Rivian (RIVN) shareholders face a crucial deadline that could impact the electric vehicle (EV) maker's near-term prospects. The $7,500 federal tax credit, which has helped drive EV adoption in the U.S., will expire by the end of this month.

The timing couldn't be more challenging for Rivian, which just initiated its second workforce reduction of 2025, cutting approximately 150 employees, or 1.5% of its staff. These layoffs targeted commercial teams handling sales and service operations, following 140 manufacturing job cuts in June.

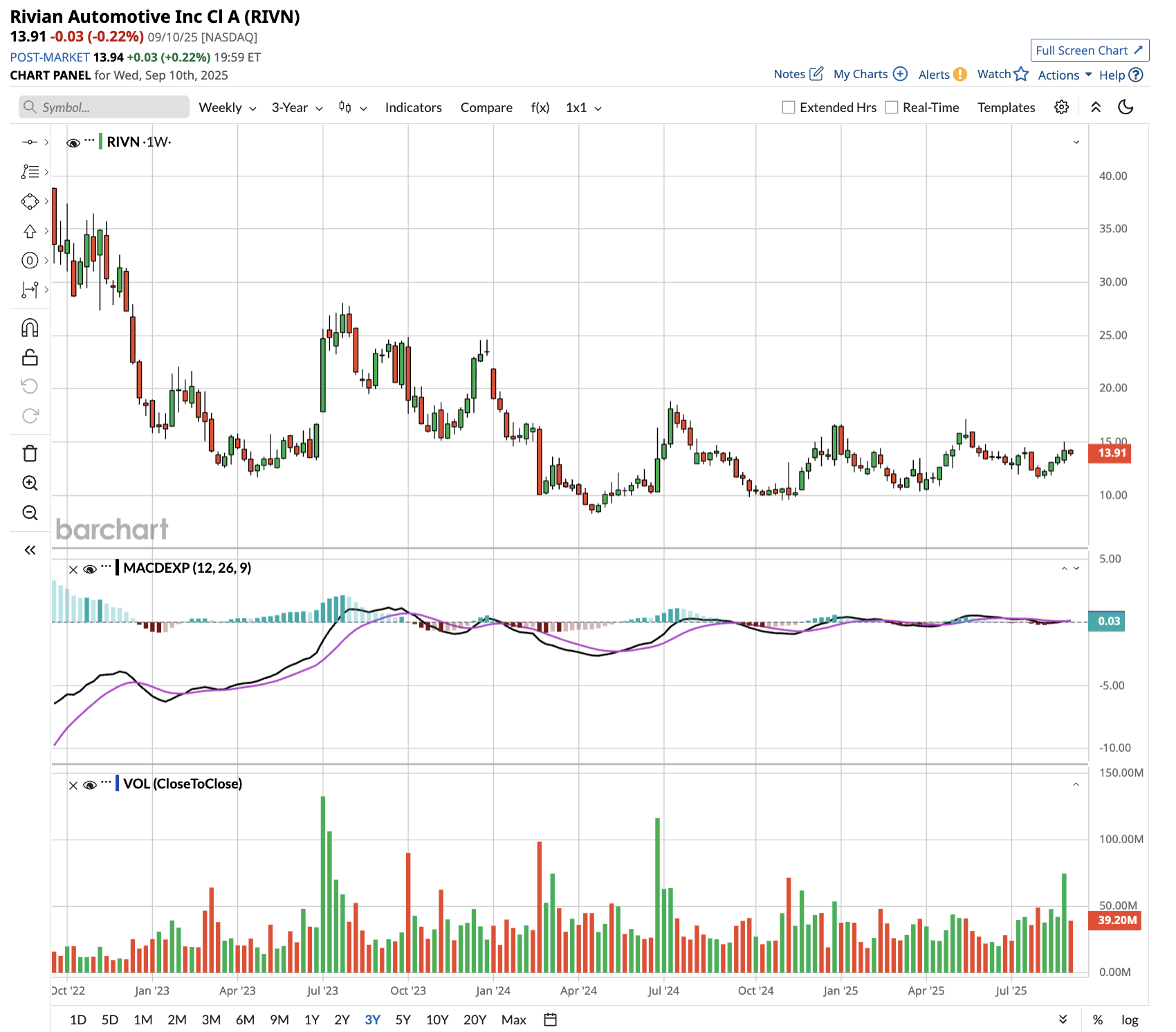

RIVN stock is down more than 60% from all-time highs due to rising competition, sluggish demand, and the company’s high cash burn rate. The ongoing selloff reflects concerns about the expiration of the tax credit and its impact on consumer demand.

The automaker is preparing for its more affordable R2 SUV launch in 2026 but faces mounting pressure from steeper-than-expected losses and regulatory headwinds. The loss of federal tax incentives could further dampen consumer interest in electric vehicles just as Rivian works to streamline operations and reduce per-vehicle costs.

How Did Rivian Perform in Q2 of 2025?

Rivian's strategic focus on the R2 platform indicates a fundamental shift toward mass-market viability, with CEO RJ Scaringe expressing confidence in the vehicle's market potential. The R2, starting at $45,000, targets the heart of the U.S. automotive market, where the average selling price is approximately $49,000, expanding Rivian's addressable customer base beyond the $90,000 R1 flagship.

Rivian has achieved critical cost reduction milestones, with R2's bill of materials costs contracted at roughly half the level of R1. This isn't aspirational, as suppliers are fully engaged with locked-in pricing, positioning R2 for healthy gross margins from launch. The vehicle will benefit from shared fixed cost absorption with R1 and commercial vans at the Illinois facility, creating an advantageous path to profitability.

