/Dominos%20Pizza%20Inc%20delivery%20by-%20Bjoern%20Wylezich%20via%20iStock.jpg)

Domino's Pizza Inc. (DPZ) generated strong free cash flow (FCF) during Q3, and its FCF margins held up. DPZ stock still looks undervalued, and its target price is 19% higher at $498 per share. Shorting out-of-the-money puts and buying in-the-money calls are good ways to play this.

DPZ is at $418.39 in morning trading on Friday, Oct. 17. This is near its recent lows before its Oct. 14 release of Q3 earnings results.

However, a closer look at its strong free cash flow (FCF) reveals that Domino's remains a powerhouse FCF generator. This article will look into this.

Strong FCF Margins

Domino's Pizza reported that its Q3 revenue was up 6.2% YoY, and its same-store sales rose 5.2% in the U.S. Moreover, it generated strong FCF, $164 million, or just slightly lower than last quarter's $167.3 million.

Moreover, for the past 3 quarters, its FCF margins (i.e., FCF/revenue) have stayed strong at 14.55%. That compares with 14.7% YTD as of Q2, as I discussed in my July 21 Barchart article ("Domino's Pizza Generates Strong Q2 Free Cash Flow - DPZ Stock Looks Cheap").

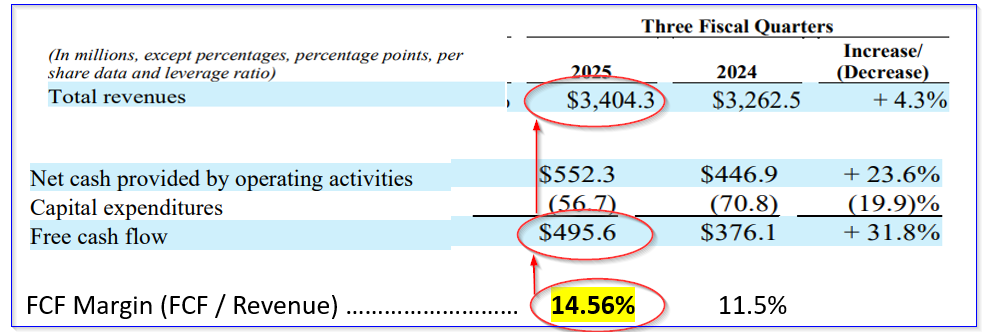

This can be seen on page 2 of its Oct. 14 earnings release:

It shows that FCF margins YTD are 14.56% vs. 11.5% a year ago. We can use that to project its free cash flow over the next 12 months (NTM).

Projecting NTM FCF

For example, analysts now forecast that revenue this year will be $4.93 billion and $5.25 billion next year. That means that the next 12 months (NTM) revenue will be:

¼ x $4.93 billion + ¾ x $5.25 billion = $1.2325b + $3.9375 billion = $5.17 billion NTM revenue

As a result, if we assume that the FCF margin will remain at 14.6%, we can project that the NTM FCF will be:

0.146 x $5.17 billion = $754.8 million NTM

That would be 19.5% higher than its trailing 12-month (TTM) FCF of $631.52 million, according to TTM data from Stock Analysis.

As a result, this could lead to a higher valuation for DPZ stock. Let's look at that.

Target Price for DPZ Stock

One way to value a stock is to assume that 100% of its FCF is paid out as a dividend. What would the dividend yield be?

That can be seen by dividing the TTM FCF by its present market capitalization.

For example, Yahoo! Finance says that the market cap today is $14.093 billion. So, the TTM FCF yield has been:

$631.52 billion /$14,093 billion = 0.0448 = 4.48% TTM FCF yield

Therefore, we can apply this to the NTM FCF forecast:

$754.8 million / 0.045 = $16.773 billion mkt value

That is +19% higher than today's $14.093 billion market cap

In other words, if Domino's generates $755 million in FCF over the next 12 months, and the market values this with a 4.5% FCF yield, the market value will rise 19%.

This means that the stock price target, before any share buybacks, is at least 19% higher:

$418.39 x 1.19 = $498 per share

That could provide an attractive return to long-term holders. Another way to play this is to set a lower buy-in by shorting out-of-the-money (OTM) put options and/or buying in-the-money (ITM) calls.

