/Expedia%20Group%20Inc%20%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $32.7 billion, Expedia Group, Inc. (EXPE) is a global online travel company operating across B2C, B2B, and trivago segments, offering a wide range of travel products and services through well-known brands such as Expedia, Hotels.com, Vrbo, and Orbitz. It connects travelers and partners worldwide through technology-driven travel solutions and marketing platforms.

Shares of the Seattle, Washington-based company have outperformed the broader market over the past 52 weeks. EXPE stock has climbed 57.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.1%. However, shares of Expedia are down 5.9% on a YTD basis, lagging behind SPX’s 1.9% return.

Focusing more closely, shares of the online travel company have outpaced the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 6.1% rise over the past 52 weeks.

Shares of Expedia surged 17.6% following its Q3 2025 results on Nov. 6, posting adjusted EPS of $7.57 and revenue of $4.41 billion, both beating Wall Street forecasts. Investors were encouraged by strong operating momentum, including 11% growth in room nights, 12% growth in gross bookings, 9% revenue growth, and a 26% jump in B2B bookings, alongside 208 bps of adjusted EBITDA margin expansion. The rally was further fueled by signs in sustained demand as U.S. bookings grew at its fastest pace in over three years.

For the fiscal year that ended in December 2025, analysts expect EXPE’s EPS to grow 35.6% year-over-year to $12.76. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

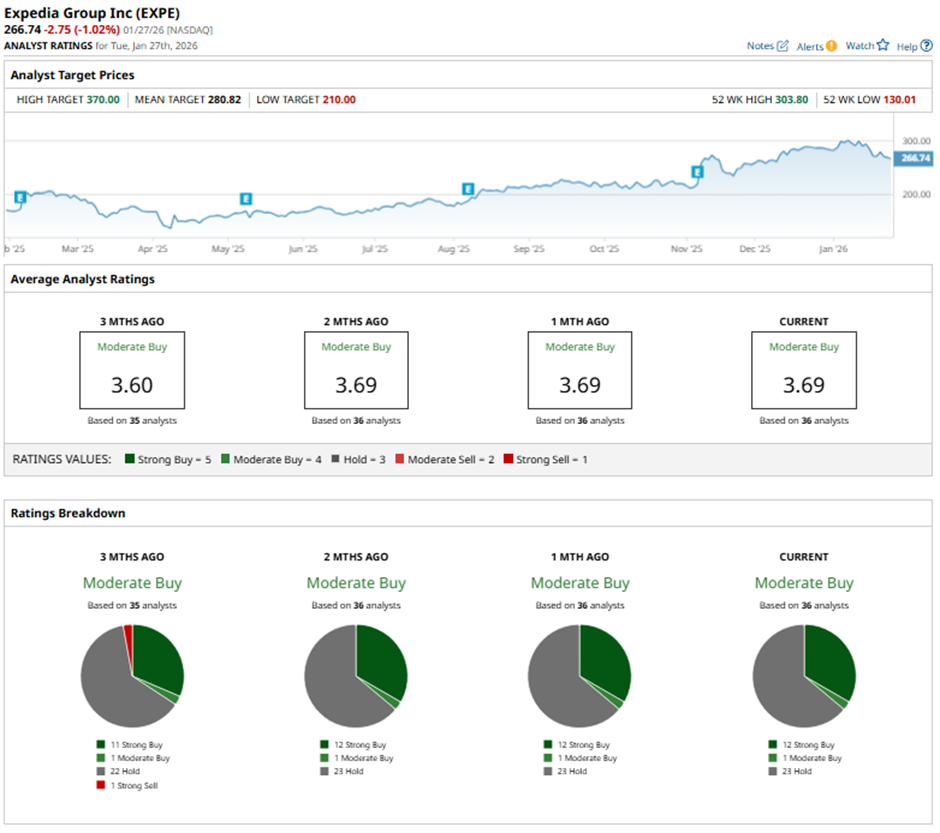

Among the 36 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and 23 “Holds.”

On Jan. 9, Wells Fargo raised its price target on Expedia to $329 and maintained an “Equal Weight” rating.

The mean price target of $280.82 represents a 5.3% premium to EXPE’s current price levels. The Street-high price target of $370 suggests a 38.7% potential upside.