New York-based Paramount Global (PARA) is a leading media, streaming, and entertainment company offering television, film production, and digital content across various global platforms. With a market cap of $8.8 billion, the company owns a diverse portfolio of entertainment brands and provides streaming services, including Paramount+, Pluto TV, BET+, and Noggin.

Shares of this entertainment giant have underperformed the broader market over the past year. PARA has gained 16.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17.1%. However, in 2025, PARA stock is up 24.7%, surpassing the SPX’s 8.6% fall on a YTD basis.

Similarly, PARA has trailed the Communication Services Select Sector SPDR ETF (XLC), which has gained about 27.9% over the past year. However, PARA’s double-digit returns on a YTD basis outshine the ETF’s 10.6% rally over the same time frame.

Paramount shares rose over 1% in pre-market trading on July 25, after receiving Federal Communications Commission’s (FCC) approval for the company’s merger with Skydance Media. This approval marks a significant step forward in the proposed deal, which aims to combine Paramount’s extensive content library and global distribution network with Skydance’s innovative production capabilities and strong track record in film and television.

For fiscal 2025, ending in December, analysts expect PARA’s EPS to decline 15.6% year over year to $1.30 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters, while missing the forecast on another occasion.

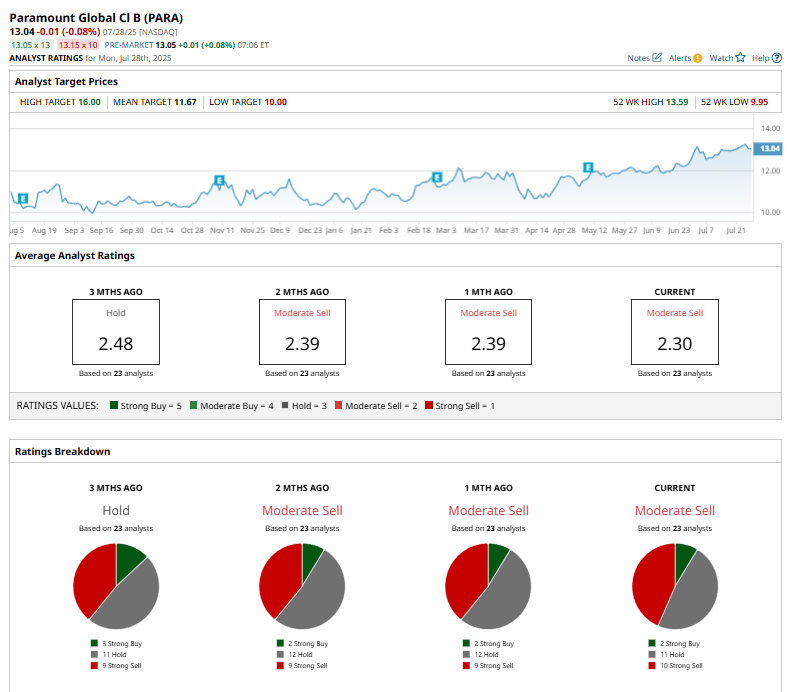

Among the 23 analysts covering PARA stock, the consensus is a “Moderate Sell.” That’s based on two “Strong Buy” ratings, 11 “Holds,” and 10 “Strong Sells.”

This configuration is more bearish than three months ago, with three analysts suggesting a “Strong Buy.”

On Jul. 28, Seaport Global Securities downgraded Paramount Global from “Neutral” to “Sell,” setting a price target of $11 ahead of its August 7 merger with Skydance. The firm cautions that PARA shares may give back recent merger-driven gains after the deal closes. The company will begin trading under the new ticker PSKY post-merger.

While PARA currently trades above its average mean price target of $11.67, its Street-high price target of $16 suggests an ambitious upside potential of 22.7%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.