/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

The AI hype has taken years to permeate markets, where it can elevate a few leaders to inevitably impressive profits at the origins of landing scores of legacy names chasing relevance. A more difficult question for investors now becomes: What companies will make generative AI be something more than a buzzword, realizing sustainable revenue growth?

As a long-time software company, Adobe (ADBE) is in the spotlight of those arguments, as Morgan Stanley lowered its rating and issued a caveat on the GenAI monetization. The bank states that the Digital Media ARR development did not proceed the way they expected it to, and they alert that the applications promoted by Adobe, publicizing their use before collecting high-priced fees, make the process pay off.

The competitive pressure of large platforms and diffusion engines puts time pressure on them, even though ADBE is trading its franchise at a favorable multiple. To both the holders and their opportunistic buyers, the question is whether Adobe would be able to transform GenAI innovation into a sustained and measurable revenue stream soon.

About Adobe Stock

Headquartered in California, Adobe is a global tech company known for its innovative software solutions that empower individuals, teams, and enterprises to create, publish, and promote content across various digital platforms. Adobe has transformed how users engage with digital media through its flagship products, Adobe Creative Cloud and Adobe Document Cloud. Moreover, Adobe's commitment to AI and generative AI technologies has significantly enhanced its product offerings, fostering creativity and productivity across its user base. The company currently boasts a market cap of $150 billion.

Adobe’s stock has had a volatile year, reflecting swings in AI optimism. Early in 2025, shares ran up on the broader AI rally, but by late September, ADBE stock was trading in the mid-$300s, about 20–21% below its year-start level. Nonetheless, shares are down more than 20% year to date (YTD).

Analysts and investors cite mixed factors: a strong macro tech rally through mid-year, shifts in interest-rate expectations, and growing concerns about how quickly Adobe can monetize new AI features. For example, analysts note that while Adobe leads creative software, its broad rollout of generative-AI tools “hasn’t yet sparked meaningful revenue growth”

From a price point of view, ADBE displays a mixed valuation landscape. Its price-to-sales (P/S) is 7, more than double the sector median of 4, suggesting it is significantly overpriced. However, its price-to-earnings (P/E) of 18 offers a 29% discount compared to the sector, indicating some areas of relative undervaluation.

Adobe’s AI Strategy and Growth Prospects

Adobe is aggressively embedding AI into its products, e.g., Firefly generative models, new editing agents in Photoshop/Premiere, and its GenStudio platform. Management argues this will cement customer loyalty and open new markets. The CEO highlighted that AI-influenced ARR now exceeds $5 billion and that Adobe has again raised its full-year targets on that strength.

On this view, Adobe’s AI investments are already bearing fruit; third-quarter results showed accelerating digital-media ARR (now +11% YoY), and Adobe raised FY growth forecasts to 11.3% ARR growth. Analysts like Angelo Zino of Craft & Capital note that Adobe’s AI monetization is “progressing ahead of expectations” and that the company’s traditionally conservative guidance was raised notably.

However, some bearish voices worry that Adobe’s open-access strategy (giving AI tools to all users rather than charging a premium) delays near-term revenue. They point to competition from startups like Canva and Figma as potential headwinds. As Finimize summarized, investors are increasingly demanding that “AI optimism faces hard numbers”; AI must translate into tangible profit growth.

Adobe Beats Q3 Earnings Estimate

Adobe’s third quarter came in stronger than Wall Street expected and showed the company still has plenty of momentum. Revenue hit a record $5.99 billion, up 11% from a year ago. Breaking down by segments, the Digital Media segment (which covers creative and document software) grew 12% to $4.46 billion, lifting ARR to $18.59 billion, while the Digital Experience segment (marketing and analytics tools) added 9% growth to $1.48 billion.

Adobe continues to demonstrate strong profitability, reporting EPS of $4.29. Its net income margin stands at 30%, more than six times the sector average, underscoring the company’s exceptional efficiency in turning revenue into profits.

Cash generation stayed healthy, too, with an operating cash flow of $2.2 billion, which was helped by Adobe’s nearly 90% gross margin.

On the balance sheet side, Adobe finished with about $4.98 billion in cash, plus $958 million in short-term investments, though that’s down from $7.61 billion a year ago. The company also bought back 8 million shares during the quarter.

Management bumped up its full-year guidance, now expecting $23.65–$23.70 billion in revenue and $20.80 to $20.85 in EPS. Notably, the CEO said Adobe already hit its $250 million “AI-first” ARR target early, with AI-influenced ARR now topping $5 billion, framing AI as a real growth engine, not just a passing buzzword.

What Do Analysts Say About ADBE Stock?

Morgan Stanley recently downgraded ADBE stock to “Equal Weight” (Hold) from “Overweight” and cut its price target to $450. Weiss said Adobe’s “push to adopt AI hasn’t yielded many benefits” yet and flagged a deceleration in its digital-media ARR. He expressed “outsized concern” over Adobe’s ability to prove that generative AI will expand its market.

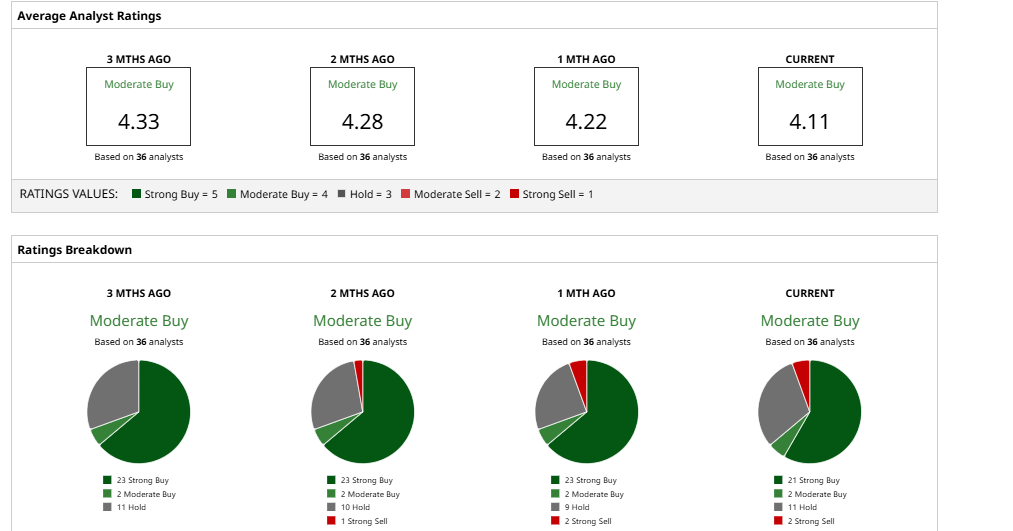

Overall, Wall Street analysts remain moderately bullish on ADBE stock. Among 36 analysts covering it, 21 rate it a “Strong Buy,” two a “Moderate Buy,” 11 a “Hold,” and only two a “Strong Sell.” The average 12-month price target of $471.34 implies the stock could rise about 33% from current levels.

Adobe’s recent stock pullback appears tied more to market timing than weak fundamentals. The company beat Q3 estimates, raised guidance, and continues to benefit from its strong subscription model and balance sheet. While AI hype has added volatility, Adobe’s leadership in creative software, expanding AI features, and recurring revenue base support its long-term growth story. Analysts view ADBE shares as moderately undervalued, suggesting the “AI bubble” concern may be overstated, with Adobe well-positioned to capture rising AI-driven demand.