/A%20Lucid%20Motors%20vehicle%20parked%20in%20front%20of%20a%20showroom_%20Image%20by%20Michael%20Berlfein%20via%20Shutterstock_.jpg)

Luxury electric vehicle (EV) maker Lucid Group (LCID) has announced a 1-for-10 reverse stock split, which will take effect on Aug. 29, and the adjusted shares will begin trading on Sept. 2. The move is not being made due to any regulatory requirement. Instead, it appears to be an effort to make the company’s stock more accessible to institutional investors, as it is currently classified as a penny stock below the $5 mark. The company is also exploring a significant partnership, which could unlock another growth dimension.

About LCID Stock

Established in 2007 and based in Newark, California, Lucid is a major player in the EV space. The company focuses on producing high-end EVs that emphasize innovation, performance, and sustainability. With deep expertise in battery systems and proprietary technology, Lucid oversees much of its development and production internally.

Vehicles are manufactured at its advanced facility located in Casa Grande, Arizona. By blending cutting-edge design with engineering excellence, Lucid strives to redefine what electric cars can offer, positioning itself as a strong contender in the global shift toward cleaner, more innovative mobility solutions. The company currently has a market capitalization of $6.24 billion.

The company’s stock has been beaten down for quite some time. Over the past 52 weeks, LCID stock has declined by 50.6%. It had reached a 52-week high of $4.43 in August 2024, but is now down 52.2% from this high. The stock is down by 30.3% year-to-date (YTD).

Lucid’s recent quarterly results have also led to a decline in the stock. Over the past month, the shares have been down by 27.9%.

Despite the selloff, Lucid Group’s stock trades at a stretched valuation. Its price sits at 6.15 times sales, which is higher than the industry average of 0.98 times.

Lucid Group’s Q2 Results Missed Wall Street Expectations

On Aug. 5, Lucid reported its second-quarter results for fiscal 2025. The company’s total revenue increased by 29.3% from the prior year’s period to $259.43 million. However, this fell short of the Wall Street analysts’ expected consensus figure of $280 million.

The reason for this topline miss was the slowing demand in the EV market, with customers increasingly opting for cheaper hybrid cars. The Trump administration’s tariffs have also impacted the EV industry, and the $7,500 EV tax credit is set to expire in September.

The company’s rollout of the Gravity SUV has been slower than expected. However, Lucid is offering a $7,500 lease discount on the Gravity SUV in Q4 to help offset the loss of the federal tax credit.

Amid all this, in July, Lucid gave its shareholders a reason to cheer when it was announced that it had formed a next-generation partnership with Uber (UBER) to launch robotaxis. This program will see Uber deploy a minimum of 20,000 Lucid Gravity vehicles equipped with Nuro Driver Level 4 autonomy. The $300 million investment provided Lucid with a financial runway, which investors welcomed.

Lucid reported an adjusted loss of $0.24 per share in Q2, which is better than the $0.29 that it had reported in Q2 2024. However, this reported figure fell short of the $0.21 loss per share that Wall Street analysts had expected.

Wall Street analysts are also optimistic about Lucid's ability to reduce its losses. For the current quarter, its loss per share is expected to narrow by 39% year-over-year (YoY) to $0.25. For the current year, the company’s loss per share is expected to reduce by 25.6% annually to $0.93, followed by a 29% improvement to $0.66 in the next year.