Shorting OTM Puts and Buying ITM Calls

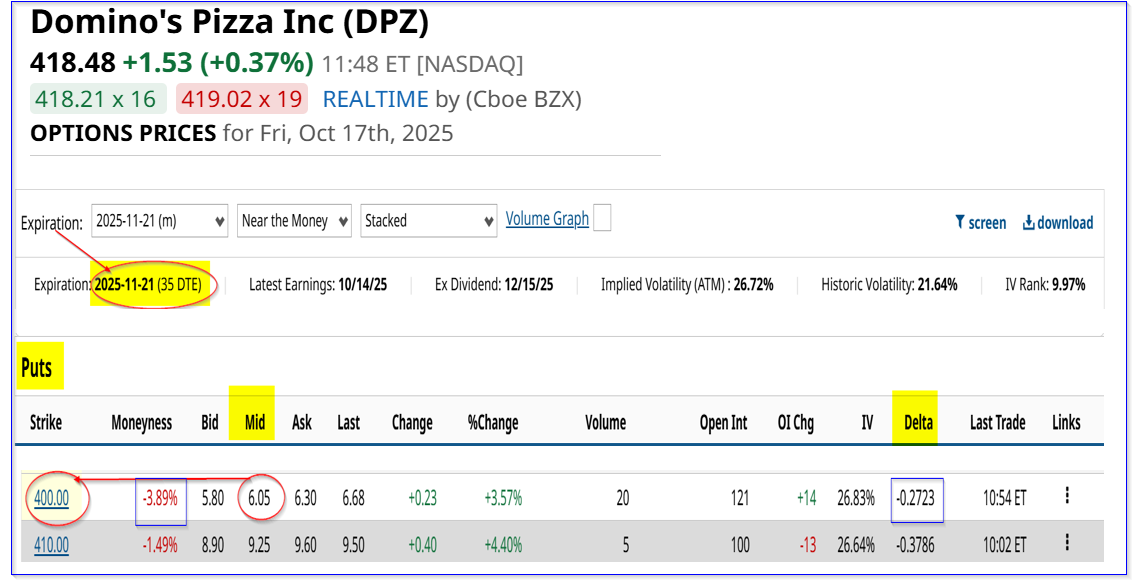

For example, the Nov. 21 expiry period shows that the $400 put option strike price has an attractive premium. The midpoint price is $6.05, providing a short-seller of these puts an immediate yield of over 1.5%:

$6.05 / $400.00 = 0.015125 = 1.5125%

Note that this strike price is almost 4% below today's price and has a low delta ratio (-0.2723), implying just a 27% chance that DPZ will fall to $400 over the next 35 days.

But, even if it does, the investor has a lower breakeven price:

$400 - $6.05 = $393.95, i.e., -5.86% below today's price

However, if DPZ rises, the investor won't gain any upside. Therefore, an investor who is willing to take on more risk could buy in-the-money calls at $400 in a 5-month call option, using the proceeds from shorting one-month puts to partially pay for this.

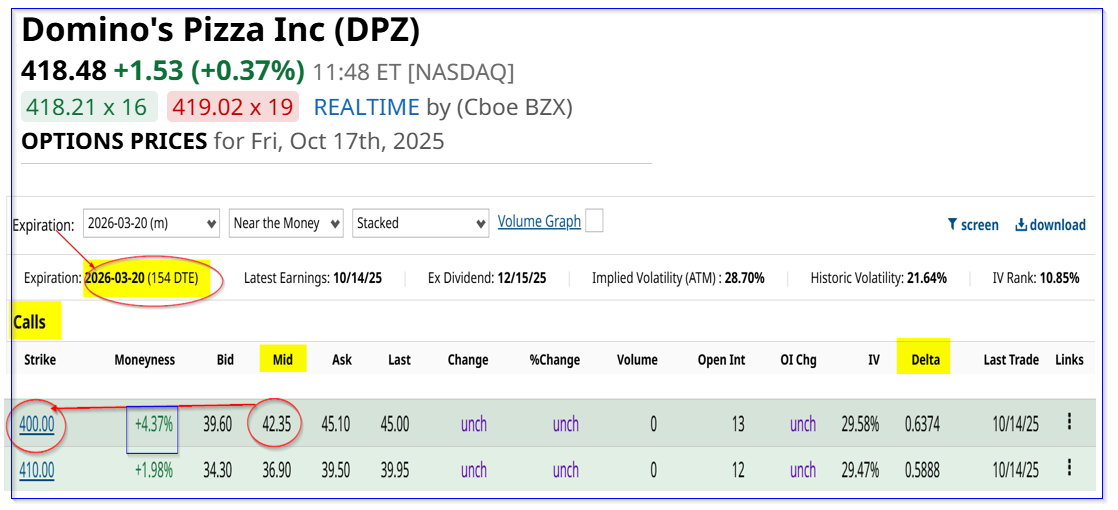

For example, the March 20, 2026, expiry period shows that the $400.00 strike price call option has a midpoint premium of $42.35 per call contract.

That means that if the investor can continue to short one-month puts for $6.05 each month for the next 5 months, the total accumulated would be $30.25, or 71% of the call premium:

$42.35 call cost - $30.05 short-put income = $12.10 net call cost

That brings the exercise price to just $412.10, or $6.11 below today's price of $418.21.

Moreover, if DPZ rises to $498, our price target, the call option price would have an intrinsic value of $98.00 (i.e., $498- $400 strike). That would be a profit of over 130% the price paid:

$98.00 / $42.35 -1 = +131.4% upside

And if the cost was reduced through shorting puts, the gain would be even greater.

The bottom line is that OTM puts and buying ITM calls are attractive ways to play DPZ over the next 5 months.