/Ralph%20Lauren%20Corp%20sign%20and%20logo%20by-%20Robert%20Way%20via%20iStock.jpg)

Ralph Lauren Corporation (RL), founded in 1967, is a global leader in the design, marketing and distribution of premium lifestyle products across apparel, footwear & accessories, home furnishings, fragrances and hospitality. The company is headquartered in New York and has a market cap of $20.4 billion. The luxury fashion giant is expected to release its Q2 fiscal 2026 earnings soon.

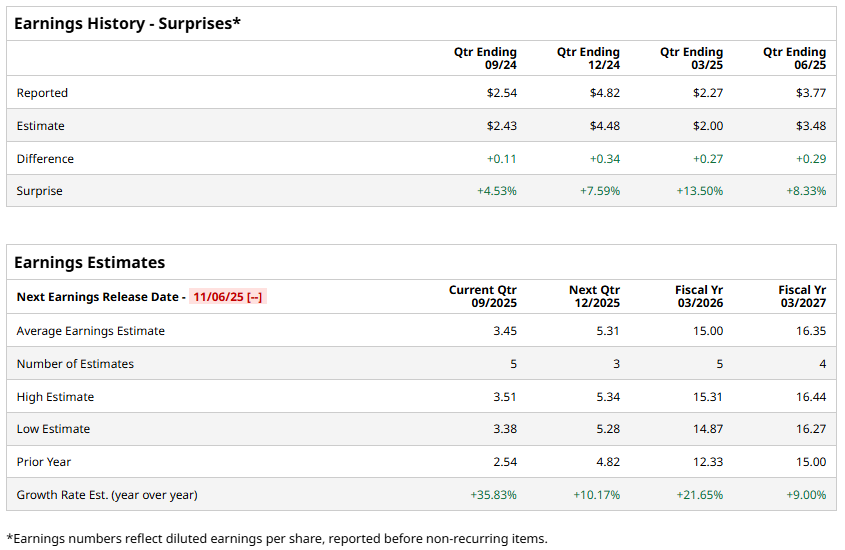

Ahead of this event, analysts expect RL to post earnings of $3.45 per share, representing a growth of 35.8% from $2.54 per share reported in the same quarter last year. The company has surpassed the Street’s bottom-line estimates in the past four quarters.

For the current year, analysts forecast Ralph Lauren to report an EPS of $15, indicating a 21.7% increase from $12.33 reported in fiscal 2025. Also, its EPS is expected to grow 9% year-over-year to $16.35 in fiscal 2027.

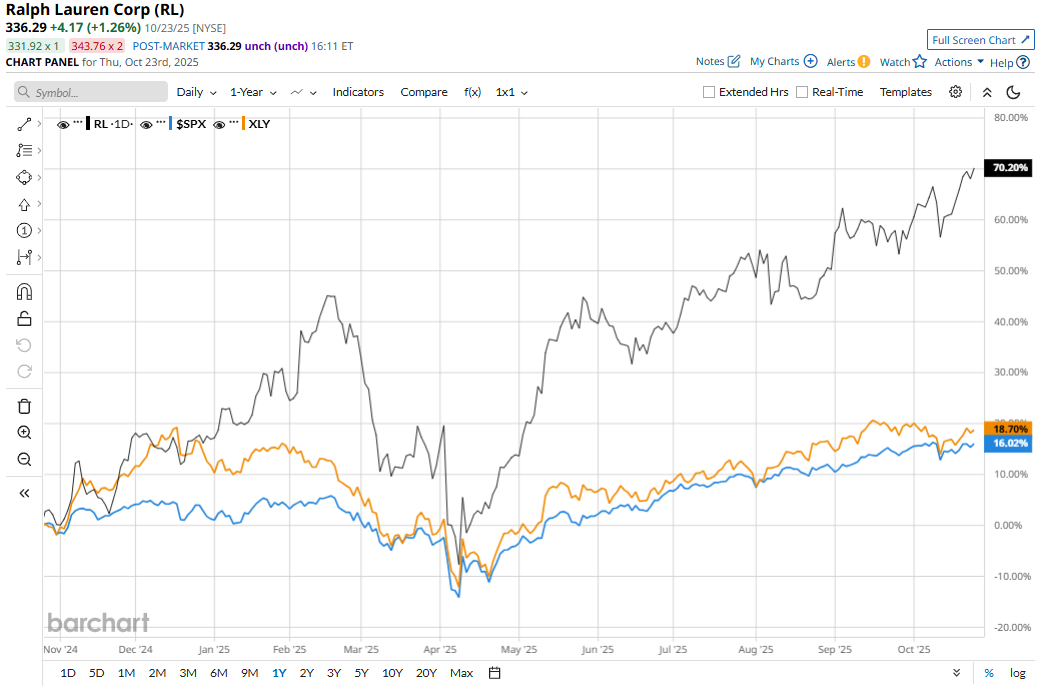

Shares of RL have gained 71.1% over the past 52 weeks, significantly outperforming the S&P 500 Index’s ($SPX) 16.2% rise and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 22.8% return during the same time frame.

Ralph Lauren’s share price is currently being driven up by consistently stronger-than-anticipated revenue and profit growth. The company is benefiting from robust demand in its international markets (especially Europe and Asia) and a strategic focus on premium positioning and digital/direct-to-consumer channels, which is resonating well with investors.

Analysts’ consensus view on RL is largely bullish, with a “Strong Buy” rating overall. Among 20 analysts covering the stock, 15 suggest a “Strong Buy,” one gives a “Moderate Buy,” three recommend a “Hold,” and the remaining one analyst gives a “Strong Sell.” Its mean price target of $346.22 represents around 3% premium to current price levels.