With a market cap of $353.5 billion, The Procter & Gamble Company (PG) is a global leader in branded consumer packaged goods with five core segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care. P&G serves consumers worldwide through various retail and professional channels.

Shares of the Cincinnati, Ohio-based company have lagged behind the broader market over the past 52 weeks. PG stock has dropped 10.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.4%. Moreover, shares of P&G are down 10.1% on a YTD basis, compared to SPX’s 7.6% return.

Narrowing the focus, shares of the world's largest consumer products maker have underperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.7% rise over the past 52 weeks.

Despite Procter & Gamble reporting better-than-expected Q4 2025 EPS of $1.48 and revenue of $20.9 billion, shares fell marginally on Jul. 29 due to a disappointing fiscal 2026 outlook. The company forecast annual net sales growth of 1% to 5%, largely below analysts' estimate, and core EPS guidance of $6.83 to $7.09, only narrowly bracketing the estimate. Additionally, rising tariffs with a $1 billion cost impact and cautious consumer behavior weighed on investor sentiment.

For the fiscal year ending in June 2026, analysts expect PG’s EPS to grow 2.3% year-over-year to $6.99. The company’s earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

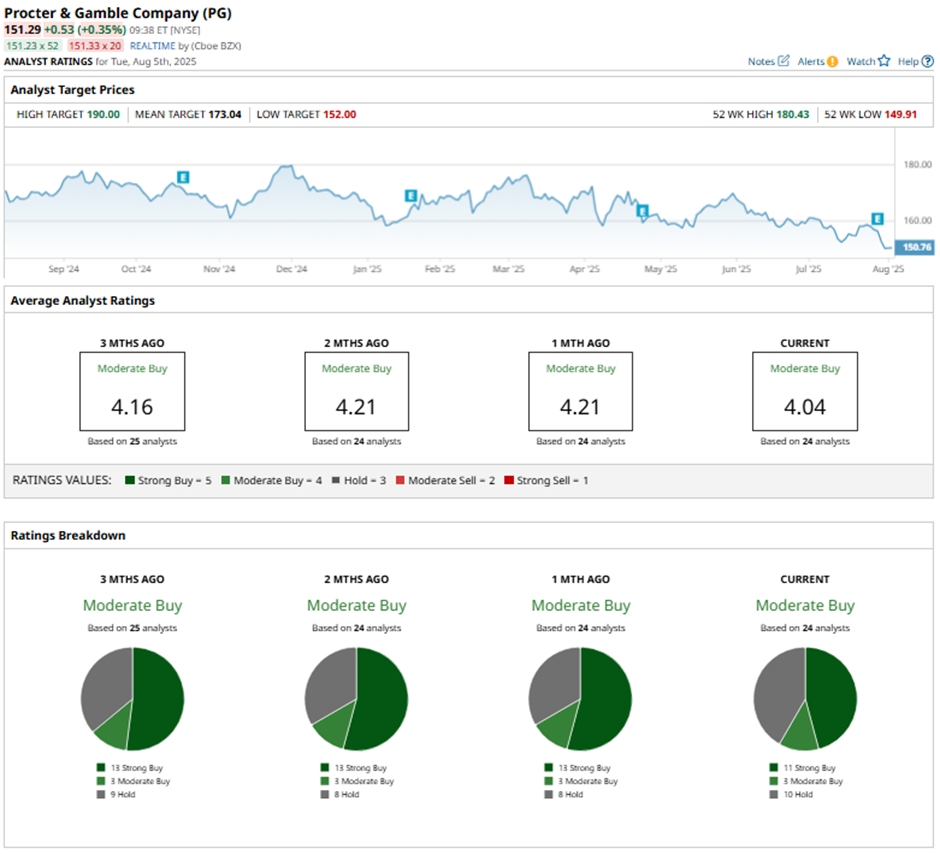

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, three “Moderate Buys,” and 10 “Holds.”

On Jul. 31, UBS analyst Peter Grom maintained a “Buy” rating on Procter & Gamble and set a $180 price target.

As of writing, the stock is trading below the mean price target of $173.04. The Street-high price target of $190 implies a potential upside of 25.6% from the current price.