/Qualcomm%2C%20Inc_%20logo%20on%20pc%20and%20website%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

QUALCOMM Incorporated (QCOM), headquartered in San Diego since 1985, designs advanced semiconductors, software, and wireless technologies. The company’s innovations power a variety of devices and platforms, from smartphones to IoT and automotive systems worldwide. The company has a market capitalization of $192.78 billion.

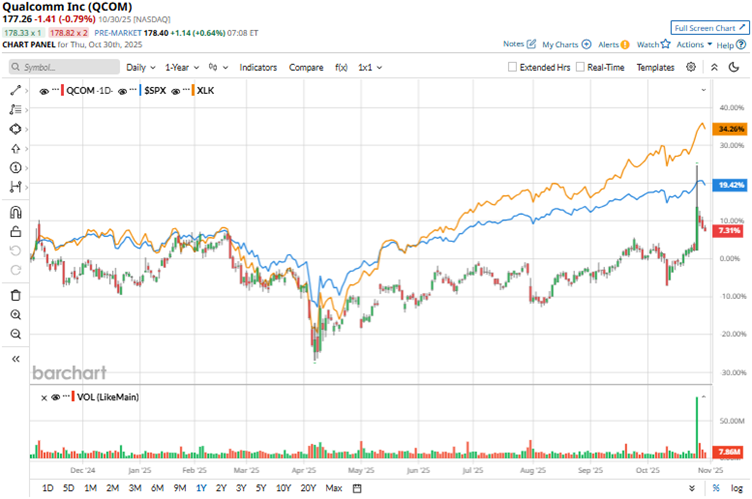

Over the past 52 weeks, the stock has gained 5.8%, and has increased by 19.4% over the past six months. Despite these gains, the stock has broadly underperformed the S&P 500 Index ($SPX), which has gained 17.4% over the past 52 weeks and 22.5% over the past six months.

Turning our focus to the tech sector, the stock has also underperformed the Technology Select Sector SPDR Fund (XLK), which is up 30.8% over the past 52 weeks and 43.1% over the past six months.

QUALCOMM shares surged more than 20% to a fresh 52-week high on Oct. 27 after the company unveiled its new AI200 and AI250 accelerator chips, marking a decisive push beyond mobile and into the AI data-center arena. Set to roll out in 2026 and 2027, the chips emphasize energy-efficient AI inferencing and debuted alongside a major partnership with Saudi Arabia’s HUMAIN to support large-scale AI infrastructure development.

For the current year that ended in September 2025 (set to be reported on Nov. 5 after the market closes), Wall Street analysts expect QCOM’s EPS to grow 15% year over year to $9.73 on a diluted basis. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

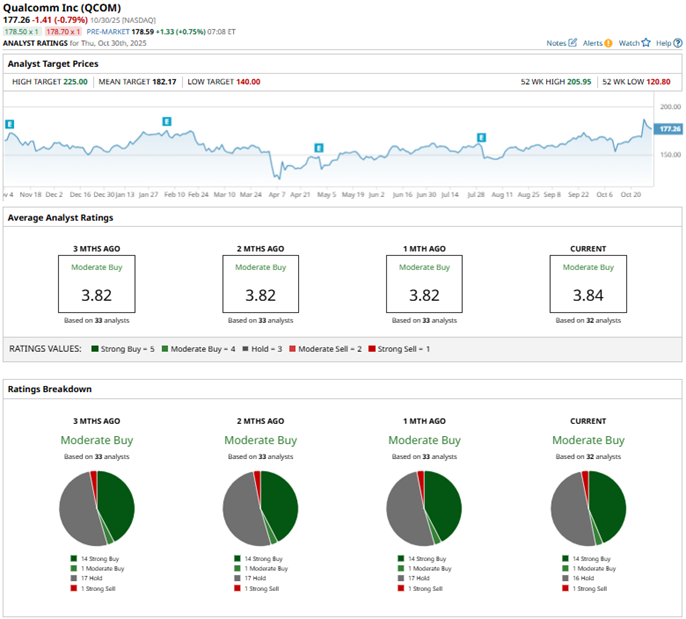

Among the 32 Wall Street analysts covering QCOM’s stock, the consensus is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” 16 “Holds,” and one “Strong Sell.”

The ratings configuration has remained relatively unchanged over the past three months.

On Oct. 28, analysts at Rosenblatt reiterated their “Buy” rating on QCOM’s stock, alongside maintaining a $225 price target, which is also the Street-high target. The firm highlighted QUALCOMM’s 200MW deployment with HUMAIN as a key strategic milestone, underscoring the company’s push into diversified growth areas while maintaining its position to expand its smartphone market footprint.

QCOM’s mean price target of $182.17 indicates a 2.8% upside over current market prices.