President Donald Trump on Monday called for markets to hold down oil prices being pressured higher by the risk premium associated with the Middle East conflict. Almost immediately, prices began to back off as the threat of Iran closing of the Strait of Hormuz appeared to fade.

Trump took to Truth Social on Monday, issuing a threat to markets that he is "watching" and that oil prices should remain low. The U.S. president also demanded that the U.S. Department of Energy should push to produce more oil.

"EVERYONE, KEEP OIL PRICES DOWN. I'M WATCHING! YOU'RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON'T DO IT," Trump posted Monday.

Trump, separately issued a statement directed at the Department of Energy.

"DRILL, BABY, DRILL!!! And I mean NOW!!!"

Throughout Trump's first term, the president repeatedly used Twitter, now X, to express his views on oil prices. The president also kept in close contact with Saudi Arabia, placing pressure on production policies of the Organization of Petroleum Exporting Countries, or OPEC. Trump's tweets sometimes influenced the market by causing a decrease in oil prices, according to reports at the time, and the president often took credit for falling prices.

In his current term, U.S. oil producers have answered Trump's calls to "Drill, Baby, Drill" with a steady decline in drilling since March. However, Saudi Arabia and OPEC have stepped up, boosting their production quotas above expectations for the past two months, with another hefty increase scheduled for July.

Those increases, in a world economy frazzled by tariff uncertainties, have driven oil supply well above demand. The result pressured U.S. oil prices to $60 and below for most of April.

Oil Prices And Trump's Comments

U.S. oil prices rose to around $76 per barrel on Sunday, but retreated more than 8% on Monday to about $67.50 on Monday. On Tuesday, U.S. oil prices continued to retreat, falling around 4% to $65.84 following Trump's announcement of a ceasefire between Israel and Iran. The news eased concerns over potential oil supply disruptions and the closure of the Strait of Hormuz.

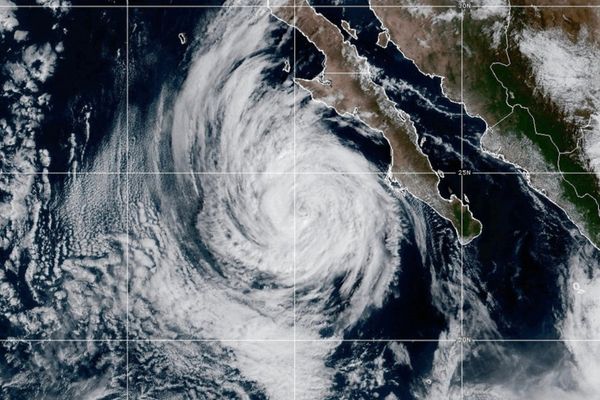

About 15% of global crude oil supply and 20% of liquefied natural gas, or LNG, passes through the Strait of Hormuz, according to Morgan Stanley analysis released last week. Those supplies are key inputs for gasoline, chemicals and electricity everywhere from China to the U.S.

However, it is unclear if the ceasefire will last even as Trump continued to post to Truth Social that Israel should bring its "pilots home" and not "drop those bombs."

Trump, speaking to reporters Tuesday morning, said he believed Iran was still committed to peace.

"Israel, as soon as we made the deal, they came out and they dropped a load of bombs the likes of which I've never seen before, the biggest load that we've seen. I'm not happy with Israel," Trump said Tuesday.

Oil prices entered Monday up around 30% from a low in May, with a gain of more than 20% since the start of June.

"It's worth noting that the current geopolitical risk premium — now exceeding $10 per barrel — cannot be sustained for long without a tangible supply disruption," Ole Hansen, head of commodity strategy for Saxo Bank, told Reuters Monday.

Stock Market Reaction To Oil Prices

Among oil tanker stocks Frontline, Teekay Tankers and International Seaways are ones to watch.

The Norway-based Frontline advanced higher before declining about 2% during Monday's stock market. Teekay Tankers and International Seaways also both fell 2.6%.

Beaten down by months of weak prices and demand outlooks, oil stocks are generally rebounding from deep lows. Oil drillers, as a group, have posted the largest advance among oil and gas stocks over the past month. Valaris and Noble led those gains.

Among the largest oil and gas names, Chevron reversed early gains to trade down 1.8% in stock market trade Monday. Exxon Mobil also backtracked from early gains, declining 2.6%.

Gas producers show better chart action. Those most responsive to recent gas price changes have included Gulfport Energy, Antero Resources and Range Resources are in buy zones after recent breakouts.

Investors can keep tabs on the IBD Leaderboard watchlist, the IBD 50 list of top growth stocks and IBD SwingTrader along with the IBD Sector Leaders list.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

The Lithium Price Cycle Has Bottomed. What To Expect Next For These Stocks.