Electronic Arts (EA) agreed on Sept. 29 to be acquired in a record-breaking $55 billion leveraged buyout by a group led by Saudi Arabia’s Public Investment Fund (PIF), Silver Lake Partners, and Affinity Partners at $210 per share, marking the largest private equity-funded acquisition in history and a defining moment for consolidation in gaming. With EA shares already trading near the offer after surging more than 16% over the last five days, attention is shifting to other opportunities in the space.

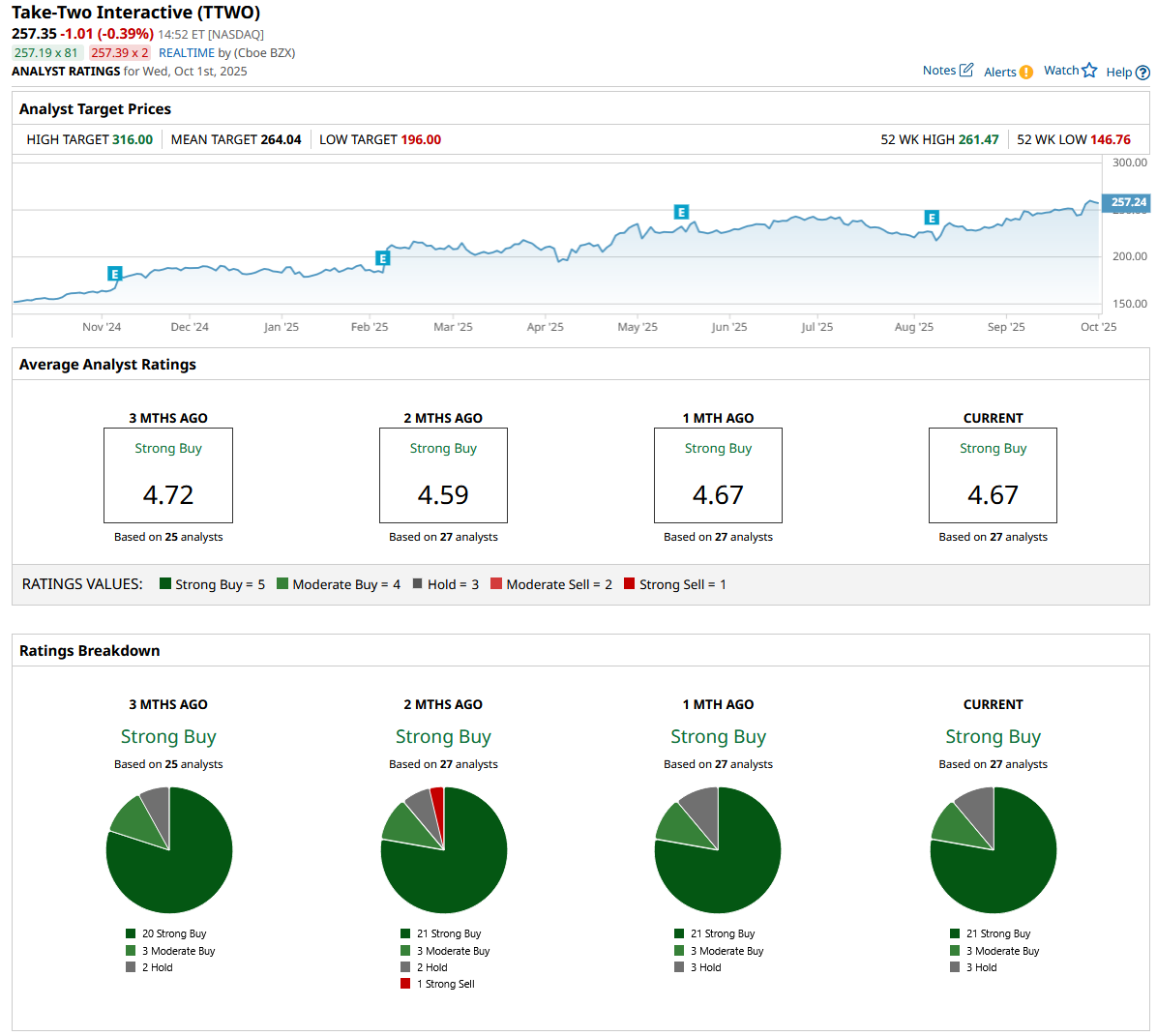

The global gaming market is expected to reach $520 billion in revenue for 2025, with projections to hit $730 billion by 2030, which keeps dealmaking and potential targets in the spotlight. In this backdrop, Take-Two Interactive (TTWO) stands out. The stock recently hit a record high of $261.47 and carries a “Strong Buy” rating from analysts. The company also topped expectations in its first-quarter fiscal 2026 print, delivering Q1 net bookings of $1.42 billion versus the $1.32 billion consensus.

