/Raymond%20James%20Financial%2C%20Inc_%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Florida-based Raymond James Financial, Inc. (RJF) is a diversified financial services company offering a broad range of investment, banking, and advisory services to individuals, corporations, and institutions across the United States, Canada, and Europe. With a market cap of $29.6 billion, the company operates through multiple subsidiaries providing wealth management, capital markets, asset management, and banking solutions.

The company's shares have soared 42.1% over the past year, surpassing the broader S&P 500 Index’s ($SPX) 14.3% rise over the same time frame. However, RJF shares are up 6.8% on a YTD basis, lagging behind SPX’s 9.5% rise.

In addition, Raymond James Financial has also outshone the Financial Select Sector SPDR Fund’s (XLF) 19.9% return over the past 52 weeks.

On July 24, Raymond James Financial reported Q3 FY2025 results with net revenue of $3.40 billion, up 5% year over year, but adjusted EPS of $2.18 missed the Street’s estimate. Client assets hit a record $1.64 trillion, reflecting rise of over 11% year over year and all major segments grew, though the Private Client Group saw earnings pressure from lower interest rates. The firm marked its 150th consecutive profitable quarter and continued strong capital returns. Despite the EPS miss, RJF shares surged 3.7% in the next trading session.

For the current fiscal year, ending in September 2025, analysts expect RJF’s adjusted EPS to grow 2.6% year-over-year to $10.31. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on the other two occasions.

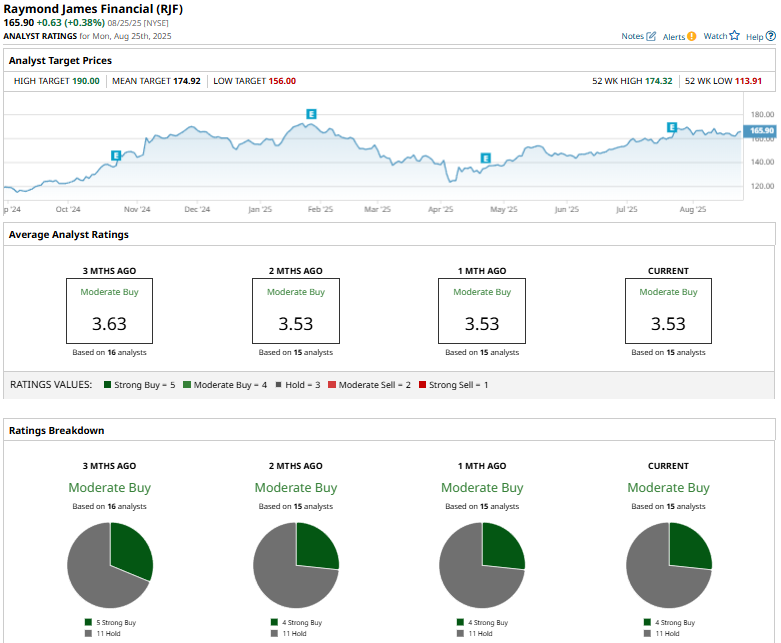

Among the 15 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on four “Strong Buy” ratings and 11 “Holds.”

This configuration is bearish than three months ago, with five “Strong Buy” ratings on the stock.

On July 24, 2025, Keefe, Bruyette & Woods analyst Kyle Voigt reaffirmed a “Market Perform” rating on Raymond James Financial and raised the price target from $167 to $170, reflecting a modest 1.8% upward revision and a slightly positive outlook.

The average price target of $174.92 implies a potential upside of 5.4% from the current price levels. Similarly, the Street-high target of $190 represents a premium of 14.5%.