/Labcorp%20Holdings%20Inc_%20logo%20magnified-by%20ll_studio%20via%20Shutterstock.jpg)

Labcorp Holdings Inc. (LH) is a major player in the global life sciences industry, offering a comprehensive range of laboratory services that support both medical diagnostics and drug development. Based in Burlington, North Carolina, the company runs an extensive clinical lab network and operates thousands of patient service centers across the U.S.

With a presence in several countries, it conducts hundreds of millions of tests each year. These services support healthcare providers, pharmaceutical companies, and researchers by providing essential data and insights that inform treatment decisions. The company has a market capitalization of $22.94 billion.

Over the past 52 weeks, Labcorp’s stock has been performing quite well, going up by 21%, while the stock has increased by 21.4% year-to-date (YTD). The stock has broadly outperformed the S&P 500 Index ($SPX), which has gained 15.1% and 9.9% over the same periods, respectively.

Focusing on the healthcare sector, we see that Labcorp has been an outperformer by a broad margin in this case as well, as the Health Care Select Sector SPDR Fund (XLV) has been down by 11.8% over the past 52 weeks and has declined marginally YTD.

On July 24, Labcorp reported solid results for the second quarter of fiscal 2025. Its revenue increased by 9.5% year-over-year (YOY) to $3.53 billion. This figure was also higher than the $3.49 billion that Wall Street analysts were expecting. Its adjusted EPS of $4.35 was 10.4% higher than the prior year’s period and exceeded the expected $4.14. On the same day, based on these robust results, the stock gained 6.9% intraday, reaching a 52-week high of $283.47.

For the fiscal year 2025, ending in December 2025, Wall Street analysts expect Labcorp’s EPS to grow 11.9% YOY to $16.30 on a diluted basis, and increase by 9.8% to $17.89 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all of the trailing four quarters.

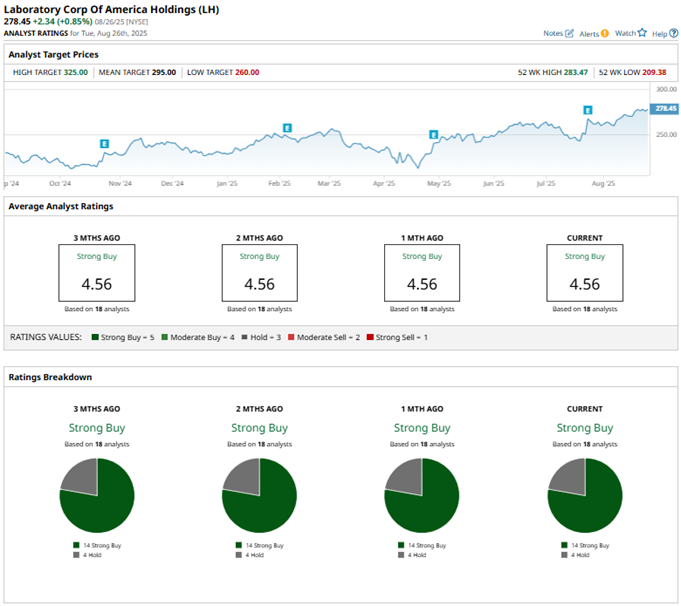

Among the 18 Wall Street analysts covering Labcorp’s stock, the consensus is a “Strong Buy.” That’s based on 14 “Strong Buy” ratings and four “Hold” ratings. The configuration of the ratings has remained stable over the past three months.

Following the release of the Q2 results, UBS analyst Kevin Caliendo maintained a “Buy” rating on Labcorp’s stock, with a price target of $305. Morgan Stanley analyst Ricky Goldwasser maintained an “Overweight” rating, while increasing the price target from $283 to $306.

Labcorp’s mean price target of $295 indicates a 5.9% upside over current market prices. The Street-high price target of $325 implies a potential upside of 16.7%.

.jpg?w=600)