/LKQ%20Corp%20laptop%20and%20phone%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of around $7.4 billion, LKQ Corporation (LKQ) is a global leader in providing alternative and aftermarket automotive parts, serving repair shops, dealerships, and consumers with recycled, remanufactured, and specialty components. Headquartered in Chicago, the company operates across North America, Europe, and Asia through over 1,400 locations and employs around 46,000 people.

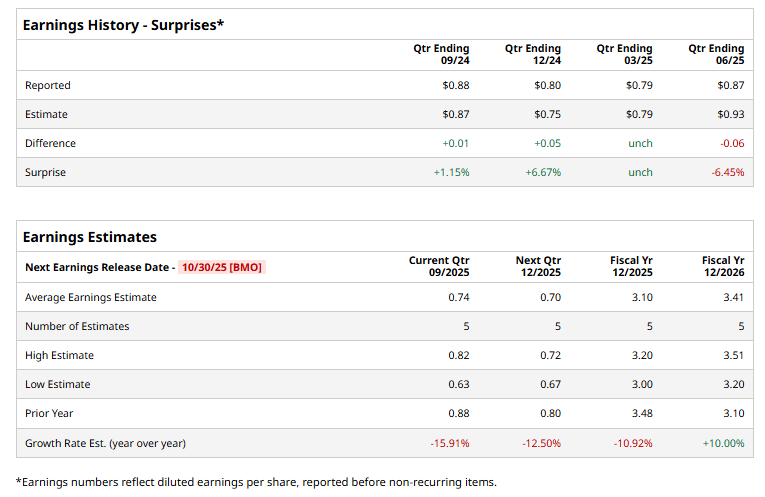

LKQ is expected to announce its fiscal 2025 Q3 earnings results before the market opens on Thursday, Oct. 30. Ahead of this event, analysts expect LKQ to report a profit of $0.74 per share, down 15.9% from $0.88 per share in the year-ago quarter. The company has met or surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For the current year, analysts expect LKQ to report an EPS of $3.10, down 10.9% from $3.48 in fiscal 2024. However, its bottom line is likely to rise 10% annually to $3.41 in FY2026

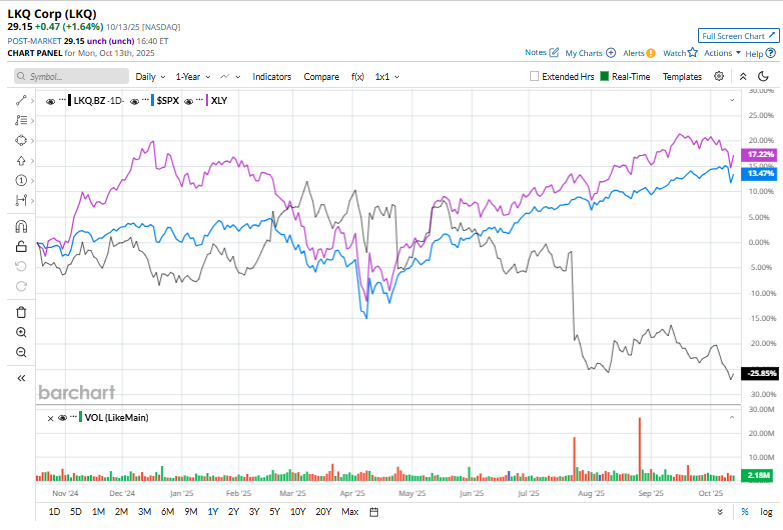

Shares of LKQ have declined 25.3% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 14.4% surge and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 19% return over the period.

On Oct. 1, LKQ shares surged 1.9% after the company completed the sale of its Self Service segment, Pick Your Part, to an affiliate of Pacific Avenue Capital Partners for $410 million. CEO Justin Jude stated that the move aligns with LKQ’s strategy to streamline operations, cut costs, and strengthen its balance sheet through debt repayment.

On the bright side, analysts' consensus view on LKQ Corporation’s stock is fairly bullish, with a "Moderate Buy" rating overall. Among eight analysts covering the stock, five recommend "Strong Buy," one suggests "Moderate Buy," one indicates “Hold,” and one “Strong Sell.” Its mean price target of $43 suggests a premium of 47.5% from the prevailing market prices.