.303 per MMBtu on September 30, 2025. The natural gas futures are steady in Q4, trading around the $3.43 per MMBtu level on October 27, with the December futures just above $4 as the peak demand and inventory withdrawal season approaches.

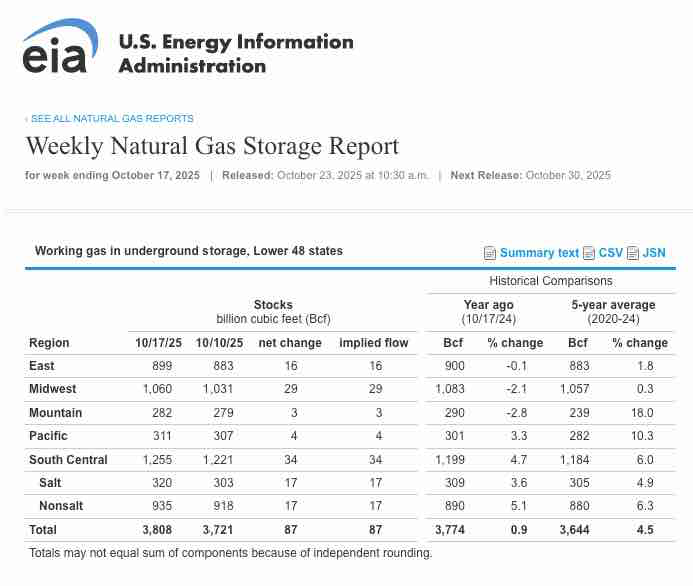

As the chart highlights, as of the week ending on October 17, 2025, natural gas inventories across the United States at 3.808 trillion cubic feet were 0.9% above last year’s level, and 4.5% over the five-year average for mid-October. As the season where withdrawal from stockpiles approaches, natural gas stocks peaked at 3.972 trillion cubic feet at the end of the 2024 injection season. Time will tell if stocks reach that level over the coming weeks before they begin declining.

As the war in Ukraine continues, Western European countries that typically depend on Russian natural gas supplies could increase their purchases of U.S. liquified natural gas, which is an increasing demand vertical for the energy commodity. However, the temperatures across the U.S. and Europe over the 2025/2026 winter will determine demand and if prices appreciate over the coming months.

Ethanol and coal prices move in opposite directions

Nearby Chicago ethanol swap prices rose 10.71% in Q3 and were 10.06% higher over the first nine months of 2025. The leading U.S. biofuel were around the $1.86 per gallon wholesale level at the end of September, and were lower with gasoline prices in October. The U.S. ethanol mandate increases the correlation between biofuel and gasoline prices. However, since U.S. ethanol is a corn product, lower corn prices, which dropped 1.19% in Q3 and 9.38%, likely prevented further price gains. The higher ethanol prices increased processing margins for refineries that process corn into biofuel. Meanwhile, Chicago ethanol swaps for November delivery were lower than the Q3 closing price, at the $1.7750 per gallon wholesale level, on October 27.

Nearby coal futures for delivery in Rotterdam, the Netherlands, moved 11.37% lower in Q3, settling at $95.50 per metric ton on September 30, 2025. The coal futures were 15.60% lower over the first three quarters of 2025. Nearby Rotterdam coal futures were virtually unchanged on October 27. Coal demand tends to increase during the winter heating season. China and India continue to burn coal for energy. Coal futures for delivery in Newcastle, Australia, declined 2.34% in Q3 and were 13.33% lower over the first nine months of 2025. The Australian coal futures were slightly lower than the Q3 closing level on October 27, 2025, at just below $108 per metric ton.

The outlook for Q4 and beyond- Crude oil approaches a critical technical level

Crude oil is the leading energy commodity that continues to power the world. U.S. energy policy, OPEC+ production increases, seasonality, and the potential for a more peaceful Middle East favor lower crude oil prices in Q4. A move below the $55.12 critical technical support on the continuous NYMEX crude oil futures contract could ignite substantial technical selling, leading to a test of the $50 per barrel level, or lower. Oil products, coal, and ethanol are likely to follow crude oil prices over the coming weeks and months.

Natural gas is heading into the peak demand season, when uncertainty about the weather will peak as inventories begin to decline in late November. Therefore, nearly U.S. natural gas prices could recover to the $4 per MMBtu level, or higher, over the coming weeks and months. U.S. natural gas prices for January 2026 delivery were already trading near $4.30 per MMBtu on October 20.

Expect lots of volatility in energy commodities over the coming days and weeks. In late October, I remain bearish on crude oil and bullish on natural gas for the coming weeks and until the end of 2025.