/JPMorgan%20Chase%20%26%20Co_%20magnified-by%20ll_studio%20via%20Shutterstock.jpg)

New York-based JPMorgan Chase & Co. (JPM) is one of the largest banks in the U.S. by assets and a global financial powerhouse. With a market cap of $825.5 billion, it operates across investment banking, consumer and commercial banking, asset management, and wealth management. Its operations span 100+ countries in the Americas, EMEA and Indo-Pacific, serving millions of individuals, corporations, and governments worldwide.

The financial services giant has significantly outperformed the broader market, soaring 39.2% over the past 52 weeks and 25% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 17% surge over the past year and an 8.2% rise on a YTD basis.

Narrowing the focus, JPM stock has also outperformed the Financial Select Sector SPDR Fund’s (XLF) 20.2% gains over the past year and 9% uptick on a YTD basis.

On July 15, JPMorgan Chase reported Q2 2025 results with EPS of $4.96 and revenue of $44.9 billion, both beating estimates. Net interest income rose 2% to $23.3 billion, and trading and investment banking saw solid gains. The bank raised its full-year NII guidance to $95.5 billion and returned $7B to shareholders.

Despite the strong report, shares dipped marginally as investors reacted to a 17% decline in net income and concerns about macroeconomic factors flagged by CEO Jamie Dimon.

For the current FY2025, ending in December, analysts expect JPM’s EPS to improve 4.7% year over year to $19.07. The company has a robust history of earnings surprises, surpassing the Street’s bottom-line estimates in each of the past four quarters.

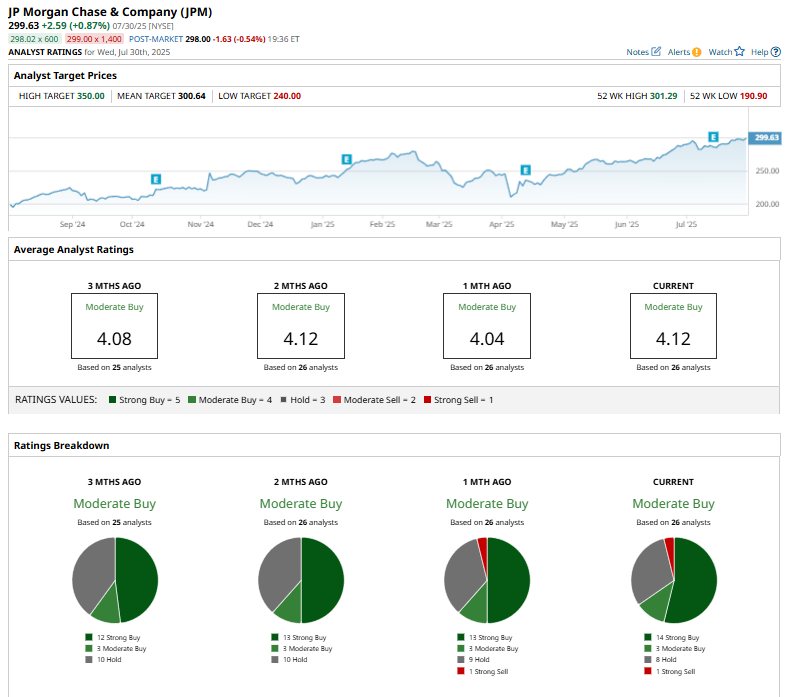

The stock has a consensus “Moderate Buy” rating overall. Of the 26 analysts covering the JPM stock, opinions include 14 “Strong Buys,” three “Moderate Buys,” eight “Holds,” and one “Strong Sell.”

This configuration is notably more bullish than a month ago, when 13 analysts gave a “Strong Buy” recommendation.

On July 16, Wells Fargo & Company (WFC) analyst Mike Mayo raised the price target on JPMorgan from $320 to $325, maintaining an “Overweight” rating. The upgrade followed the bank’s strong Q2 performance, with increased estimates reflecting improved net interest income driven by a better yield curve, loan growth, and stable deposits. Mayo continues to view JPMorgan as a “best-in-class” bank, also highlighting its ongoing $7 billion share buyback program.

JPM’s mean price target of $300.64 indicates a marginal premium to current price levels, while its Street-high target of $350 suggests a staggering 16.8% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.