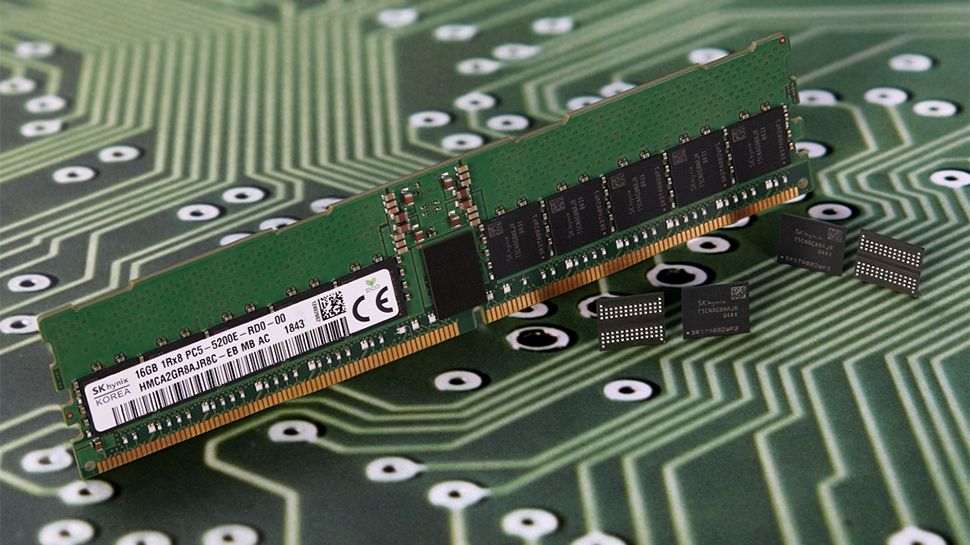

A severe shortage in global DRAM supply has reportedly led some distributors in Taiwan to impose unprecedented bundling requirements on buyers, according to a report in Taiwan’s Economic Daily News. It claims that certain channels are now requiring customers to purchase motherboards alongside DRAM modules at a one-to-one ratio, or risk being denied access to memory stock entirely.

This type of allocation control has reportedly never been seen before in the DRAM industry. It appears that distributors are using high-demand memory modules to drive additional board sales, a tactic more common in constrained consumer electronics markets than in the hardware space. Asus, Gigabyte, MSI, and the Chinese board vendor Chaintech are reported as direct beneficiaries of the practice.

The global DRAM memory chip shortage has become so severe that some distributors are requiring clients to buy motherboards with DRAM modules together, an unprecedented move that has sparked hot sales of motherboards, media report, noting Taiwan’s Asustek, Gigabyte, MSI are…November 17, 2025

Dan Nystedt, a Taipei-based financial analyst known for translating and tracking Taiwan's tech industry media, relayed the news in a post on X, noting that the bundling policy has “sparked hot sales of motherboards.”

Ultimately, all this reflects how rapidly the memory market has shifted since the start of the year. DRAM contract prices are now up roughly 170% year over year, driven largely by demand from AI server manufacturers, and TrendForce recently raised its Q4 DRAM forecast to 18-23% growth quarter-over-quarter.

On the client side, Mini-PC maker Minisforum recently hiked prices for prebuilt configurations that include DRAM and SSDs, while keeping barebones SKUs untouched, a move it explicitly attributed to “significant increases” in its overall costs.

While the bundling tactic described in Taiwanese media appears to be localized to that market for now, it illustrates how DRAM allocation is tightening across the entire supply chain.

It also highlights how downstream buyers could face new hurdles as hyperscalers and smartphone manufacturers continue to hoover up most of the available capacity.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.