Rivian's $5.8 billion software licensing partnership with Volkswagen (VWAGY) validates its technological differentiation. The deal represents one of the largest software licensing agreements in automotive history, providing Rivian with recurring revenue streams while demonstrating the scalability of its software-defined vehicle architecture. This technological advantage stems from Rivian's clean-sheet approach, utilizing just three computers versus the industry-standard 100-plus electronic control units.

The company's autonomy platform development, featuring 65 megapixels of camera sensors on R2, positions it for the next generation of vehicle capabilities. Management believes that autonomous features will become table stakes by the end of the decade, with Level 3 autonomy planned for 2026.

Despite near-term headwinds from policy changes and supply chain disruptions that limited Q2 production to 5,979 vehicles, Rivian maintains its 2027 EBITDA breakeven target. Moreover, the company's $7.5 billion cash position, supplemented by potential Department of Energy loans, provides runway for execution.

What Is the RIVN Stock Price Target?

Rivian appears positioned to transition from startup challenges to sustainable growth through superior technology and strategic partnerships. Analysts tracking RIVN stock forecast revenue to rise from $5 billion in 2024 to $28.3 billion in 2029.

The EV maker is expected to benefit from economies of scale and narrow its loss per share to $0.69 in 2029, from a loss per share of $3.61 in 2024. Notably, Rivian is expected to end 2029 with a free cash flow of $960 million, compared to an outflow of $3.30 billion this year.

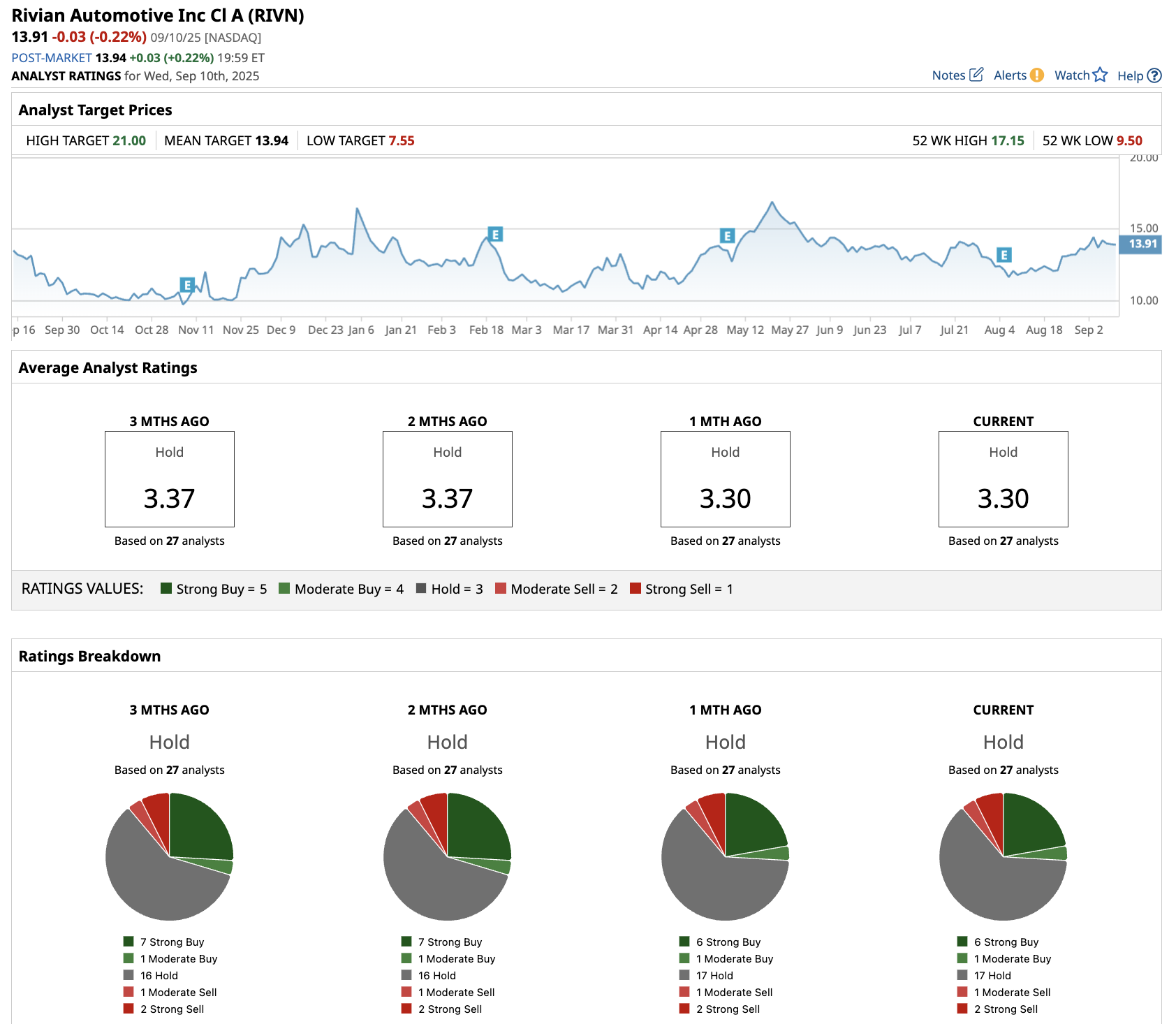

Out of the 27 analysts tracking Rivian, six recommend “Strong Buy,” one recommends “Moderate Buy,” 17 recommend “Hold,” one recommends “Moderate Sell,” and two recommend “Strong Sell.”

The average RIVN stock price target is about $13.94, which is in line with its current price.