Dogecoin (CRYPTO: DOGE) fell over 4.5% on Tuesday, breaking down from its compression zone as sellers extended control across multiple timeframes.

Price Cracks Below Key Triangle Support

DOGE Price Analysis (Source: TradingView)

Dogecoin's daily structure had been coiling inside a descending triangle for nearly three weeks, but instead of breaking higher toward the 20- and 50-day EMA cluster near $0.2080–$0.2150, price dropped below the lower boundary.

The breakdown pushed DOGE price straight into the mid-$0.15 range, retesting a demand shelf last seen in May and July.

Losing this level removes the final visible support before the deeper liquidity zone between $0.14 and $0.11.

The 20-day EMA continues to reject price on every bounce, while the 50- and 100-day EMAs hover directly above it, creating a tight resistance ceiling.

The 200-day EMA remains well above, showing the long-term downtrend is still intact.

The supertrend indicator flipped red weeks ago and has not signaled reversal.

A descending trendline from the April high continues to cap every rally attempt, confirming that momentum remains fully in the hands of sellers.

Exchange Flows Reinforce Selling Pressure

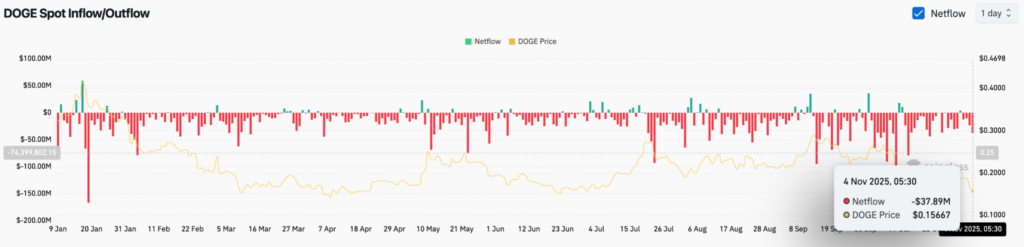

DOGE Netflows (Source: Coinglass)

Coinglass figures show roughly $37.8 million in net outflows in the latest session, marking the fifth significant withdrawal event in two weeks.

Since September, the flows line has stayed negative almost continuously, highlighting consistent distribution instead of accumulation.

DOGE Short-Term Price Action (Source: TradingView)

On the 30-minute chart, price has repeatedly rejected the VWAP band, and the RSI continues to fail near the mid-range.

When price trades below VWAP during a decline, it shows that intraday sellers are hitting bids aggressively, keeping rallies short-lived.

Bulls Face A Steep Recovery Challenge

To regain control, buyers must reclaim the breakdown zone near $0.175. Without a daily close above that level on strong volume, each rebound risks becoming another short entry.

If price fails to hold $0.15, the next key demand sits between $0.135 and $0.110 — a region tied to earlier accumulation zones and unfilled liquidity from July's rally.

Until DOGE closes back above the EMA stack and on-chain flows shift toward inflows, the broader trend remains bearish.

The market's current posture rewards patience for short sellers and caution for buyers attempting to time a bottom.

Read Next:

Image: Shutterstock