Commanding a whooping market cap of $497.5 billion, Netflix, Inc. (NFLX) is a global streaming giant offering a vast library of TV shows, movies, and original content through a subscription-based model. With a presence in over 190 countries, the company drives growth through heavy investments in exclusive content, expansion into gaming, and strategic pricing models, including an ad-supported tier. The company is set to release its third-quarter earnings after the market closes on Tuesday, Oct. 21

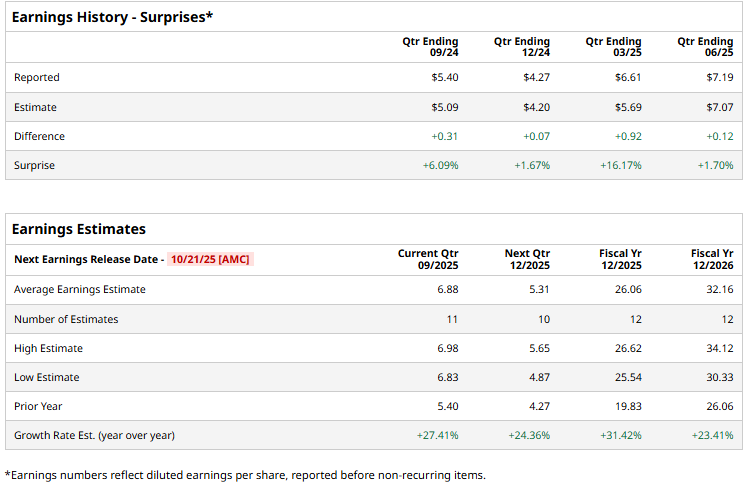

Ahead of the event, analysts expect Netflix to report an adjusted profit of $6.88 per share, up 27.4% from $5.40 per share reported in the year-ago quarter. The company’s earnings surprise history is solid, as it has surpassed Wall Street’s bottom-line estimates in all of the past four quarters.

For fiscal 2025, Netflix’s adjusted EPS is expected to increase 31.4% year-over-year from $19.83 in fiscal 2024 to $26.06. In fiscal 2026, its earnings are expected to grow 23.4% year-over-year to $32.16 per share.

NFLX stock prices have soared 63.5% over the past year, significantly outperforming the S&P 500 Index’s ($SPX) 17.6% returns and the Communication Services Select Sector SPDR ETF Fund’s (XLC) 29.1% surge during the same time frame.

On Sept. 17, Netflix gained more than 1% in pre-market trading after Loop Capital raised its rating on the stock to “Buy” from “Hold” and set a price target of $1,350. The upgrade reflects renewed optimism around Netflix’s growth prospects, with the firm citing stronger subscriber momentum, continued success of its original content pipeline, and the potential for revenue expansion through initiatives like the ad-supported tier and password-sharing crackdown.

The consensus opinion on NFLX is reasonably bullish, with an overall “Moderate Buy” rating. Out of the 46 analysts covering the stock, 28 recommend “Strong Buy,” three advise “Moderate Buy,” 14 suggest “Hold,” and the remaining analyst advocates a “Moderate Sell” rating.

Its mean price target of $1,338 indicates a potential upswing of 15.1% from the current market prices.