For many investors, dividend stocks are the foundation of a reliable income strategy — but not all dividend payers are created equal.

In his latest video, Rick Orford breaks down the major types of dividend stocks and how each plays a different role in your portfolio. From the long-term consistency of Dividend Kings to the high-yield potential of Real Estate Investment Trusts (REITs) and Business Development Companies (BDCs), understanding these distinctions can help you balance income and growth.

#1. Dividend Aristocrats (25+ Years of Growth)

Dividend Aristocrats are companies in the S&P 500 Index ($SPX) that have increased their dividend payouts for at least 25 consecutive years.

Income credentials:

- They demonstrate strong financial discipline and resilience.

- They raise dividends even during recessions or inflationary cycles.

- They often attract long-term investors focused on consistency.

Examples include:

- Abbott Laboratories (ABT)

- Archer Daniels Midland (ADM)

- McDonald’s (MCD)

- PepsiCo (PEP)

- Caterpillar (CAT)

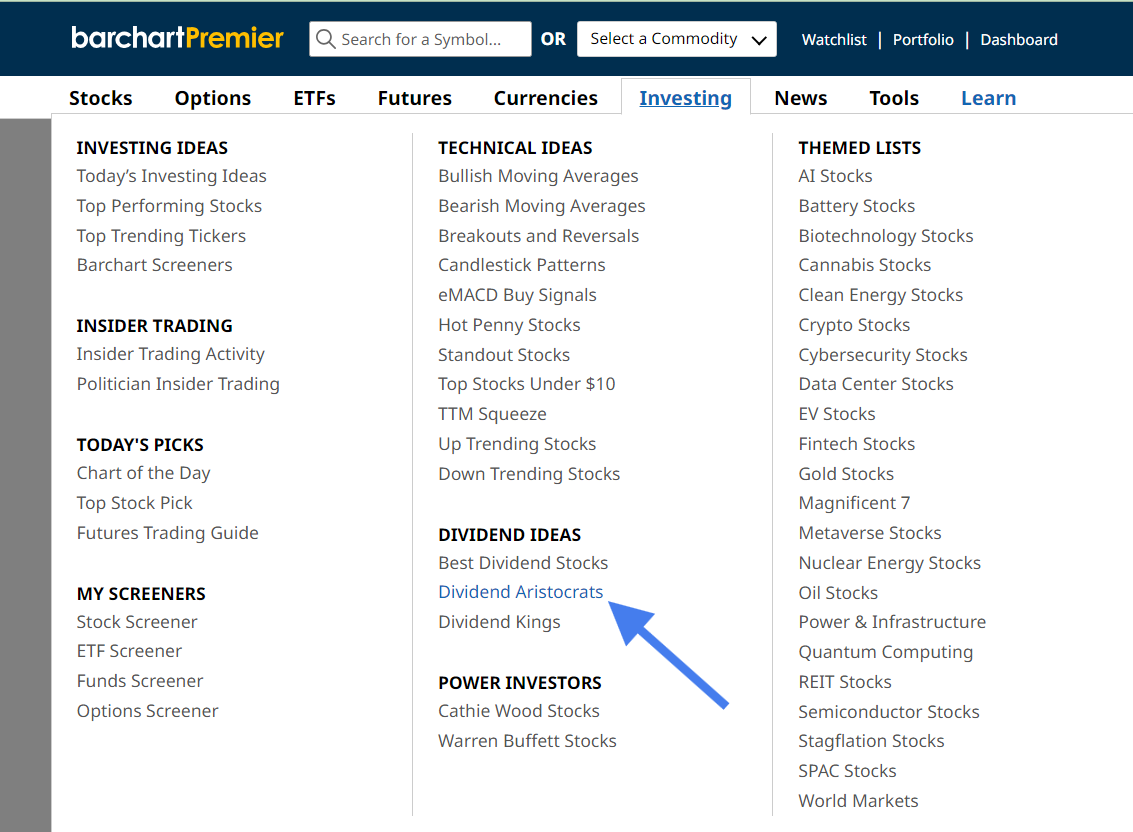

Explore the full Dividend Aristocrats Watchlist →

#2. Dividend Kings (50+ Years of Increases)

Dividend Kings take reliability to another level. While not necessarily S&P members, these companies have increased their dividends for 50 or more straight years.

Income credentials:

- They’ve survived multiple market crashes and inflation cycles.

- They represent the gold standard of dividend consistency.

- Their steady payouts appeal to conservative, income-focused investors.

Examples include:

See the full Dividend Kings Watchlist →

#3. Dividend “Zombies” (100+ Years of Payments)

Dividend “zombies” have paid dividends for over a century without interruption. They haven’t necessarily raised their payouts each year, but they’ve consistently delivered income for generations.

Income credentials:

- They include companies with unmatched longevity.

- They provide steady, predictable cash flow.

- They’re often household names that have stood the test of time.

Examples include:

- General Mills (GIS)

#4. REITs and BDCs (High Yield, Slower Growth)

If you’re after higher income, Real Estate Investment Trusts (REITs) and Business Development Companies (BDCs) offer above-average yields — often 5–10% or more.

Income credentials:

- By law, they must pay out at least 90% of their profits to shareholders.

- They can provide strong cash flow during low-rate or volatile markets.

- However, they have limited reinvestment ability, which can slow long-term price growth.

Find top-paying REIT stocks for investors seeking passive income →

Which Type Fits Your Strategy?

- Long-term investors: Focus on Dividend Aristocrats or Kings for reliability and compounding income.

- Income seekers: Look at REITs and BDCs for higher immediate yield.

- Balanced investors: Blend a few Aristocrats with select high-yield plays for growth and income.

Find and Track Dividend Leaders on Barchart

Use these resources to research dividend opportunities:

The Takeaway

“If you’re after long-term reliability, look to Dividend Aristocrats and Kings,” Rick says. “If you’re chasing yield, REITs and BDCs can give you more income — but they often trade growth for payouts.”

No matter your approach, dividend investing rewards patience — and Barchart’s tools can help you find the right balance for your portfolio.

Watch Rick’s Clip on Dividend Stocks →

- Stream the Full Video: 7 Ways to Make Money from Your Investments

- Screen Options Strategies for Income: Covered Call // Cash-Secured Put