/Dell%20Technologies%20by%20Poetra_RH%20via%20Shutterstock.jpg)

Dell Technologies’ (DELL) second-quarter results turned out stronger than Wall Street expected. However, the market responded negatively. The tech company, popular for its PCs, servers, and data storage solutions, has been witnessing significant demand for its artificial intelligence (AI)-optimized servers. That surge in AI-related business was strong enough for management to raise its full-year outlook, signaling confidence in the growth pipeline ahead.

Despite this beat-and-raise quarter, Dell’s stock slipped in after-hours trading. The issue wasn’t revenue or the upbeat forecast. It was margins. Investors zeroed in on the performance of Dell’s Infrastructure Solutions Group (ISG), the segment that houses its server and storage business. ISG posted an operating margin of 8.8% in the second quarter, down from 11% a year ago. The reason behind the drop was the shift in product mix. Dell saw record AI server shipments in the quarter, but those high-demand products carried lower margins, pulling the segment’s overall profitability down.

The margin compression spooked some investors, who worry about the long-term profitability of AI servers. Management, however, maintained an optimistic tone. They highlighted Dell’s engineering capabilities and integrated solutions as advantages that should help margins recover in the back half of the year. In other words, while AI shipments are currently weighing on profitability, Dell expects efficiency gains and improved mix management to mitigate the impact over time.

Interestingly, Dell is likely to benefit from the AI boom. However, on the other hand, the immediate cost of capturing that growth is tighter margins, at least until the company can optimize its operations. With this backdrop, should you buy Dell stock now?

Is Dell Stock a Buy Now?

Dell continues to see strong demand for AI servers, which will support its future growth. The company booked $5.6 billion in AI server orders in Q2 and shipped a record $8.2 billion worth of products. That left Dell with a solid backlog of $11.7 billion, evidence of sustained demand. Notably, Dell has already shipped more AI servers in the first half of fiscal 2026 than it did all of last year.

This demand isn’t concentrated in just one sector. Dell is seeing enterprise orders grow across various industries, including financial services, healthcare, and manufacturing. Its sales pipeline is also expanding, posting double-digit growth quarter over quarter. Importantly, Dell’s management noted that the company’s pipeline remains several times larger than its backlog, indicating a long runway for continued growth.

Reflecting this strength, Dell raised its AI server shipment outlook for fiscal 2026 from $15 billion to $20 billion, with most of that volume expected in the third quarter. Management also sees signs of stabilization in the traditional server and storage markets, while its PC division is likely to benefit from the ongoing refresh cycle. Together, these drivers are setting the stage for strong growth in the back half of the year. Moreover, management expects profitability to improve in the second half across its business segments, primarily within the AI server segment.

Looking ahead to Q3, Dell expects revenue to be between $26.5 billion and $27.5 billion, translating to approximately 11% growth at the midpoint. Its ISG business is projected to grow in the low 20% range, while the Client Solutions (CSG) business is expected to see mid-single-digit growth. Operating income is forecast to increase by approximately 7%, with adjusted earnings per share expected to be around $2.45, representing a 11% year-over-year rise.

For the full year, Dell raised its revenue guidance to a range of $105 billion to $109 billion, with a midpoint of $107 billion. That’s 12% growth, compared with earlier expectations of 8%. ISG is expected to deliver mid- to high-20% growth, driven by AI servers, while CSG is expected to continue its steady improvement. Profitability is also likely to strengthen, thanks to lower operating expenses. Adjusted EPS guidance was also lifted to $9.55 at the midpoint, representing 17% growth.

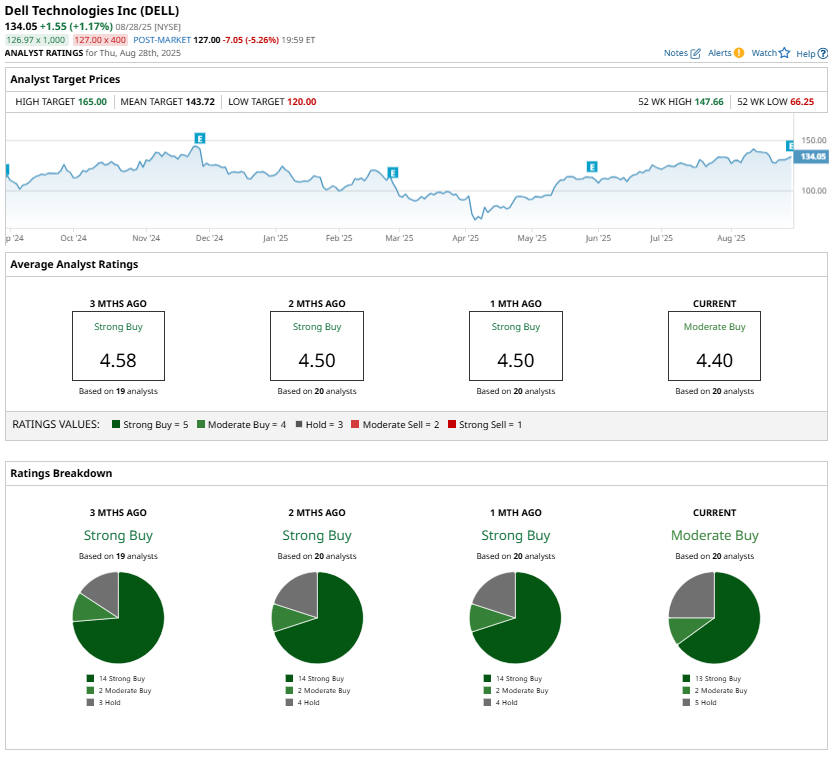

Overall, with demand for AI servers surging, profitability expected to improve, and guidance moving higher, Dell stock is a compelling investment. While analysts remain cautiously optimistic, Dell stock trades at a forward price-earnings multiple of approximately 15.4x and appears inexpensive, given the projected 17% EPS growth.