/CSX%20Corp_%20outside%20logo-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $63.8 billion, CSX Corporation (CSX) is a leading transportation company in North America, providing rail-based freight services across the United States and Canada. With a vast 20,000-mile rail network and a fleet of approximately 3,500 locomotives, CSX connects key production and distribution centers through its rail, intermodal, and trucking services.

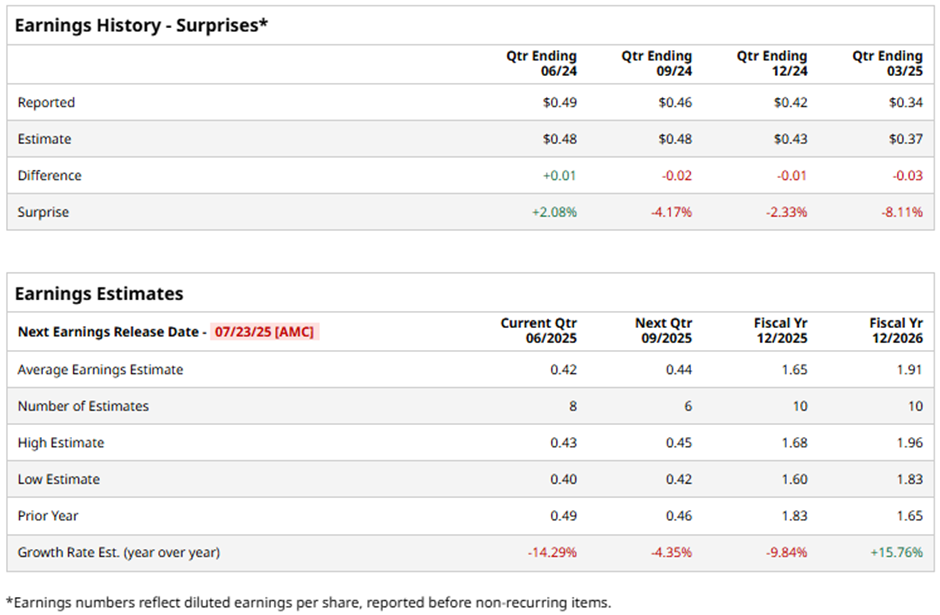

The Jacksonville, Florida-based company is expected to release its fiscal Q2 2025 earnings results after the market closes on Wednesday, Jul. 23. Ahead of this event, analysts project CSX to report an EPS of $0.42, a 14.3% decline from $0.49 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in one of the last four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast the freight railroad to report EPS of $1.65, down 9.8% from $1.83 in fiscal 2024. However, EPS is expected to grow 15.8% year-over-year to $1.91 in fiscal 2026.

CSX stock has risen marginally over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 11.6% return and the Industrial Select Sector SPDR Fund's (XLI) 21.6% gain over the same period.

On Apr. 16, CSX Corporation reported disappointing Q1 2025 financial results, with earnings per share coming in at $0.34, missing analysts’ expectations and marking a 26% decline compared to the same quarter last year. Revenue also fell short, totaling $3.4 billion, a 7% year-over-year decrease, driven primarily by a 27% drop in coal revenues, a 6% decline in trucking, and a 20% fall in other revenues. Despite the weak performance, CSX shares rose 1.2% the following day.

Analysts' consensus view on CSX Corporation stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, 14 suggest a "Strong Buy," one gives a "Moderate Buy," and 10 provide a "Hold" rating. This configuration is less bullish than three months ago, with 17 analysts suggesting a "Strong Buy."

As of writing, the stock is trading below the average analyst price target of $34.33.