/Abbvie%20Inc%20logo%20and%20meds-%20by%20Ascannio%20via%20Shutterstock.jpg)

North Chicago, Illinois-based AbbVie Inc. (ABBV) is a research-based biopharmaceutical company with a market cap of $385.2 billion. It discovers, develops, manufactures and commercializes innovative medicines that address complex health challenges across therapeutic areas such as immunology, oncology, neuroscience, eye care and aesthetics.

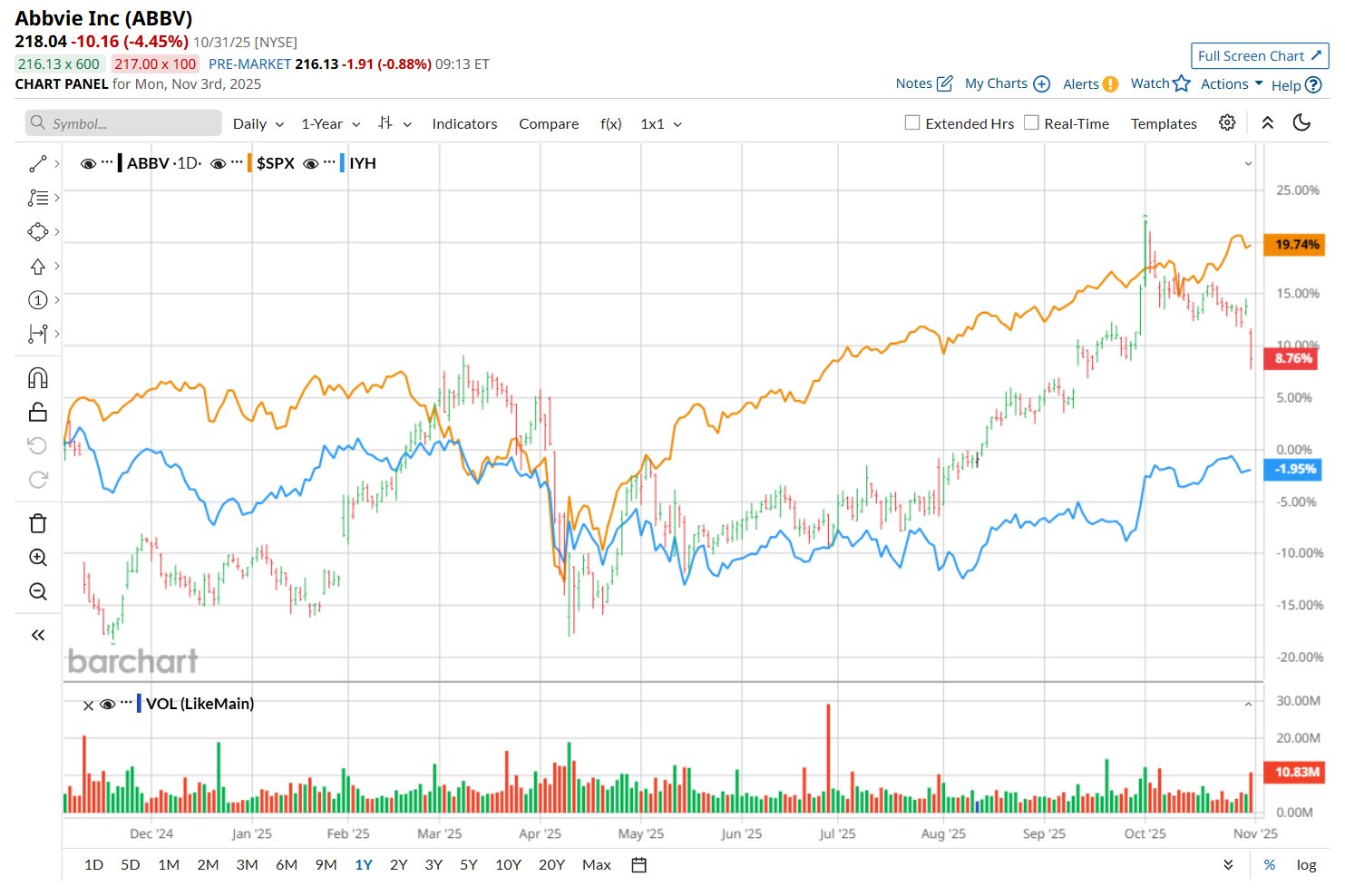

Shares of this healthcare company have lagged behind the broader market over the past 52 weeks. AbbVie has gained 6.6% over this time frame, while the broader S&P 500 Index ($SPX) has soared 17.7%. Nonetheless, on a YTD basis, the stock is up 22.1%, outpacing SPX’s 16.3% uptick.

Zooming in further, AbbVie has also outperformed the iShares U.S. Healthcare ETF’s (IYH) 2.9% drop over the past 52 weeks and 4.4% return on a YTD basis.