Could Take-Two Interactive represent the next compelling investment opportunity in the rapidly consolidating gaming sector? Let’s take a closer look.

Take-Two’s Numbers Tell a Different Story

Take-Two Interactive is a well-known name in entertainment, anchored by blockbuster series like Grand Theft Auto (GTA), Red Dead Redemption, and NBA 2K. The model starts with big game launches and increasingly leans on steady spending inside those games through in-game purchases, online services, and mobile titles that keep money coming in after release.

TTWO stock’s performance backs that up. Over the past 52 weeks, shares are up 70%, and year-to-date (YTD) they’re up about 40%, showing strong confidence in execution and what’s ahead.

Even after that run, the valuation sits high, with a forward P/E of 185.79x compared to a sector average of 14.43x, pointing to a rich premium for expected growth.

Recent results explain why. Total net bookings rose 17% to $1.42 billion in the latest quarter, and recurrent consumer spending made up 83% of bookings. GAAP net revenue increased to $1.50 billion from $1.34 billion a year ago, with recurrent spending contributing 84% of that total. The biggest drivers were NBA 2K25, Grand Theft Auto V and its GTA Online component, Toon Blast, Match Factory!, Color Block Jam, Empires & Puzzles, Red Dead Redemption 2 and its Red Dead Online, Words With Friends, and Toy Blast. The bottom line also improved sharply, with a GAAP net loss of $11.9 million, or $0.07 per share, compared with a $262.0 million loss, or $1.52 per share, in the prior-year quarter.

The Power of Franchises and the Next Big Catalyst

Take-Two has long relied on its biggest series, and recent steps show it’s expanding that base in a focused way. The $460 million purchase of Gearbox Entertainment brings the Borderlands franchise in-house after more than 20 years of working together, adding a popular action series to Take-Two’s owned lineup and removing a potential rival for internal development priorities. Bringing Gearbox into the fold is expected to spark fresh collaboration across teams, support broader types of games, open new revenue channels, and help smooth out the ups and downs that come with shifting player tastes.

Alongside acquisitions, the company’s execution in 2025 has kept momentum alive. WWE 2K25 launched in March across all major platforms, reinforcing Take-Two’s dominance in sports entertainment gaming. Just months later, the company delivered Mafia: The Old Country in August, adding another sought-after title to its lineup. Together, these launches highlight Take-Two’s ability to consistently deliver high-quality content across genres.

Equally important has been the rollout of its direct-to-consumer model, allowing players to buy in-game currency directly from Take-Two’s web stores and from within the games themselves. By sidestepping the 30% fees often tied to app stores, the company has improved profitability and created a scalable framework for its growing mobile business.

Why Wall Street Sees More Upside Ahead for TTWO Stock

The company raised its fiscal 2026 net bookings guidance to $6.05 to $6.15 billion, a clear sign management is confident in what’s coming next. That shows up in earnings, too. For the quarter ending September 2025, the Street is looking for EPS of $0.47, up 80.77% from $0.26 a year ago, and for fiscal 2026, estimates sit at $1.38, up 146.43% year-over-year (YoY).

Big firms are backing that view. Bank of America took its target up from $260 to $285 in early August with a “Buy” rating, and J.P. Morgan moved from $250 to $275 with an “Overweight” call around the same time. Both are leaning into the idea that upcoming releases and recent deals can drive results.

The consensus is just as strong. The 26 analysts covering TTWO stock rate it a consensus “Strong Buy,” with an average target of $264.04. With shares at $257.35, that points to about a 3% upside from here.

As EA gets pulled off the public market in a mammoth buyout, Take-Two stands alone with its compelling growth profile and relentless franchise momentum. The analyst community is clearly convinced, rating TTWO stock a strong buy, and consensus price targets offer a modest but notable upside. With huge releases on deck and recent results blowing past expectations, it feels like Take-Two’s shares are destined to move higher in the coming quarters. If growth continues anywhere near its projected pace, investors could easily see TTWO set new highs before long.