As the Trump administration ploughs forward with its incendiary policies, European trust in the US government is fading.

Amid tariff threats and pledges to conquer Greenland, citizens and politicians in Europe are unsettled — questioning a long-standing alliance.

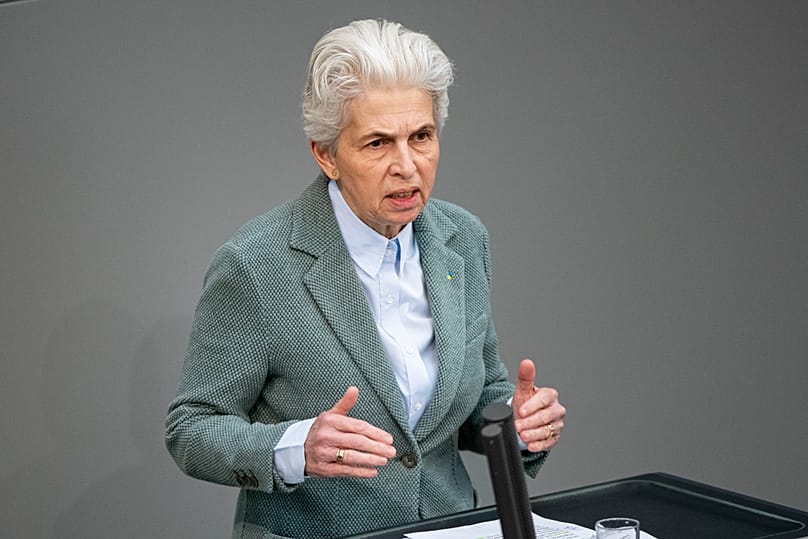

Marie-Agnes Strack-Zimmermann (FDP), chair of the Defence Committee in the EU Parliament, claims to have an answer that is "worth its weight in gold". In this case, the expression is more literal than figurative.

Around 1,236 tonnes of German gold, worth more than €100bn, are sitting in vaults in the US. Strack-Zimmermann has now announced that, in view of Trump's recent political manoeuvres, it's no longer justifiable to leave them be. This has reignited a fierce debate: to retrieve or not to retrieve?

The demand to bring gold back to Germany has been around for a long time, with some surveys suggesting that many citizens are in favour of the move. Similar debates are happening in Italy, which has the third-largest gold reserves in the world after the US and Germany.

Why does Germany hold gold in the US?

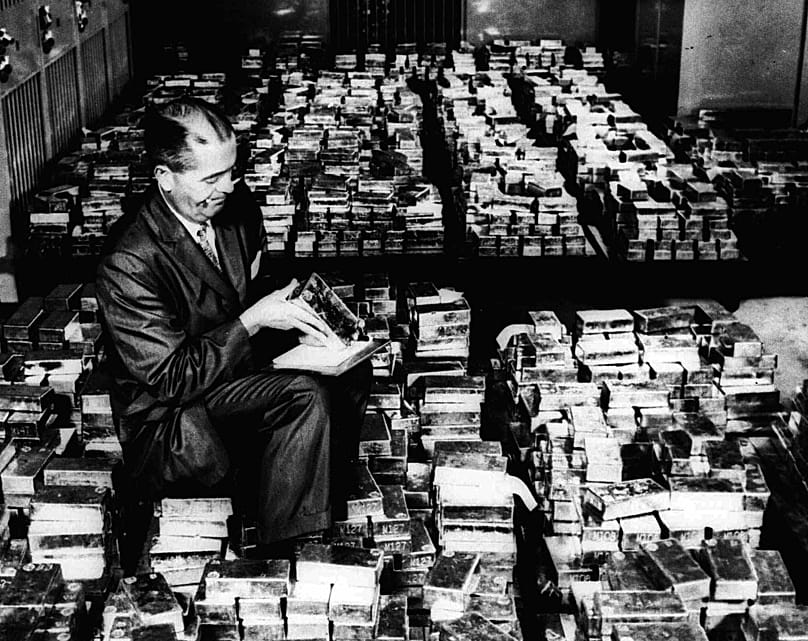

Germany's gold reserves amount to around 3,350 tonnes. About 36.6% of this is in the US, a legacy of the Bretton Woods system of fixed exchange rates after World War II.

“At the time, all exchange rates were tied to the dollar, and the dollar was tied to gold,” Dr. Demary, senior economist for Monetary Policy and Financial Markets at the German Economic Institute (IW), told Euronews.

“Germany had large export surpluses with the US, so we accumulated a lot of dollars. To keep exchange rates stable, we exchanged those dollars for gold. That’s how these reserves were built up.”

During the Cold War, it was also practical to store gold abroad, as the US was considered a safe place in case of conflict with the Soviet Union. Over the years, some gold has been repatriated. By 2017, 300 tonnes were brought back from New York, 380 tonnes from Paris, and 900 tonnes from London.

This was part of a Bundesbank plan, unveiled in 2013, to store half of Germany's gold reserves in Germany from 2020 onwards.

Bringing in the gold treasure: What are the risks?

Strack-Zimmermann and other politicians and economists cite Trump’s unpredictable trade and foreign policy as the reason for moving the gold out of the US.

“Of course, there is always some risk when you keep assets abroad,” said Demary. For example, there is a storage risk if a break-in occurs. But this risk exists whether the gold is stored abroad or in Germany.

"Another possible scenario is that the US government, due to tight currency reserves, could prevent the gold from being transferred," he explained.

To ensure the safety of gold holdings, the Bundesbank has had to make frequent trips to New York in the past to take an inventory.

“It makes sense to leave this gold in the US in case we have a banking crisis here and need to obtain dollars,” said Demary.

Retrieving the gold could not only be logistically complex, but also risky.

“The gold would have to be transported in armoured vehicles onto a ship, which would also need to be guarded, and then brought back to Frankfurt under security,” added Demary. “There could be robberies, the ship could sink, or the cargo could be seized.”

Is Strack-Zimmermann's demand pure populism?

Is Strack-Zimmermann's demand pure symbolic politics? "I think so," said the economist. “Perhaps it was a political move in response to the tariff threats, saying, ‘We’re bringing our gold back now.’”

According to the economist, it is also possible that Strack-Zimmermann estimated the magnitude of this gold value to be somewhat greater than it really is. In any case, the gold is currently safe in New York, even if Trump wanted to use it to exert pressure on Germany.

"The Federal Reserve is actually independent in its monetary policy. The US government cannot simply intervene. They would have to change laws first," explained Dr Demary.

Even in the absolute worst case, if the US refused to release the gold, there would still be the option to go to court and enforce its return or receive compensation in dollars, said Demary.

"You have to weigh up the pros and cons and I would say the advantages of leaving the gold in the US outweigh the disadvantages," he told Euronews.