/Applied%20Materials%20Inc_%20mobile%20and%20computer%20logo-by%20vieimage%20via%20Shutterstock.jpg)

Santa Clara, California-based Applied Materials, Inc. (AMAT) provides manufacturing equipment, services, and software to the semiconductor, display, and related industries. Valued at $182.2 billion by market cap, the company’s customers include semiconductor wafer and integrated circuit manufacturers, flat-panel liquid crystal display manufacturers, solar photovoltaic cell and module manufacturers, and other electronic device manufacturers. The world’s largest semiconductor fabrication equipment supplier is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

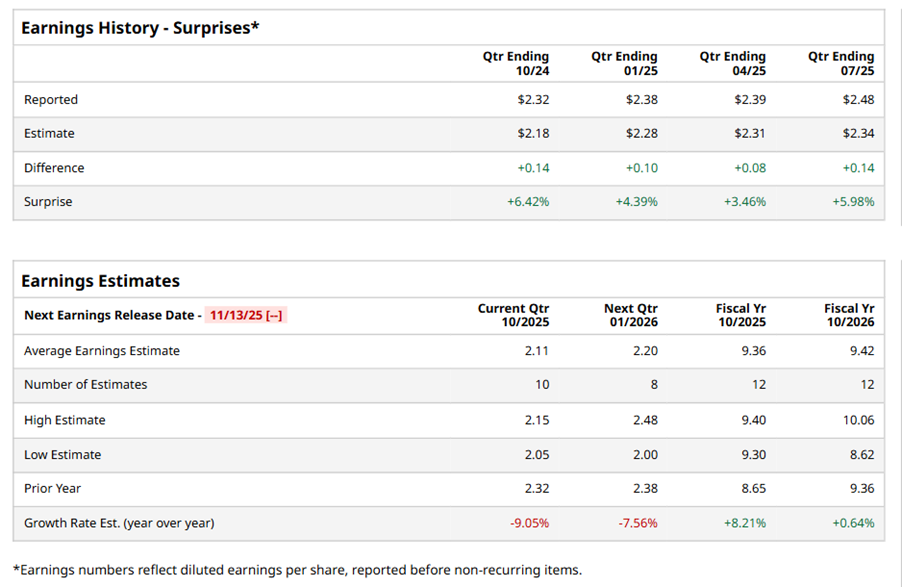

Ahead of the event, analysts expect AMAT to report a profit of $2.11 per share on a diluted basis, down 9.1% from $2.32 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect AMAT to report EPS of $9.36, up 8.2% from $8.65 in fiscal 2024. Its EPS is expected to rise marginally year over year to $9.42 in fiscal 2026.

AMAT stock has outperformed the S&P 500 Index’s ($SPX) 16.9% gains over the past 52 weeks, with shares up 24.5% during this period. However, it underperformed the Technology Select Sector SPDR Fund’s (XLK) 28.1% gains over the same time frame.

On Aug. 14, AMAT reported better-than-expected Q3 results but saw a 14.1% stock price drop the next day due to disappointing Q4 guidance. The company expects adjusted EPS of $2.11 and revenue of $6.70 billion, below consensus estimates. Despite this, AMAT's revenue grew 7.7% year over year to $7.3 billion, beating estimates, and adjusted EPS rose 17% from the year-ago quarter to $2.48, exceeding analyst forecasts.

Analysts’ consensus opinion on AMAT stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 35 analysts covering the stock, 18 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” 13 give a “Hold,” and one recommends a “Strong Sell.” While AMAT currently trades above its mean price target of $218.67, the Street-high price target of $265 suggests an upside potential of 15.8%.