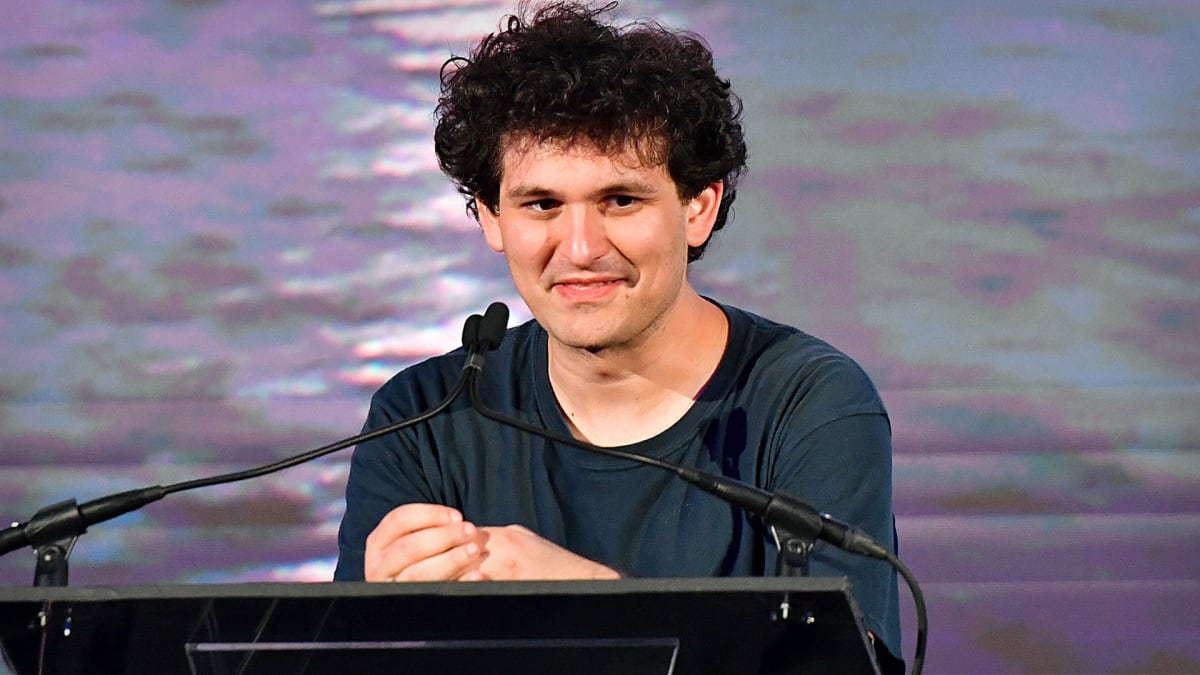

Sam Bankman-Fried, the founder of the bankrupt cryptocurrency exchange FTX, has been on a media tour since Nov. 30 to try to rewrite the overnight implosion of his empire.

According to him, everything that happened is the fault of no luck. He knew nothing and had no intention of ripping off the investors and clients of his two flagship companies -- FTX and the hedge fund Alameda Research, which is also a trading platform.

"I made a lot of mistakes," he said during his interview with the New York Times/DealBook. "There are things I would give anything to be able to do over again. I didn't ever try to commit fraud on anyone."

Bankman-Fried's media offensive is all the more surprising, as regulator investigations are ongoing. It is unclear right now whether they will result in charges or not. But the former trader doesn't seem to be in a rush to testify before Congress.

Contrary to his hopes, his tour has so far failed to change public opinion in his favor. Calls to send him to jail continue to amplify on social networks. The more he talks, the more the comments on social media are negative, especially since millions of FTX customers and investors do not know if they will ever be able to recover their money after the company filed for Chapter 11 bankruptcy on Nov. 11 following a liquidity crunch.

'The Big House'

One of the most influential voices has just joined the call to imprison him. This is Elon Musk, the CEO of Tesla (TSLA), SpaceX and Twitter. The richest man in the world believes it's time for Bankman-Fried to spend his days in jail.

It all started with a thread on Twitter in which he claimed that the former fallen king of cryptocurrencies was bad in the video game League of Legends, aka LoL.

"SBF was bad at League. Nuff said," the Techno King, as he is known at Tesla, posted on Twitter on Dec. 3, referring to Bankman-Fried's low rank of Bronze III in the game.

"SBF doesn’t need anymore mentioning except for his court date," a Twitter user commented, referring to Bankman-Fried's initials.

"Agreed," Musk quipped. "Let’s just give him an adult timeout in the big house & move on."

A very large majority of the comments that followed agreed with Musk.

"Martha Stewart went to jail for less!" said one Twitter user.

"I can't believe some media is trying to make him seem less guilty," posted another user.

"A large timeout and every one of his accomplices," added another user.

It's important to point out that Musk has a brief and complicated relationship with Bankman-Fried. The latter had wanted to participate in the financing of the acquisition of Twitter by Musk.

Musk vs. Bankman-Fried

The tech mogul claimed at the time of FTX's bankruptcy filing that Bankman-Fried "set off [his] bs detector." But a Semafor article later claimed, backed by text messages, that Musk had asked Bankman-Fried to roll his $100 million Twitter stake into Twitter 2.0, which Musk denied.

"As I said, neither I nor Twitter have taken any investment from SBF/FTX. Your article is a lie. Now, I’m asking again, how much of you does SBF own?" Musk said of the article.

"Semafor is owned by SBF. This is a massive conflict of interest in your reporting. Journalistic integrity is 🗑️," Musk said at the time.

Bankman-Fried is one of Semafor shareholders.

As a crypto exchange, FTX executed orders for clients, taking their cash and buying cryptocurrencies on their behalf. FTX acted as a custodian, holding the clients’ crypto.

FTX then used its clients’ crypto assets, through its sister company’s Alameda Research trading arm, to generate cash through borrowing or market-making. The cash FTX borrowed was used to bail out other crypto institutions in summer 2022.

At the same time, FTX was using the cryptocurrency it was issuing, FTT, as collateral on its balance sheet. This was a significant exposure, due to the concentration risk and the volatility of FTT.

The insolvency of FTX stemmed from a liquidity shortfall when clients attempted to withdraw funds from the platform. The shortfall appears to have been the result of Bankman-Fried allegedly transferring $10 billion of customer funds from FTX to Alameda Research.