/Microchip%20Technology%2C%20Inc_%20HQ%20sign-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Microchip Technology Incorporated (MCHP) is a semiconductor company that designs, develops, and manufactures microcontrollers, memory, analog, and mixed-signal integrated circuits for embedded control applications. It’s headquartered in Chandler, Arizona. The company’s market cap is $35.3 billion

Microchip plays a key role in supplying components to a wide range of industries, including automotive, industrial, communications, consumer electronics, and more, positioning it as a significant player in the embedded systems and semiconductor markets. The company is expected to announce its fiscal second-quarter earnings for 2026 soon.

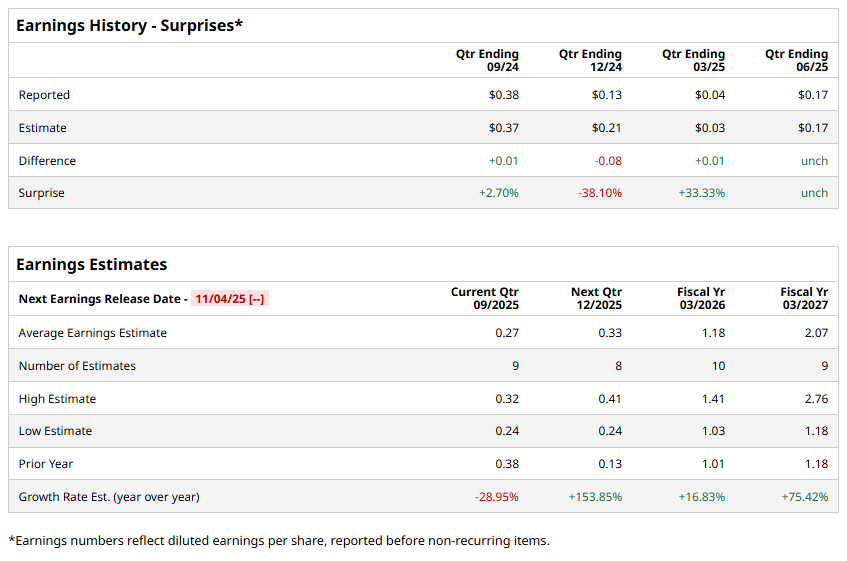

Ahead of the event, analysts expect MCHP to report an EPS of $0.27 per share, down 29% from a profit of $0.38 per share reported in the year-ago quarter. It has exceeded or met analysts’ earnings estimates in three of the past four quarters, while missing on one occasion.

For the full year 2026, analysts expect MCHP to report EPS of $1.18, up 16.8% from $1.01 in fiscal 2025. Also, its EPS is expected to rise 75.4% year over year to $2.07 in fiscal 2027.

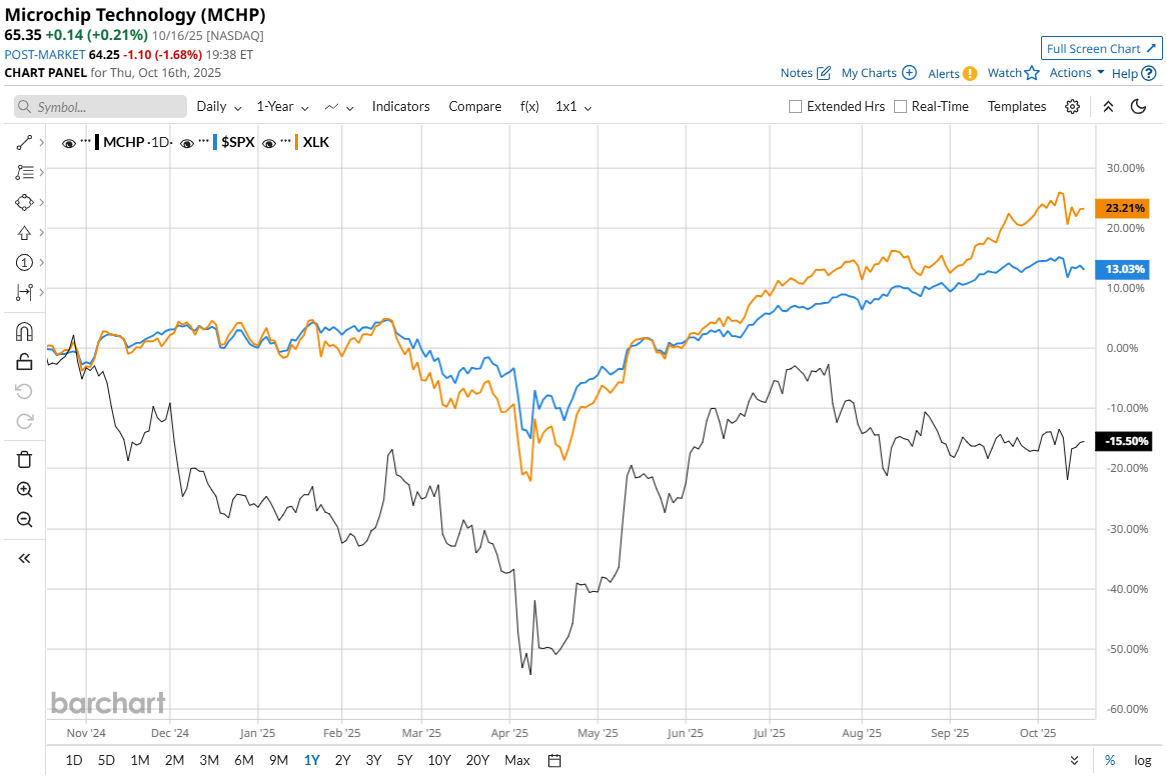

MCHP stock has declined 13.9% over the past 52 weeks, underperforming the Technology Select Sector SPDR Fund’s (XLK) 24% surge and the S&P 500 Index’s ($SPX) 13.5% uptick during the same time frame.

Microchip Technology’s shares have been under pressure over the past year due to a mix of operational and macro headwinds. The company has also been relying on stock offerings, which raised dilution concerns among investors.

Additionally, it is undergoing restructuring, including job cuts and the shutdown or sale of certain fabrication assets to counter a steep decline in demand and excess inventory. The company’s revenues and margins have also weakened amid sluggish demand. Also, broader macro pressures like concerns around trade tensions are also weighing on the stock.

Wall Street analysts are moderately bullish about MCHP’s stock, with a “Moderate Buy” rating overall. Among 25 analysts covering the stock, 16 suggest a “Strong Buy,” one recommends a “Moderate Buy,” and eight recommend a “Hold.” MCHP’s mean price target of $76.88 indicates a potential upswing of 17.6% from the current market price.