ABBV released better-than-expected Q3 earnings results on Oct. 31. Due to robust revenue growth in its Immunology and Neuroscience portfolios, the company’s overall revenue improved 9.1% year-over-year to $15.8 billion, surpassing consensus estimates by 1.2%. Meanwhile, its adjusted EPS declined 38% from the year-ago quarter to $1.86, but topped analyst expectations of $1.77. Moreover, the company raised its fiscal 2025 adjusted EPS guidance, and now expects it to be between $10.61 and $10.65. However, despite these positives, its shares plunged 4.5% that day, as investors likely reacted to the sharp fall in profitability, largely driven by a $1.50-per-share impact from acquired R&D and milestone expenses.

For the current fiscal year, ending in December, analysts expect ABBV’s EPS to grow 4.6% year over year to $10.58. The company’s earnings surprise history is promising. It surpassed the consensus estimates in each of the last four quarters.

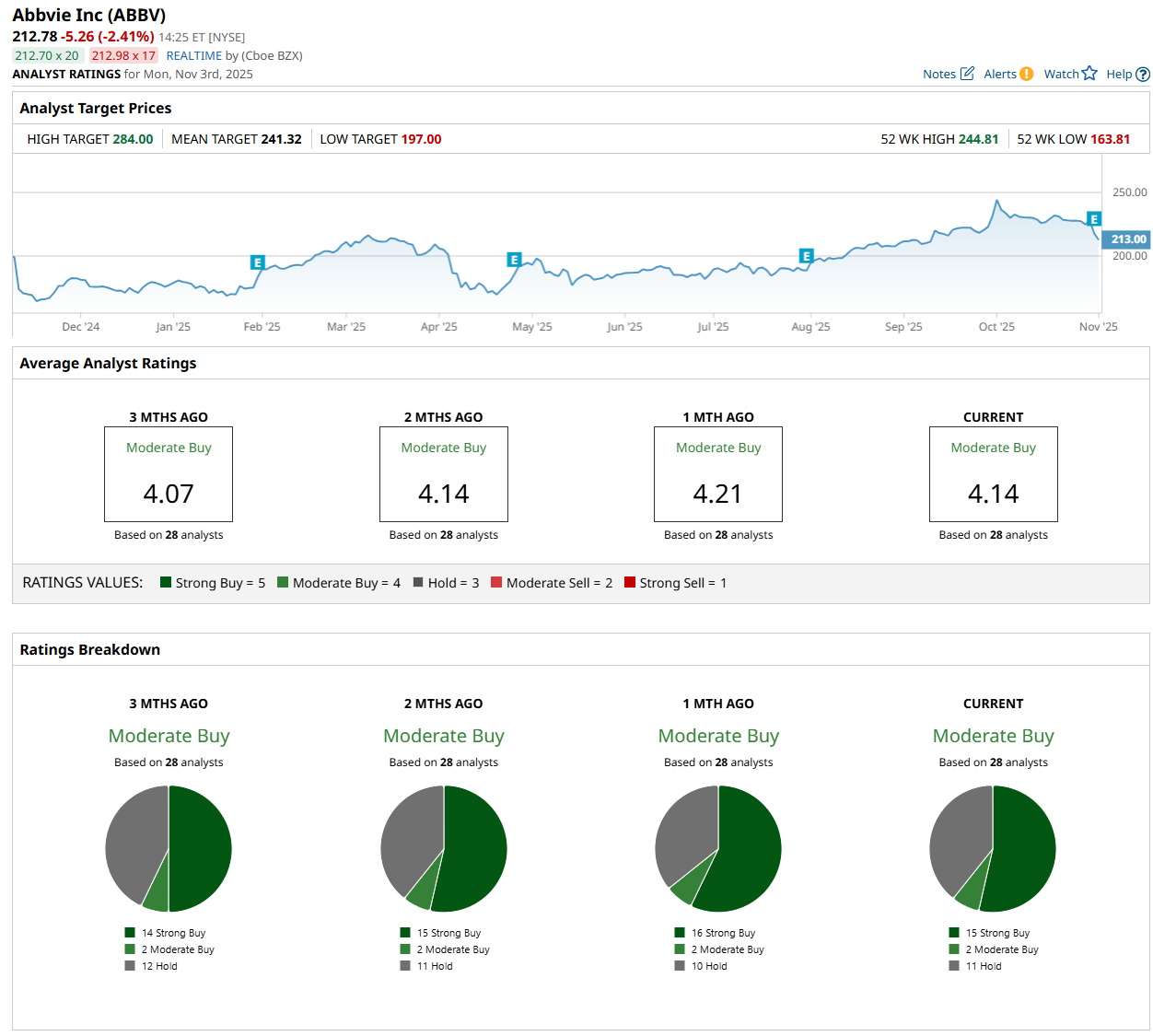

Among the 28 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 15 “Strong Buy,” two “Moderate Buy,” and 11 "Hold” ratings.

This configuration is slightly less bullish than a month ago, with 16 analysts suggesting a “Strong Buy” rating.

On Nov. 3, JPMorgan Chase & Co. (JPM) maintained an "Overweight" rating on ABBV and raised its price target to $260, indicating a 22.2% potential upside from the current levels.

The mean price target of $241.32 represents a 13.4% premium from ABBV’s current price levels, while the Street-high price target of $284 suggests an upside potential of 33.5%.