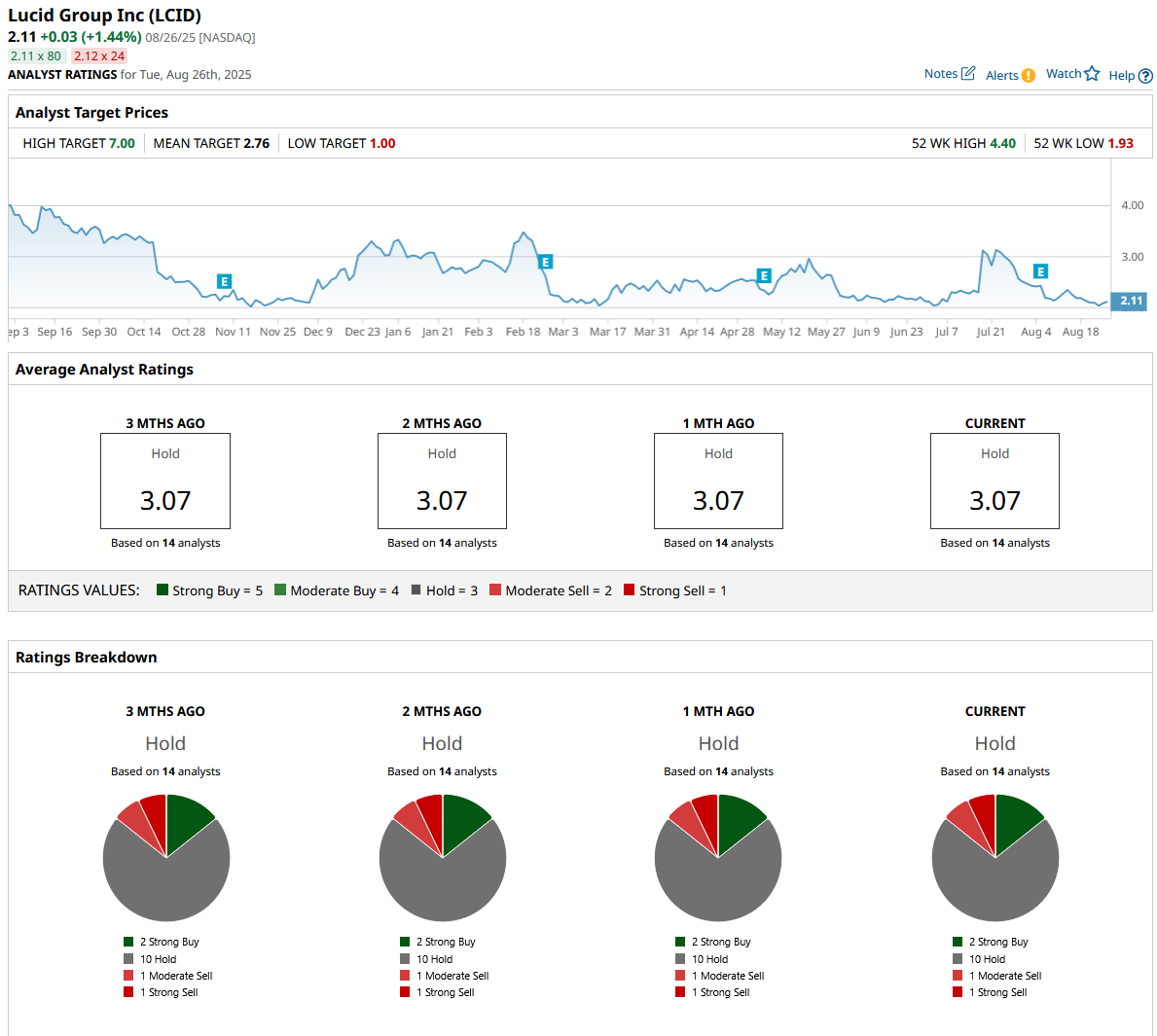

What Do Analysts Think About LCID Stock?

While analysts are optimistic about Lucid’s prospects, they do recommend caution. Analysts at Cantor Fitzgerald maintained a “Neutral” rating on the stock and a $3 price target. This reiteration was likely due to the company’s robotaxi partnership with Uber and the prospects its Gravity SUVs exhibit.

Analysts at Baird maintained a “Neutral” rating on the shares of Lucid, but post its Q2 results, lowered the price target from $3 to $2. The firm believes that cost reductions to improve vehicle profitability and a potential technology licensing deal will be the catalysts that Lucid needs at this time.

Wall Street analysts are cautious about LCID, giving it a consensus “Hold” rating overall. Of the 14 analysts rating the stock, two have given it a “Strong Buy” rating, a majority of 10 analysts are cautious with a “Hold” rating, one gave a “Moderate Sell” rating, and one has given a “Strong Sell” rating. The consensus price target of $2.76 represents a 31% upside from current levels. The Street-high price target of $7 indicates a 231% upside.