Diamondback Energy, Inc. (FANG), headquartered in Midland, Texas, operates as an independent oil and natural gas exploration and production company. With a market cap of $39.5 billion, the company acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and FANG perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the oil & gas E&P industry. FANG's competitive edge stems from its high-quality acreage, technological innovation, and strong balance sheet, driving growth and resilience. Its efficient operations and cost management enable robust free cash flow, even in volatile commodity markets. Focused on the Permian Basin, Diamondback prioritizes operational excellence and strategic growth to deliver long-term value.

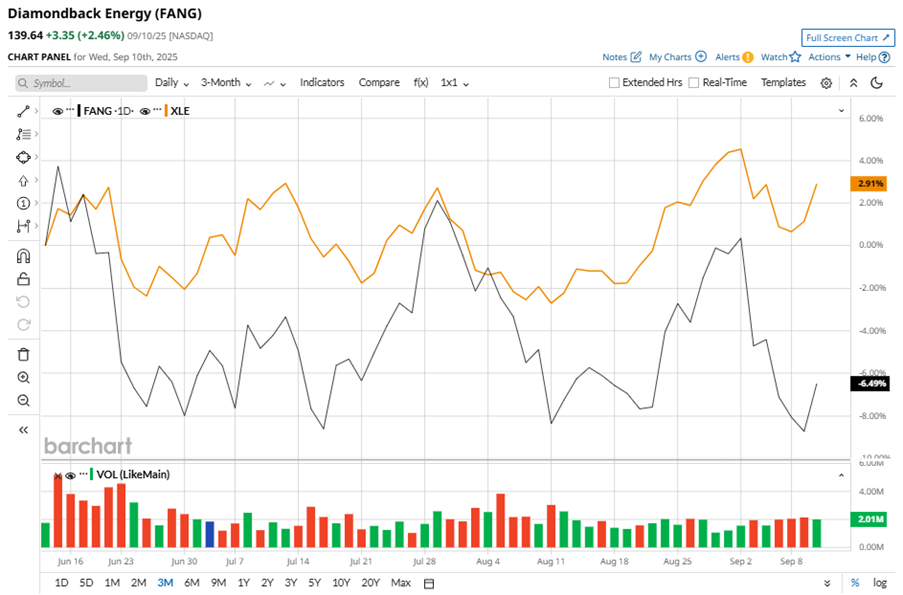

Despite its notable strength, FANG slipped 30.3% from its 52-week high of $200.47, achieved on Oct. 7, 2024. Over the past three months, FANG stock declined 4.1%, underperforming the Energy Select Sector SPDR Fund’s (XLE) 4.8% gains during the same time frame.

In the longer term, shares of FANG dipped 14.8% on a YTD basis and fell 18.6% over the past 52 weeks, underperforming XLE’s YTD gains of 4% and 4.7% returns over the last year.

To confirm the bearish trend, FANG has been trading below its 50-day and 200-day moving averages over the past year, experiencing some fluctuations.

On Aug. 4, FANG shares closed up more than 1% after reporting its Q2 results. Its adjusted EPS of $2.67 topped Wall Street expectations of $2.63. The company’s revenue was $3.7 billion, topping Wall Street forecasts of $3.3 billion.

FANG’s rival, Occidental Petroleum Corporation (OXY), has taken the lead over the stock with its shares plummeting 6.3% on a YTD basis and 9.9% over the past 52 weeks.

Wall Street analysts are bullish on FANG’s prospects. The stock has a consensus “Strong Buy” rating from the 31 analysts covering it, and the mean price target of $182.34 suggests a potential upside of 30.6% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.