/Everest%20Group%20Ltd%20phone%20and%20chart-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $15.1 billion, Everest Group, Ltd. (EG) is a leading global reinsurance and insurance provider offering a broad range of property, casualty, and specialty products. Headquartered in Hamilton, Bermuda, the company operates through two main segments, Reinsurance and Insurance, serving clients across the Americas, Europe, the Middle East, Africa, and the Asia-Pacific region.

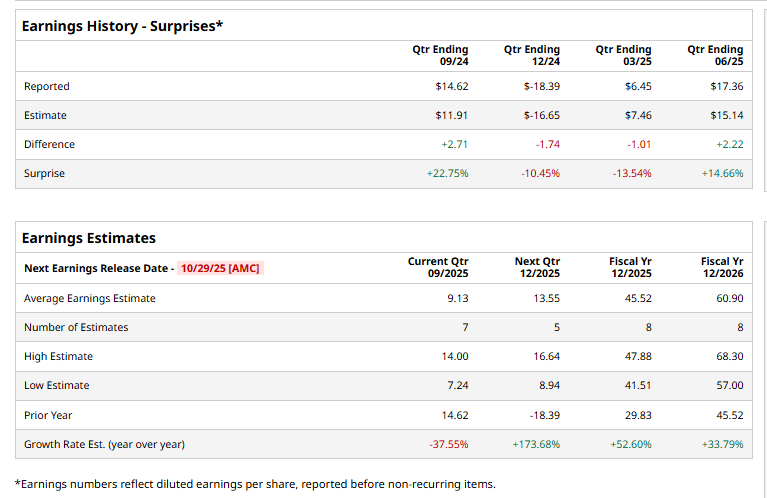

EG is expected to announce its fiscal Q3 2025 earnings results after the market closes on Wednesday, Oct. 29. Ahead of this event, analysts expect the company to report an adjusted earnings of $9.13 per share, down nearly 37.6% from $14.62 per share in the year-ago quarter. The company has surpassed Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the reinsurance company to report an adjusted EPS of $45.52, up 52.6% from $29.83 in fiscal 2024.

EG stock has declined nearly 9.6% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.3% rise and the Financial Select Sector SPDR Fund's (XLF) 16.5% return over the same period.

On Oct. 9, shares of Everest Group declined 2.3% after Wells Fargo & Company (WFC) analyst Elyse Greenspan reaffirmed a “Hold” rating on the insurer and maintained a $383 price target.

Analysts' consensus view on Everest Group’s stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 18 analysts covering the stock, five recommend "Strong Buy," two "Moderate Buy," nine suggest "Hold," and two have a "Strong Sell."

Its average analyst price target of $382.88 indicates a premium of 8.8% from the current market prices.