Tesla Inc. (NASDAQ:TSLA) shares have dipped amid fresh blows from slumping China sales and a high-profile investor revolt against Elon Musk‘s eye-popping $1 trillion pay package, yet the electric vehicle giant’s underlying momentum tells a defiant tale of resilience.

Check out TSLA’s stock price here.

Tesla’s Car Sales Drop In October

The starkest setback hit in China, Tesla’s vital growth engine. October wholesale sales from its Shanghai factory plunged 9.9% year-over-year to 61,497 units—the lowest since May—reversing September’s modest 2.8% gain, according to the China Passenger Car Association.

Fading hype around the six-seat Model Y Long Range, launched in August, contributed to the 32% month-over-month drop, exacerbating a brutal price war where even rival BYD saw a 12% global sales decline.

Additionally, Tesla registrations in nine key European countries, as per the early data out for October, were down 36.3% year-over-year.

Norway Fund Rejects Musk’s Massive Tesla Payout

Compounding the pain, Norges Bank Investment Management, which manages Norway’s $2.1 trillion sovereign wealth fund—holding a 1.12% stake worth $17 billion—announced it will vote against ratifying Musk’s proposed decade-long compensation plan Tuesday, just ahead of Thursday’s shareholder meeting.

Citing excessive dilution, “key person” risks, and the award’s sheer scale, the fund, which also did not approve of Musk’s $56 billion package last year, is opposing the re-election of two board directors as well.

What Do Benzinga Edge Rankings Say About Tesla?

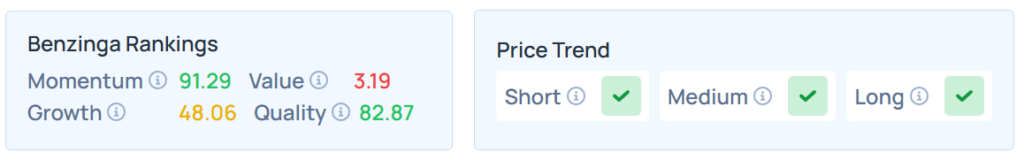

Yet beneath the headlines, Tesla’s momentum score has surged. Benzinga Edge’s Stock Rankings report showed that the stock catapulted into the top 10th percentile at 91.29, a +2.67 jump from 88.62.

Benzinga’s momentum ranking measures relative price strength, volatility-adjusted patterns, and multi-timeframe trends against peers.

A 17.13% year-to-date gain was accompanied by a recent 3.97% five-day slide and 1.98% monthly dip. In premarket hours on Wednesday, the stock was trading 0.57% higher. However, in the short, medium, and long-term, trends were positive with a poor value ranking. Additional performance details are available here.

While the S&P 500, Dow Jones, and Nasdaq 100 closed lower on Tuesday, the futures were mixed on Wednesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock