Electric vehicle stocks meandered to a mixed close in the week ending Nov. 11, with earnings news and the broader market sentiment serving as catalysts. Tesla, Inc. (NASDAQ:TSLA) stock extended its slide despite recovering strongly in the second half of the week.

Now, here are the key events that happened in the EV space during the week:

Musk Denies Reports Of MIC Car Exports Into North America: After Reuters said Tesla could be looking to export made-in-China cars for sale in North America., CEO Elon Musk dismissed the report. The publication said the rumored move was meant to combat a demand slowdown in China and to take advantage of the increased production rate achieved by Giga Shanghai following factory upgrades.

Worries concerning Musk’s Twitter buy and its impact on Tesla – the “golden child” of Musk’s business empire, were front and center this week. Many avowed Tesla bulls said the purchase of the social media platform will impact Tesla, primarily due to Musk’s divided attention and Twitter being a money pit.

The billionaire disclosed this week that he sold about $4 billion worth of his Tesla stake over three days, which triggered negative sentiment toward the stock. More importantly, Tesla retail investors wanted to know if Musk was done with his stock sale.

Rivian Affirms Guidance: Rivian Automotive, Inc. (NASDAQ:RIVN) reported third-quarter revenue that came in below estimates, but the loss was narrower than expected. The company affirmed its full-year adjusted loss before income, taxes, depreciation and amortization guidance, although it trimmed its capex guidance for 2022 from $2 billion to $1.75 billion, stating that some of the planned spending will be moved to next year.

See also: Tesla Bull Yanks Off EV Maker From Wedbush's 'Best Ideas' List Amid Elon Musk's 'Twitter Antics'

Nio Q3 Loss Widens: Chinese EV maker Nio, Inc. (NASDAQ:NIO) reported a loss for the third quarter that widened from a year ago due to higher input prices, and production and supply chain challenges. Revenues came in ahead of the consensus estimate. The company guided to a pickup in volume and revenue in the fourth quarter, although the revenue guidance trailed expectations.

Lucid Taps Funding Sources: Luxury EV maker Lucid Group, Inc. (NASDAQ:LCID) announced this week it has entered into an “at-the-market” program with investment banks, including BofA Securities, Barclays and Citigroup, to sell up to $600 million shares of its common stock. The company also said it has entered into an agreement with its majority stockholder and affiliate of the Public Investment Fund, Ayar Third Investment Company, to sell $915 million of shares in one or more private placements through at least March 31, 2023.

Canoo Buys Manufacturing Facility: Canoo Inc. (NASDAQ:GOEV) said it is acquiring a 120-acre site in Oklahoma City, which would employ more than 500 people and produce EVs starting in 2023. Announcing its third-quarter results, the company said it has a growing order book, valued at over $2 billion, with $750 million in binding orders. The company expects production to start on Nov. 17.

Faraday Future Gets Shareholder Nod For Reverse Split: Faraday Future Intelligent Electric Inc. (NASDAQ:FFIE) announced that its shareholders have approved a reverse split to help it to regain compliance with the Nasdaq listing standards. The approval allows the company to announce a split in the ratio of 1-for-2 to 1-for-10.

Workhorse’s Disappointing Q3: Workhorse Group, Inc. (NASDAQ:WKHS) reported third-quarter results that came in below estimates. The company also narrowed its 2022 production and delivery guidance to 100-200 units, assuming the current supply chain lead times remain unchanged.

Lordstown To Get New Investment: Lordstown Motors Corp. (NASDAQ:RIDE) said it would receive about $170 million in new funding from Apple, Inc.’s (NASDAQ:AAPL) iPhone supplier Hon Hai Precision Industry Company Limited (OTC:HNHPF). The investment will be in the form of subscriptions to $70 million worth of Class A common stock and up to $100 million of newly-created Series A convertible preferred stock. Following this, Foxconn will have an 18.3% stake in Lordstown, more than the 17.2% stake held by founder Stephen Burn.

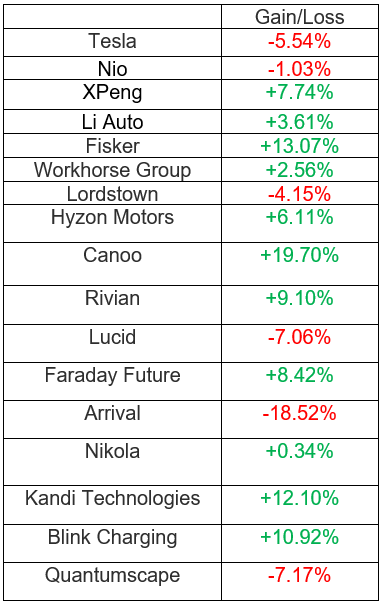

EV Stock Performances for The Week:

Read Next: Best Electric Vehicle Stocks