/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

The Q3 earnings season has begun, and electric vehicle (EV) manufacturer Tesla (TSLA) is scheduled to report its quarterly results on Oct. 22. According to consensus estimates, Tesla is forecast to report revenue of $26.58 billion and adjusted earnings of $0.55 per share in Q3 of 2025. In the year-ago period, it reported revenue of $25.18 billion and earnings of $0.72 per share.

While revenue is forecast to increase, adjusted earnings are projected to decline by over 20% year-over-year (YoY). In recent years, Tesla has been wrestling with multiple headwinds, such as rising competition, elevated interest rates, and sluggish consumer demand. To offset these factors, Tesla has reduced vehicle prices numerous times, resulting in narrower margins.

In 2022, Tesla increased its revenue by 51.4% YoY to $81.46 billion, while earnings growth was much higher at 84.8%. However, its earnings are forecast to narrow from $4.07 per share in 2022 to $1.71 per share in 2025. In this period, free cash flow is expected to decline from $7.57 billion to $4 billion.

Tesla Deliveries Rose 7% in Q3

Tesla stock faces a pivotal moment as the electric vehicle market undergoes dramatic shifts following the expiration of federal tax credits. The EV maker reports Q3 earnings next week amid questions about whether it can maintain momentum without the $7,500 consumer incentive that ended in September.

The automaker delivered 497,099 vehicles in the third quarter, up 7% from a year earlier, a turnaround after two consecutive quarterly declines to start the year. However, production actually fell compared to last year, with analysts projecting the first full-year revenue decline in company history for 2025.

Tesla appears insulated from troubles plaguing traditional automakers. For instance:

- General Motors (GM) took a $1.6 billion charge on EV investments.

- Ford's (F) CEO predicted demand for fully electric vehicles could be cut in half without tax credits.

- Stellantis (STLA) abandoned its goal of producing only EVs in Europe by 2030.

These retreats could actually help Tesla as competitors pull back from the segment. Tesla has recently introduced lower-priced versions of its Model Y and Model 3 to offset the impact of losing tax credits, which has effectively increased their prices.

However, Tesla's U.S. market share has declined to 43.1% from 49% at year-end as competition intensifies. The brand has faced consumer backlash due to CEO Elon Musk's controversial political activities, including endorsements of far-right groups in Europe. European registrations plunged 23% in August, even as overall EV demand in the region rose 26%.

Industry experts warn Tesla could continue to wrestle with slowing sales and falling profit margins. Many consumers likely pulled forward purchases to capture expiring credits, creating a demand vacuum in the near term.

Trump administration policies beyond tax credits have also created obstacles, which include revoking California's vehicle standards waiver and cutting funding for EV charging infrastructure.

Musk continues to pivot investor attention toward robotaxis and humanoid robots, claiming these will represent 80% of Tesla's future value. But those markets remain largely unproven while the core vehicle business faces mounting pressure in a shrinking market.

What Is the TSLA Stock Price Target?

Analysts tracking TSLA stock forecast it to increase adjusted earnings from $1.71 per share in 2025 to $9.56 per share in 2029. In this period, free cash flow is estimated to improve from $4.06 billion to $24.6 billion.

Tesla’s stellar growth rates imply that the EV stock should command a premium valuation. If it is priced at 100x forward earnings, TSLA could double within the next four years.

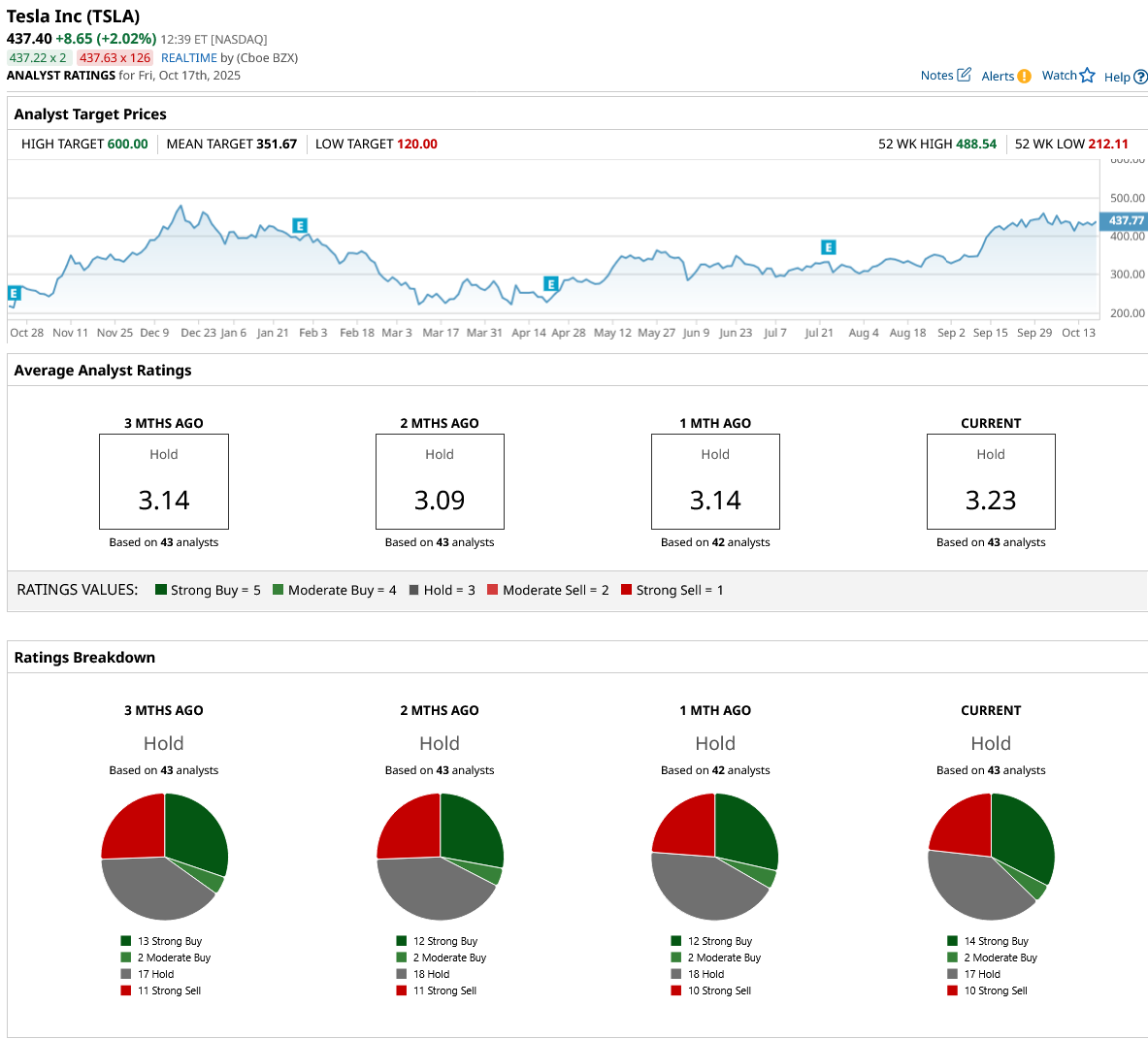

Out of the 43 analysts covering TSLA stock, 14 recommend “Strong Buy,” two recommend “Moderate Buy,” 17 recommend “Hold,” and 10 recommend “Strong Sell.” The average TSLA stock price target is $351.67, below the current price of $437.40.